Green bonds: Growing bigger and broader

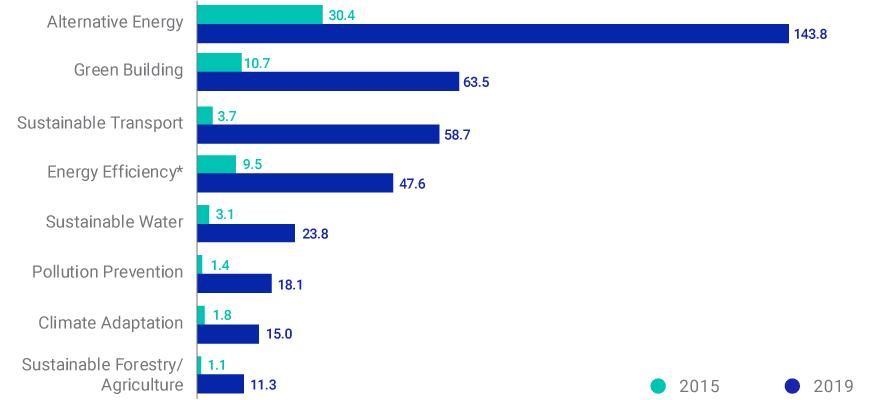

- The variety of purposes funded by green bonds has expanded beyond alternative energy to green building and sustainable-transport projects.

- Green-bond initiatives include transition bonds, target-linked bonds and innovative structures designed to enhance bond liquidity.

- The amount raised by ESG-linked loans — those that are tied to the issuer's ESG performance — more than doubled in FY 2019 from the prior year.

- Transition bonds. These bonds fund a movement away from environmentally damaging projects (such as coal-based power generation) toward greener projects (such as natural-gas-based power generation), although not toward best-in-class green projects (like solar photovoltaic power generation). For example, the European Bank for Reconstruction and Development in 2019 issued a green transition bond whose proceeds are used to help conversions from coal to gas and in the manufacture of recyclable plastic.2 Similarly, Marfrig Global Foods, a beef processor, issued a "sustainable transition bond" through which it would purchase cattle from farms that respect its deforestation criteria.3

- Target-linked bonds. By linking their coupon to the successful achievement of an environmental or social target, these bonds help finance specific green objectives. For example, Italian utility Enel SpA issued a bond linked to the United Nations Sustainable Development Goals that ties its yield to achievement of targets, such as the percentage of renewable energy installed.4 If Enel achieves its defined target by a set date, the coupon remains unchanged, and if not, the coupon is stepped up. Similarly, Conservation Capital arranged a "rhino bond" in which investors would be repaid their investment plus a coupon only if the population of black rhinos, an endangered species, increases through funding from the bond.5

- Bond structures that increase liquidity. Denmark's central bank has been exploring the possibility of splitting a conventional green bond into two parts: a conventional green bond plus a green certificate that could be traded separately.6 The purported advantage is that the underlying sovereign bond would be more liquid, while a tradeable "green certificate" would ensure that green expenditures at least match the proceeds from the package. This model is designed to help sovereign states with limited funding to maintain liquidity by not fragmenting their issuance.

Unnamed: 0 | Green / Social / Sustainability Bonds | ESG-linked Loans |

|---|---|---|

Unnamed: 0 Purpose | Green / Social / Sustainability Bonds Invest in specific green, social or sustainability projects or project categories | ESG-linked Loans Create a time-bound financial link (via the interest rate) between a borrower's ESG target and its achievement |

Unnamed: 0 Use of proceeds | Green / Social / Sustainability Bonds Ring-fenced to green, social or sustainability projects | ESG-linked Loans General-purpose use |

Unnamed: 0 Interest rate | Green / Social / Sustainability Bonds Independent of projects invested in through the bond | ESG-linked Loans Interest-rate changes based on success or failure in achieving ESG-linked target |

Unnamed: 0 Borrower industry | Green / Social / Sustainability Bonds Primarily financial institutions, utilities, real estate and governments | ESG-linked Loans Various industries |

Unnamed: 0 Benefits to issuer/borrower | Green / Social / Sustainability Bonds Investor diversification, "green" reputation | ESG-linked Loans Potential for lower interest rate if target is achieved |

Unnamed: 0 Benefits to investor/lender | Green / Social / Sustainability Bonds Increase "green" or "social" portfolio | ESG-linked Loans Potential for higher interest rate if borrower does not meet target |

Unnamed: 0 Size of market | Green / Social / Sustainability Bonds ~USD 250 billion in 2019 | ESG-linked Loans ~USD 100 billion in 2019 |

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.