SEC Climate Disclosure: Targeting Standardization

- The Securities and Exchange Commission's proposal for climate disclosures could help standardize information on climate-related goals declared by U.S. companies.

- 60% of companies in the MSCI USA Investable Market Index that have set targets for reducing greenhouse-gas emissions are currently reporting information that is consistent with the proposal.

- Conversely, 40% of the companies that have set targets have missed some key target-related metrics required by the proposal.

Observations: Target-related information

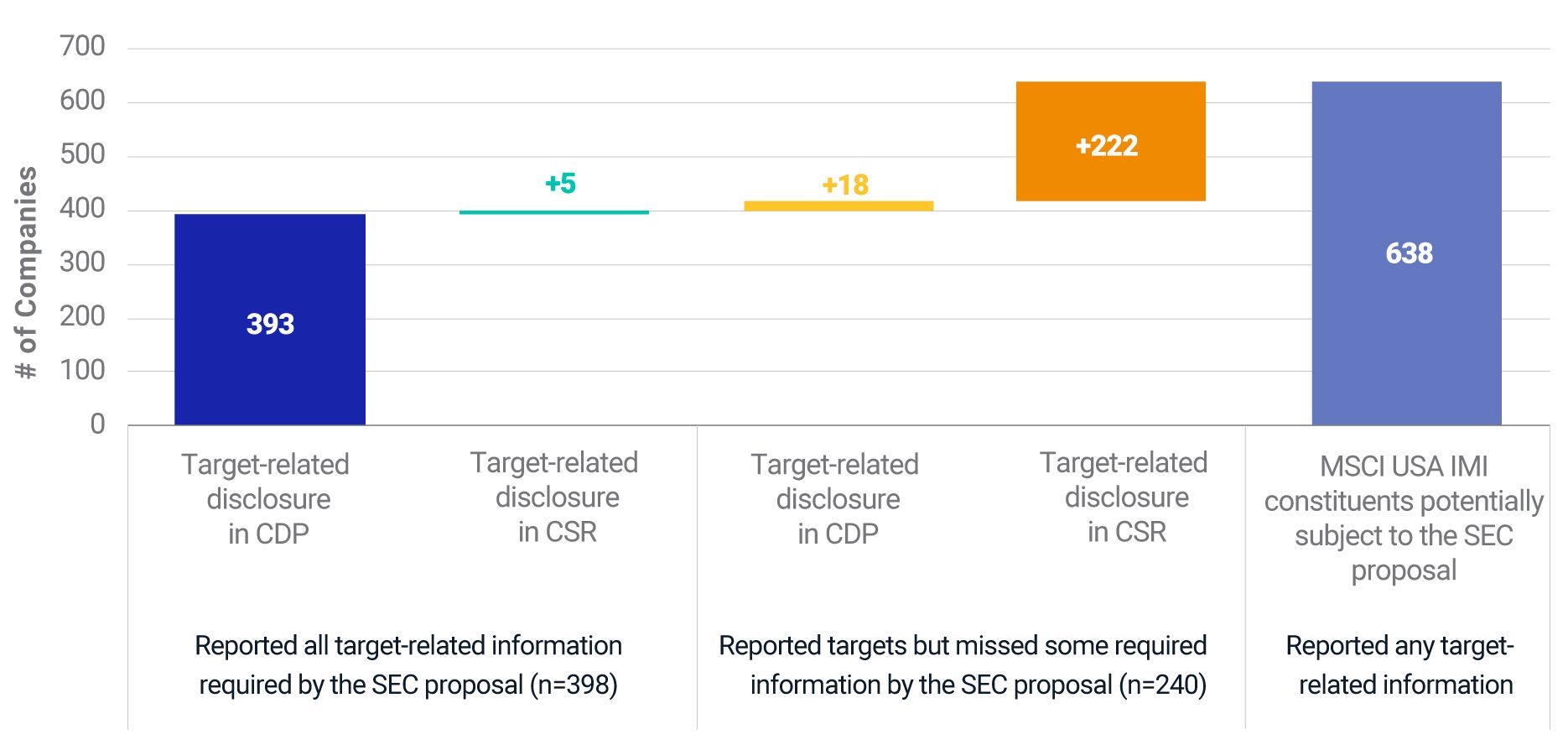

We observed that 638 companies, or about 25% of the MSCI USA Investable Market Index (IMI), have disclosed some type of climate target as of May 2022 (shown below): About 60%, or 398 companies, have reported target-related information consistent with the SEC proposal on base greenhouse-gas (GHG) emissions, target carbon-reduction values and emission scopes covered, among others.2 However, 40%, or 240 companies, reported some targets but missed key target-related metrics that were in line with the SEC proposal.

MSCI USA IMI companies that have disclosed target-related information

Differences between 393 companies that reported all target information requirements and five companies that reported all target-related information mainly resulted from varied reporting platforms (i.e., CDP and corporate sustainability reports). Source: MSCI ESG Research

Disclosures varied

The companies that fell short on proposed climate-target disclosures were mostly idiosyncratic and not always comparable, making it difficult to systematically measure these targets' actual reduction in tons of CO2 equivalent. For instance, we found no consistent disclosure around baseline year or baseline emissions among the 222 companies that reported targets in their corporate-social-responsibility (CSR) or sustainability reports. Without a clear starting point, it is difficult for investors to assess the rate of reduction that companies commit to, as well as any progress.

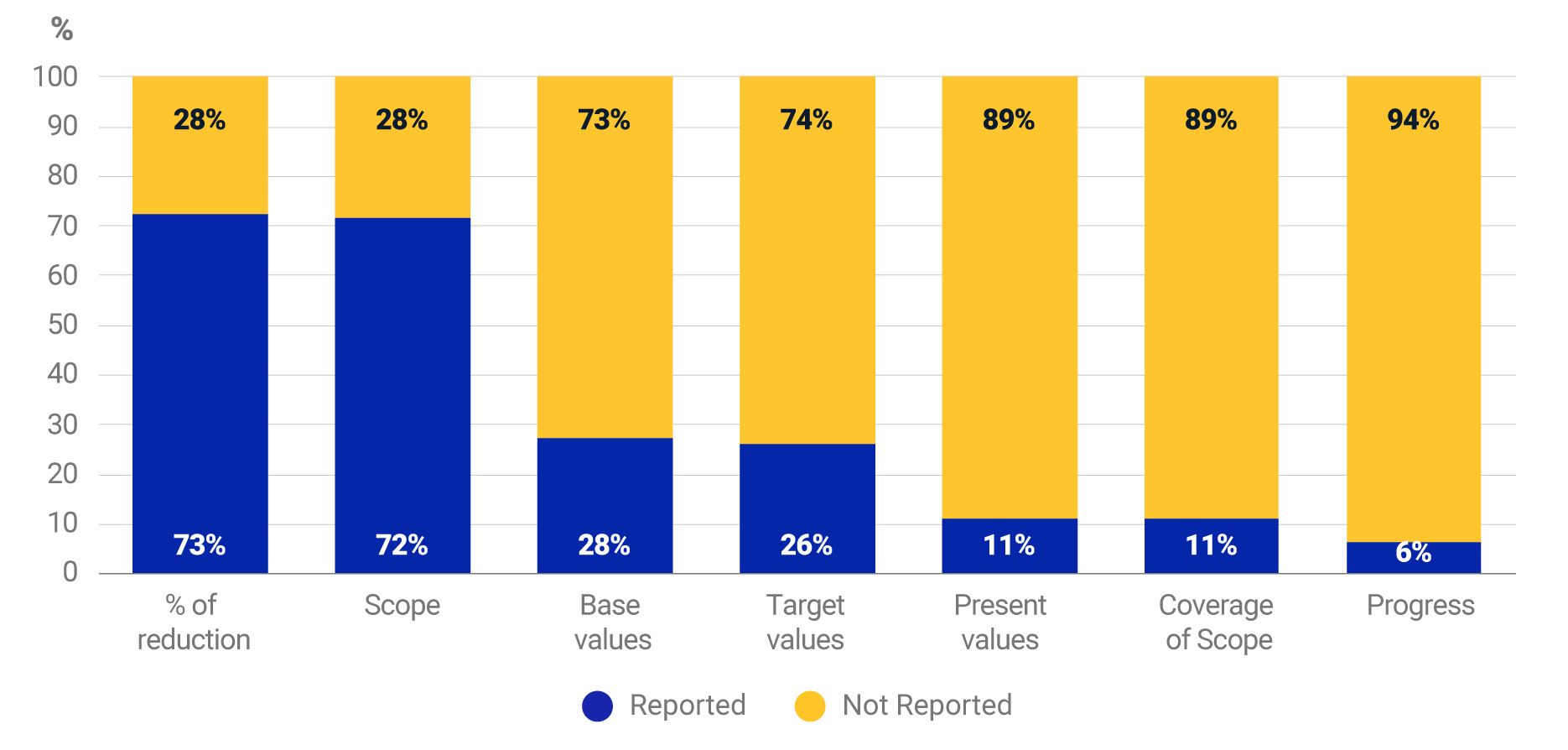

Additionally, some companies focused on emission intensities per economic unit, while others focused on absolute emissions reduction. Without standardized disclosure frameworks, the breadth and divergency of companies' climate targets can make it difficult to assess the potential impact such targets could have, if achieved, on companies' carbon-risk profiles. In total, we found 240 companies did not report key target information from their climate disclosures (shown below). Key target metrics range from the target's coverage to its progress, as well as the values associated with the possible monitoring of that progress (including intensity values and base-year and target-year emissions).

Reporting of information related to climate targets

Data as of October 2021. Coverage of scope refers to business activities and geographies covered by the targets. Source: CDP, MSCI ESG Research

Potential impact of the disclosure proposal

We believe the SEC disclosure proposal attempts to remedy disclosure inequity and the absence of key data by requiring companies to provide certain target-related information on the following publicly declared climate goals:

Type: Whether the target is absolute- or intensity-based

Scope: The extent of targeted emissions

Progress: Baseline emissions and annual improvement against stated targets

Time horizons: When the target is intended to be achieved, with any interim targets

Strategy: How the company intends to meet the target

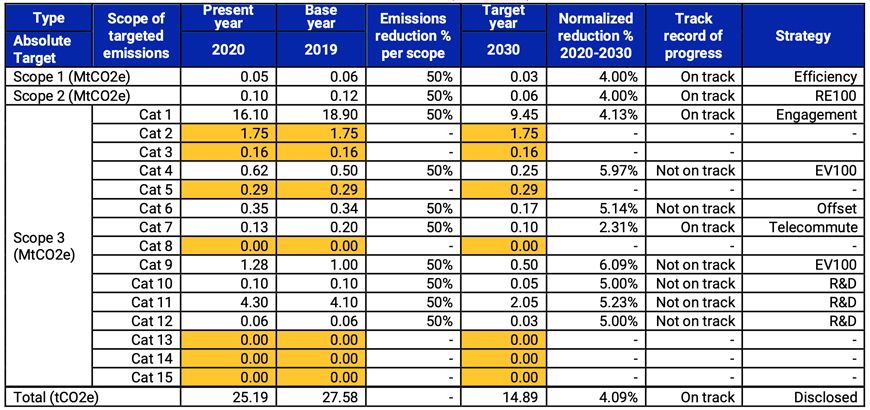

If companies report all of these components, the result may look similar to the table below, based on a hypothetical company. The company targets a 50% reduction of Scope 1 and 2, as well as Scope 3 (categories 1, 4, 6, 7, 9, 10, 11 and 12) emissions below 2019 levels by 2030. The company's decarbonization strategy and progress per scope and category are also indicated. We believe that similar disclosures could help investors more directly compare companies' relative annual emissions reductions and climate-target progress.

Disclosing target-related information: A hypothetical example

□=Reported emissions per scope and category ■=Estimated emissions per category

When a target does not focus on a particular scope or category, the table above assumes that the latest reported and estimated emissions remain constant. In "Track record of progress," we assessed the progress companies made to meet their ongoing targets by benchmarking companies' latest reported emissions against their targeted trajectory and indicated "On track" if the company's latest emissions were below the targeted trajectory and "Not on track" if above the trajectory. In "Strategy," "Efficiency" means energy-efficiency measures, "RE100" and "EV100" refer to industry initiatives, "Engagement" means supplier engagement, "Telecommute" means work from home, "Offset" refers to the amount and source of carbon offsets used for emissions reduction, "R&D" indicates development of low-carbon products and manufacturing process. We assumed that the company did not target to reduce emissions it did not report such as Scope 3 categories 2, 3 and 5. We estimated the company produced zero emissions from Scope 3 categories 13, 14, and 15. Source: MSCI ESG Research

Potential for transparency and standardization

If adopted, the SEC's proposal could help standardize target-related information on climate goals and enhance investors' ability to monitor and assess annual emissions reductions. This disclosure framework may represent an opportunity to transition to a more transparent, measurable and comparable climate-related playing field.

Further Reading

Which Scope 3 Emissions Will the SEC Deem 'Material'?

Companies May Not be Ready for SEC Climate-Disclosure Rules

Understanding the SEC's Proposed Climate Disclosure Rules

Capital for Climate Action Conference – Fireside Chat with the SEC

A decisive step forward on climate change disclosure

Breaking Down Corporate Net-Zero Climate Targets

Subscribe todayto have insights delivered to your inbox.

1 “Proposed rule: The Enhancement and Standardization of Climate-Related Disclosures for Investors.” Securities and Exchange Commission, March 21, 2022.2A majority of companies have reported this information to the CDP in 2021.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.