China’s Role in Supply-Chain Strategies

Key findings

- Nearshoring, friendshoring, reshoring and “China plus” strategies are gaining popularity and may have implications for investors’ allocations to sectors, themes and countries.

- China’s strategic-development agenda and its wealth of natural resources enabled the country to become a global manufacturing leader, accumulating significant competitiveness in the process.

- Certain technology- and resource-intensive industries and more-innovative industries may have greater long-term resilience to potential supply-chain shifts away from China.

A significant transformation is underway in global manufacturing and supply chains, as multinational companies increasingly adopt nearshoring, friendshoring, reshoring and China-plus strategies. Geopolitical uncertainties, macroeconomic-regime change and disruptions following the COVID-19 pandemic have all played a role in companies' moving away from existing just-in-time logistics and lean inventories.

Given that China is the world's largest manufacturing base,[1] it becomes particularly important for investors to understand China's role in the global supply chain. Are parts of the global supply chain more heavily reliant on China than other parts? We explore which industries and themes may be more dependent on China from a manufacturing-ecosystem and raw-resources perspective.

Establishing competitiveness over the years via R&D

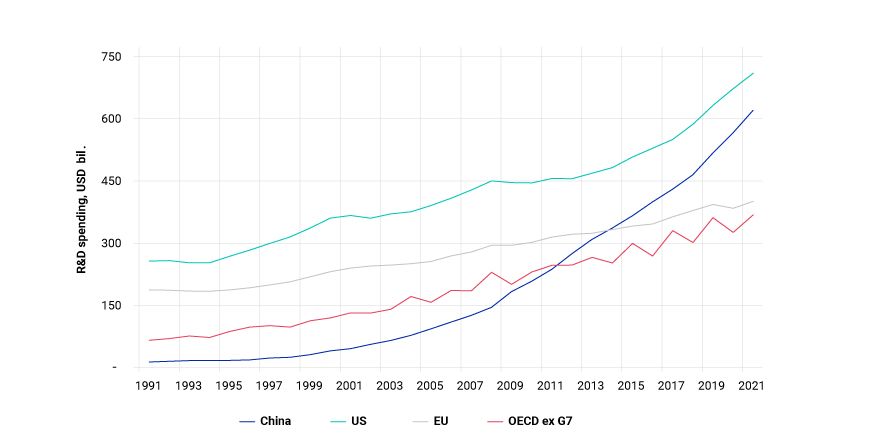

China's historical supply-chain advantage may no longer be based solely on labor cost but on its manufacturing ecosystem.[2] Policy-driven development of human capital and technological innovation has been supported by investment in research and technology development. After growing rapidly year on year over the past three decades, China's total R&D spending hit USD 660 billion in 2021.[3]

China's R&D spending was second only to the US

Data is from 1991 to 2021 (latest available for all countries). The indicator, gross domestic spending on R&D, is measured in USD constant prices using 2015 as base year and purchasing-power parities, and as a percentage of GDP. Source: Organization for Economic Cooperation and Development (OECD)

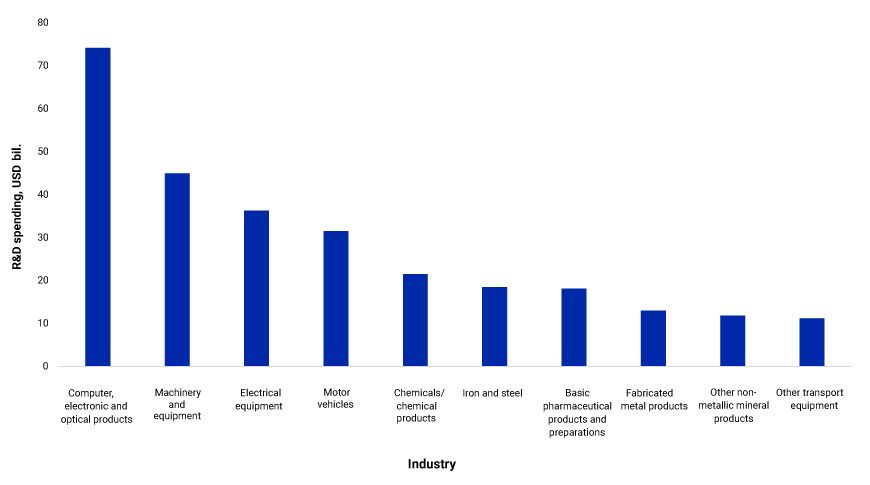

Recent spending has been concentrated in tech- and resource-driven manufacturing, such as computers, communications and electronic equipment, machinery, automobiles, medicines, raw-chemical materials and metal products. China's long-term efforts have made it a mainstay manufacturing center in numerous technologies and industries. Some companies in these sectors may find it difficult to move supply chains out of China in the short term.

China's highest R&D spending was in computer, electronic and optical products

Data as of Dec. 31, 2020 (latest available). Spending is measured in USD constant prices using 2015 base year and purchasing-power parities, and as a percentage of GDP. Source: OECD, OECD/Eurostat

China has focused its R&D spending on technology and manufacturing infrastructure, including telecommunications networks, data centers, industrial parks and logistics networks, as well as on talent development.[4] Through 2021, China had installed more industrial robots than the rest of the world combined. This infrastructure and talent pool have supported efficient and cost-effective production processes, an important factor in the competitiveness and leadership of China's manufacturing hub.

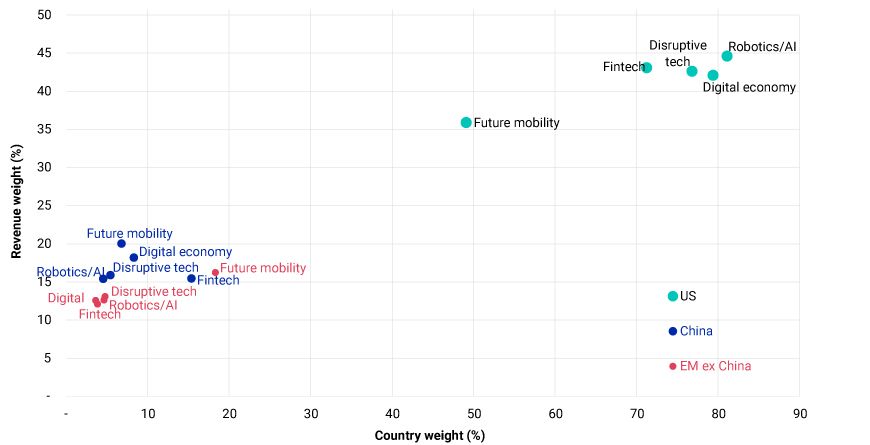

Using MSCI Economic Exposure data and the MSCI global transformative-technologies thematic indexes, we can compare the revenue exposure and index weight of companies linked to these themes in the U.S., China and emerging markets (EM) ex China. The U.S. is the leader in global technology by index weight and revenue exposure. China's revenue exposure to the transformative-technologies theme, however, exceeded that of all other EM combined.

China's tech-innovation exposure exceeded that of other EM countries

Data as of Oct. 31, 2023. The vertical axis shows the MSCI ACWI Investable Market Index's thematic indexes' revenue exposure to the region or country. The horizontal axis shows the country weight of the thematic index.

China's footprint and role in high-end manufacturing and technological innovation may make it more resilient to supply-chain reconfiguration for companies in technology- and innovation-oriented industries.

Natural resources may strengthen China's supply-chain resilience

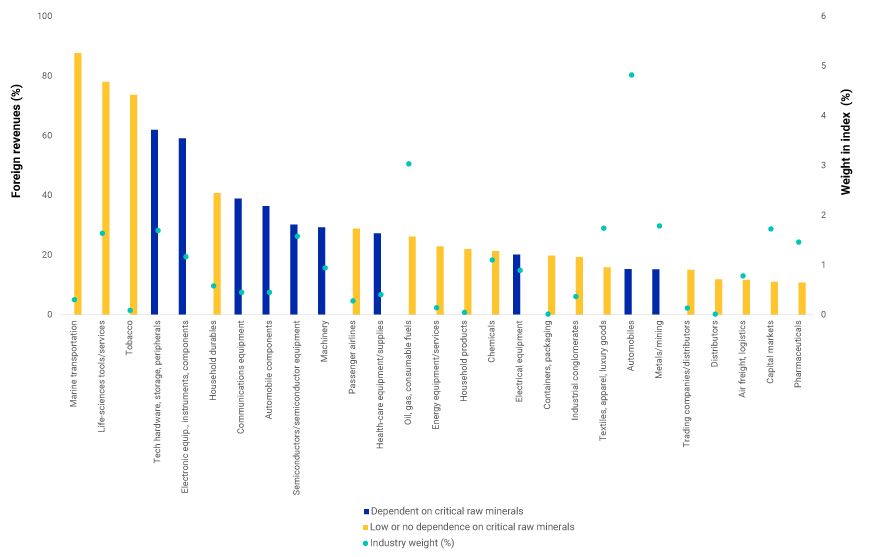

China also controls a significant share of the global supply chains in several critical raw minerals, at either the extraction or processing stage.[5] Many of these minerals are key inputs in industries, such as clean energy and technology, advanced electronics and health care.[6] These industries may have less flexibility to reconfigure their supply chains to locations outside of China in the short to medium term compared to other export-dependent industries.

To understand which industries could be more resilient, we first identified the Global Industry Classification Standard (GICS®)[7] industries in China that have more than 10% exposure to foreign revenues. As of Sept. 29, 2023, 27 GICS industries derived more than 10% of their revenues through exports and accounted for a 27.5% weight in the MSCI China Index.

We then mapped the GICS sub-industries to the industries dependent on critical raw minerals[8] and found 10 with dependencies, including technology hardware, electronic and communications equipment, automobile components and machinery. Multinational companies in these industries may face a challenge in diversifying their production away from China.

Critical mineral dependence of top export-oriented industries in the MSCI China Index

Data as of Sept. 29, 2023.

Our analysis could raise two important points for global investors. First, our observations can serve as a reminder of China's continued importance in the global supply chain. And second, they may provide a better understanding of why certain industries and themes highly dependent on China could be more exposed to geopolitical risk or sentiment, as well as the challenges of diversifying that risk away by moving supply chains to other countries.

Subscribe todayto have insights delivered to your inbox.

1 Wang Zheng, “China maintains world's largest manufacturing hub for 12 consecutive years,” People's Daily Online, March 13, 2022.2 Rosemary Coates, Michael Gherman and Rafael Ferraz, “Global Labor Rate Comparisons,” Reshoring Institute, accessed on Dec. 5, 2023.3 “Gross domestic spending on R&D,” Organization for Economic Cooperation and Development, accessed on Dec. 18, 2023.4 Sam Howell, “Technology Competition: A Battle for Brains,” Center for a New American Security, July 24, 2023.5 Francesco Paron, “Europe's Dependence on Critical Raw Materials: Implications for the Competitiveness and Independence of Strategy Industries,” Istituto Affari Internazionali, March 8, 2018.6 “Critical Materials: Geopolitics, Interdependence, and Strategic Competition,” Lazard, May 2023.

“The Role of Critical Minerals in Clean Energy Transitions,” International Energy Agency, March 2022.7 GICS is the global industry-classification standard jointly developed by MSCI and S&P Global Market Intelligence.8 Our mapping process began with the minerals for which China controls a significant amount of the global supply. We then mapped these minerals to the products and industries highly dependent on them. Our next step was to map the products and industries to the GICS sub-industries. The identification of industries dependent on critical raw minerals was based on data sources specified in endnote 6.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.