Real estate may be yielding less than you thought

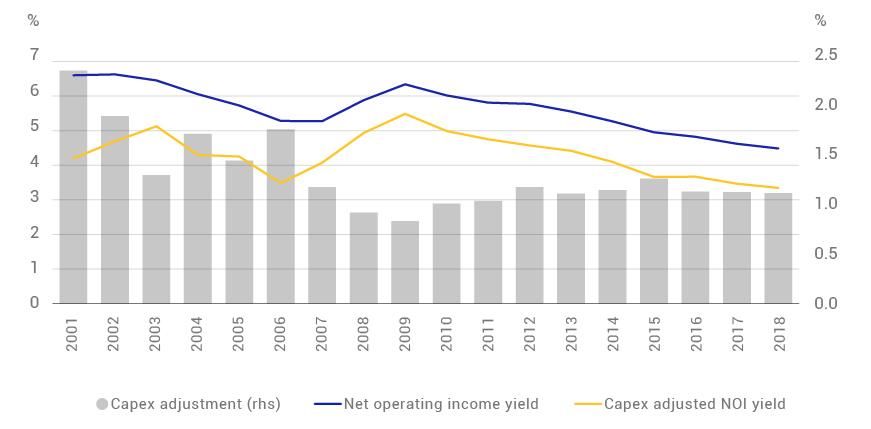

- Income is an important part of real estate returns, meaning yields are often heavily scrutinized by investors. But headline yields often do not factor in capital-expenditure (capex) requirements.

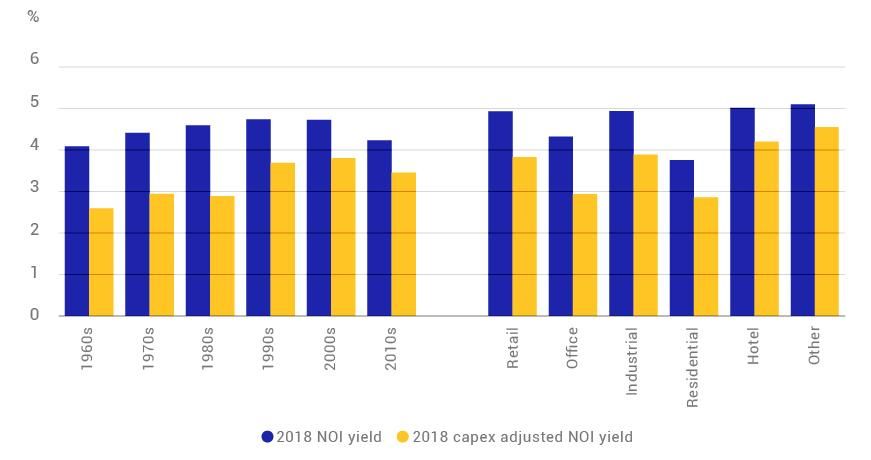

- Variables such as age, location and property type can influence how much capex is required to operate an asset.

- Investors looking to understand the potential "free cash flow" position of assets or portfolios post-capex may want to adjust the yields they use to account for it.

Country | Net Operating Income Yield | Capex Adjusted NOI Yield |

|---|---|---|

Country South Africa | Net Operating Income Yield 7.9% | Capex Adjusted NOI Yield 6.6% |

Country New Zealand | Net Operating Income Yield 5.8% | Capex Adjusted NOI Yield 3.0% |

Country Belgium | Net Operating Income Yield 5.6% | Capex Adjusted NOI Yield 5.0% |

Country Poland | Net Operating Income Yield 5.5% | Capex Adjusted NOI Yield 4.8% |

Country Hungary | Net Operating Income Yield 5.3% | Capex Adjusted NOI Yield 4.5% |

Country Portugal | Net Operating Income Yield 5.2% | Capex Adjusted NOI Yield 4.9% |

Country Australia | Net Operating Income Yield 5.2% | Capex Adjusted NOI Yield 3.5% |

Country Czech Republic | Net Operating Income Yield 4.8% | Capex Adjusted NOI Yield 3.5% |

Country Ireland | Net Operating Income Yield 4.7% | Capex Adjusted NOI Yield 4.2% |

Country Norway | Net Operating Income Yield 4.5% | Capex Adjusted NOI Yield 3.3% |

Country Canada | Net Operating Income Yield 4.5% | Capex Adjusted NOI Yield 2.6% |

Country Japan | Net Operating Income Yield 4.4% | Capex Adjusted NOI Yield 4.0% |

Country UK | Net Operating Income Yield 4.4% | Capex Adjusted NOI Yield 3.7% |

Country US | Net Operating Income Yield 4.4% | Capex Adjusted NOI Yield 2.8% |

Country Spain | Net Operating Income Yield 4.3% | Capex Adjusted NOI Yield 3.3% |

Country Austria | Net Operating Income Yield 4.1% | Capex Adjusted NOI Yield 3.6% |

Country Italy | Net Operating Income Yield 4.1% | Capex Adjusted NOI Yield 3.5% |

Country South Korea | Net Operating Income Yield 4.0% | Capex Adjusted NOI Yield 3.9% |

Country Netherlands | Net Operating Income Yield 4.0% | Capex Adjusted NOI Yield 3.6% |

Country France | Net Operating Income Yield 4.0% | Capex Adjusted NOI Yield 3.5% |

Country Germany | Net Operating Income Yield 3.9% | Capex Adjusted NOI Yield 3.4% |

Country Sweden | Net Operating Income Yield 3.7% | Capex Adjusted NOI Yield 2.3% |

Country Switzerland | Net Operating Income Yield 3.6% | Capex Adjusted NOI Yield 3.1% |

Country Denmark | Net Operating Income Yield 3.6% | Capex Adjusted NOI Yield 2.9% |

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.