Coronavirus and a potential MBS convexity whipsaw

Blog post

March 6, 2020

- Year-to-date MBS underperformance, relative to the curve hedge, seemed to show the growing fear of a refinance wave, as rates dropped to historical lows amid fears of COVID-19's potential impact on the global economy.

- Recent empirical durations — i.e., those implied by observed MBS pricing data — trended well below durations predicted by MSCI models, indicating a new reality of MBS hedging and potential risk of underhedging in the future.

- Horizon analysis of a hypothetical index-tracking MBS portfolio showed potentially significant profit-and-loss leakage driven by MBS convexity whipsaw, under scenarios in which rates reverse course and rise.

Tracking the growing fears of a refinance wave

Investors commonly use Treasurys and various interest-rate products to hedge unwanted duration risk in MBS portfolios. But the relative price movements between MBS and the hedges may diverge, leaving investors over- or underhedged.

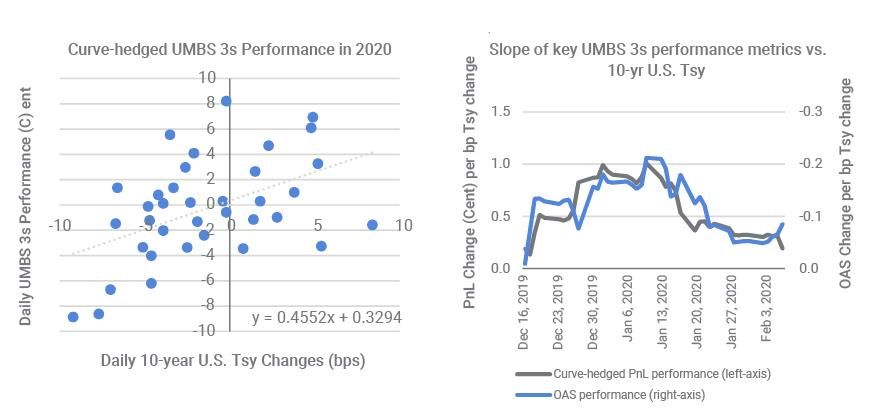

The exhibit below shows the underperformance of a curve-hedged position in uniform MBS (UMBS) with a 3% coupon from the to-be-announced (TBA) market since the end of last year. As rates rallied, refinance fears might have grown greater than what was previously priced in when the initial hedge was constructed. The positive correlation between daily changes of realized profit and loss (P&L) of curve-hedged MBS and the 10-year Treasury yield implied that the TBA market kept pricing in more and more refinance risk as rates kept trending lower. In other words, the subsequent market pricing judged that previous hedging may have been overdone.

Similarly, the strong negative correlation of the option-adjusted spread (OAS) and rate movements — OAS widened when Treasury yield dropped — suggested the same insight. The widening OAS illustrated MBS underperformance, even as both gamma (near-term rates volatility) and vega (long-term rates volatility) were theoretically hedged out by this metric. Note that, more recently, the hedge ratio was eventually adjusted to the new reality, resulting in less P&L leakage.

Underperformance of curve-hedged MBS showed market's growing fear of refinance wave

Data is based on UMBS 3% coupon. The curve hedging was constructed with 2- and 10-year swaps based on empirical duration with convexity adjustment; the OAS directionality was computed using the MSCI Agency Fixed Rate Prepayment Model.

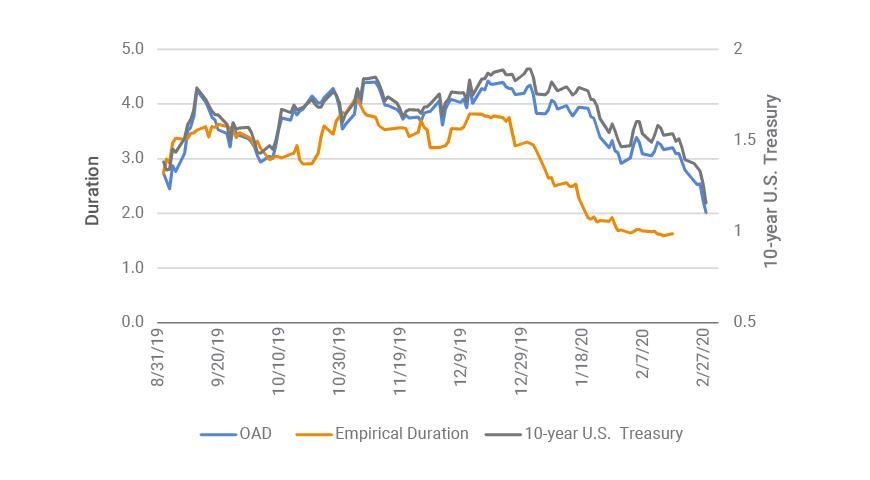

As we pointed out in our 2020 outlook, a sharp rate rally could stoke a refinance wave even stronger than the one in 2019. In this scenario, the aggregate prepayment speed could double from the current 15% conditional prepayment rate (CPR) to 30% CPR in the coming months, according to the MSCI Agency Fixed Rate Prepayment Model. The following exhibit illustrates that empirical duration — derived by regressing securities' historical price changes against changes in the rates of swaps and Treasurys — has trended well below model option-adjusted duration (OAD) since the beginning of 2020. This is consistent with the underperformance of curve-hedged MBS so far this year. Indicators have pointed to a market that seemed to increasingly worry about the refinance wave as rate levels plunged.

Widening gap between empirical and model durations shows new challenges in MBS hedging

Data is based on UMBS 3% coupon. OAD was computed using the MSCI Agency Fixed Rate Prepayment Model,

Is the market now overestimating prepayment risk but underhedging duration risk?

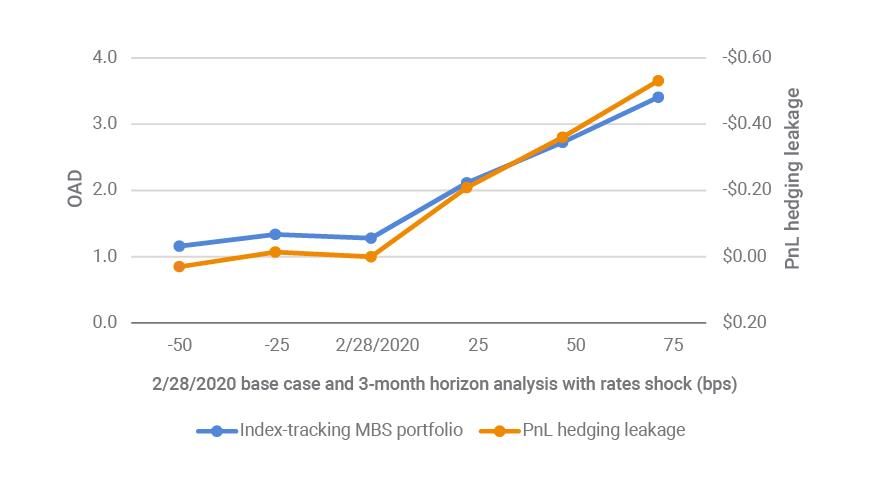

With the hopeful prospect that this coronavirus could be contained soon, MBS investors face the challenge of adjusting hedge ratios to avoid whipsaw in the event rates normalize. The exhibit below shows the duration profile of our hypothetical MBS portfolio, overlayed with the potential P&L hedging leakage if the current hedge ratio were applied.

According to our prepayment model, the simulated portfolio's duration would lengthen significantly in high-rate scenarios — possibly lengthening beyond the duration observed at the beginning of the year — as a result of a roughly 6-bp overall coupon down-drift and mild refinance-propensity burnout, after a three-month period of high prepayment activity. If rates were to reverse course and rise, investors could be underhedging risk as refinance fear wanes, leading to significant P&L leakage. This is a typical historical whipsaw for MBS: When the market makes a roundtrip, thanks to the fear of negative MBS convexity, duration shortens/extends as rates rally/sell off. Meanwhile, a further rates rally potentially poses much less risk at this point, asymmetrically.

Hypothetical MBS index-tracking portfolio may underperform the curve hedges if rates back up

Source: MSCI Agency Fixed Rate Prepayment Model

In summary, investors and risk managers may wish to monitor coronavirus developments closely and adjust their hedging activities accordingly — to avoid potential whipsaw from MBS convexity.

Further Reading

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.