Pursuing ESG Standards and Diversification

Blog post

July 27, 2017

Many of the world's largest institutional investors are integrating ESG standards into their investment strategies. But they face a challenge: Excluding every objectionable firm or selecting only ESG (environmental, social and governance) leaders can slash the number of acceptable stocks by half while foreclosing on opportunities for dialogue and engagement. How can institutions implement ESG principles without sacrificing diversification or abandoning efforts to improve corporate conduct?

One way is to increase the weightings of companies with strong ESG profiles, including those that show improved ESG ratings over the most recent 12 months, while minimizing exclusions to a core group of objectionable stocks. This approach can enable investment in a broad, diversified stock universe while allowing institutional investors to engage poor ESG performers.

The first challenge is establishing the core set of excluded stocks. After consulting large asset owners, we arrived at a consensus to exclude only the worst ESG performers, as defined by their involvement in controversial weapons (cluster munitions, landmines, biological and chemical weapons), and violations of international human-rights and environmental norms. The second challenge is weighting the remaining stocks toward companies that have a strong ESG profile or are improving their ESG performance.

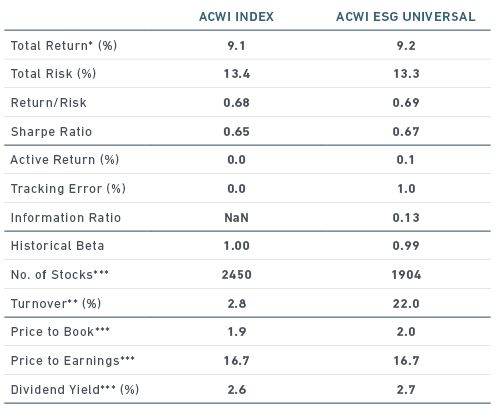

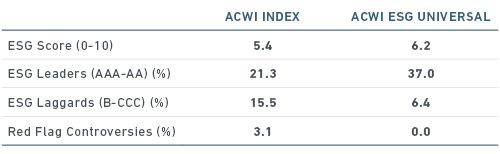

Backtested performance of the MSCI ESG Universal Index, designed to represent such a strategy, produced a superior ESG profile to the index's parent ACWI index while retaining similar risk-return characteristics, with a 1% tracking error (the degree to which a portfolio's performance deviates from its parent index). As shown in the charts below, the ESG Universal Index narrowly outperformed the MSCI ACWI Index (which represents 46 developed and emerging markets) by an annual average of 10 basis points over a 7.5-year simulation period.1

Thus, targeting companies with stronger ESG profiles than their peers produced a result with similar risk-return characteristics as the parent index. Such approaches could help large asset owners seeking a more systematic way to integrate ESG considerations into their investment strategy.

The MSCI ACWI ESG Universal Index Narrowly Outperformed the MSCI ACWI Index

Backtested simulation from Nov. 30, 2009 to June 30, 2017

Relative Performance

Backtested simulation from Nov. 30, 2009 to June 30, 2017

Data as of June 30, 2017

Further Reading:

Subscribe todayto have insights delivered to your inbox.

1 Backtested performance is not actual performance, but is hypothetical. There are frequently significant differences between backtested performance results and actual results subsequently achieved by any investment strategy. Such results are not indicative of future results or performance, which may also differ materially.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.