Integrating ESG into Factor Portfolios

Blog post

November 30, 2016

Over the past decade, many long-term institutional investors have incorporated Environmental, Social and Governance (ESG) considerations into their portfolios, by creating segregated ESG mandates or by incorporating ESG criteria across the entire portfolio.

Adding ESG criteria into long-term portfolios raises some important questions:

- What is the impact of ESG on portfolio performance and characteristics?

- How does it alter the risk profile and the factor exposures of portfolios?

- How does it affect investors' ability to pursue their investment strategy?

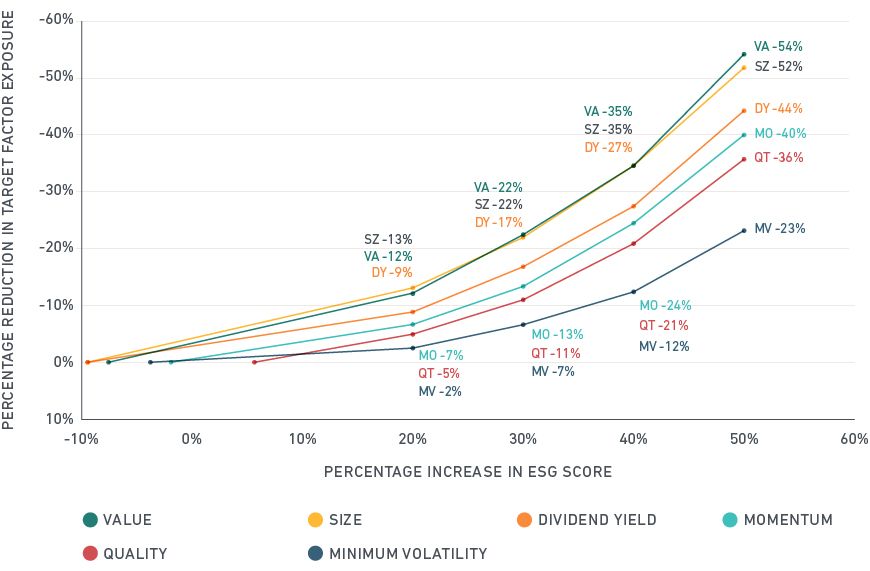

The effect of ESG scores on target factor exposure

Our results suggest that passive investors would have been able to improve the ESG characteristics of their strategies without a negative impact on their ability to capture market returns efficiently. Defensively oriented factor strategies (where ESG had positive correlation with the target factors), such as high quality and low volatility, would have benefited from incorporating ESG. Even dynamic strategies, such as those based on the value and momentum factors, could have enhanced their ESG profile with only a modest impact on target factor exposures and ex-ante information ratios.

These results may provide guidance to passive and active managers who wish to incorporate ESG criteria into their strategies. They show that historically ESG has generally improved the information ratio of many typical passive and factor-based investment strategies. They also show that the impact of ESG on ex-ante information ratios of these strategies is relatively moderate and varies according to the primary investment objective and target factors of the underlying strategy.

The author would like to thank Zoltán Nagy and Padmakar Kulkarni for their contributions to this research.

Further reading:

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.