Underwater assets? Real estate exposure to flood risk

Blog post

September 17, 2019

- Real estate investors are buying and leasing assets whose useful lives might very well extend into a climate-changed world. Some assets could be much more exposed to physical hazards than others under some scenarios.

- Geospatial analysis combining individual property locations and detailed local data, as well as resilience measures such as flood barriers, can help investors identify high-risk assets.

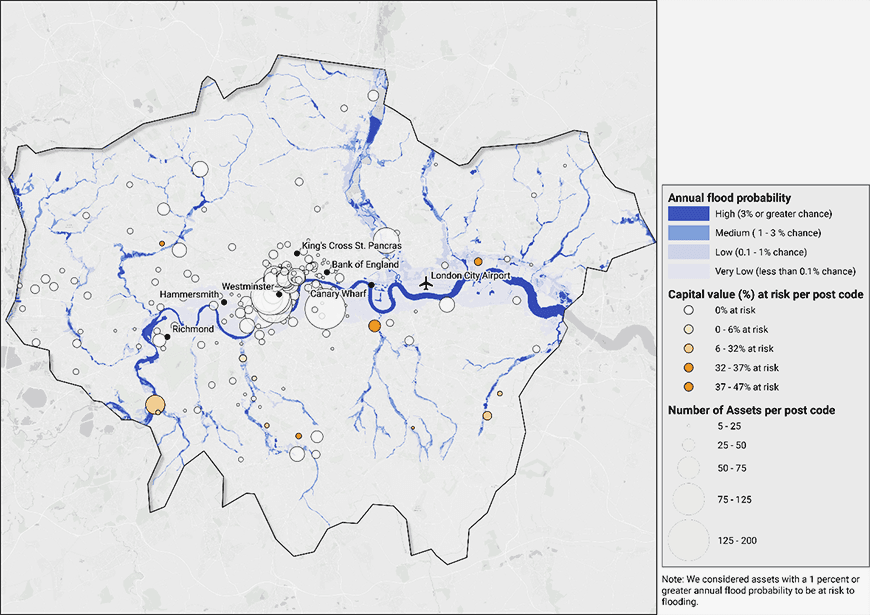

- While the Thames Barrier protects much of Central London, we found certain areas more exposed. For example, 35% of measured assets by capital value are at risk in the borough of Lewisham.

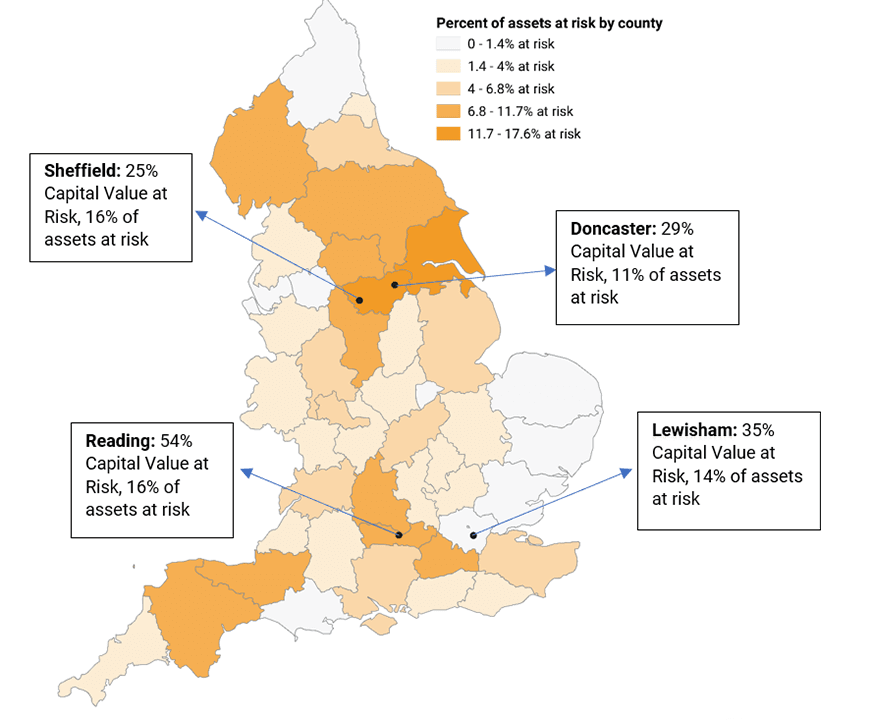

Exposure to flood risk by county in England

Sources: MSCI Real Estate, Natural Earth, Environment Agency

Greater London, on the other hand, was somewhat less exposed. This is due in large part to the Thames Barrier, the world's second-largest movable flood-defense system, which protects Greater London from high tides and storm surges emanating from the North Sea. The Thames Barrier can provide a flood defense as tall as an eight-story building, protecting 1.3 million people and billions of pounds in property value.8

The map below illustrates that the largest concentrations of assets in Central London closest to the Thames itself are at low to very low risk of flooding. In contrast, the postcodes with most assets at risk tend to be located closest to the Thames' tributaries in less central areas of Greater London.

Capital value at risk per postcode in Greater London area

Sources: MSCI Real Estate, Natural Earth, Environment Agency

How can real estate investors manage these risks? A detailed asset-level risk-exposure assessment is a useful first step. After assessing exposure, investors may consider avoiding high-risk areas. Another approach may be to transfer the risk to insurance companies and tenants as these hazards become more probable and extreme; however, insurance premiums may rise — or worse: Insurance coverage itself might become unattainable. Alternatively, investors might consider whether to engage with policymakers and regulators on local climate-resilience strategies. Regardless of the approach, investors can likely no longer ignore these risks.

The authors thank Gaurav Trivedi, Cyrus Lotfipour and Niel Harmse for their contributions to this post.

Further Reading

Subscribe todayto have insights delivered to your inbox.

1"New data confirm increased frequency of extreme weather events: European national science academies urge further action on climate change adaptation." ScienceDaily, March 21, 2018.2Burgess, K. and Rapoport, E. 2019. “Climate Risk and Real Estate Investment Decision-Making.” Heitman, Urban Land Institute.3Teuben, B. and Bothra, H. 2018. “Real Estate Market Size: Annual Update on the Size of the Professionally Managed Global Real Estate Investment Market.” MSCI Research Insight.4Our analysis is based on geocoding of real estate properties representing 98% coverage by number of assets and 96% by capital value of the England real estate market (11,500 assets with USD 253.4 billion capital value) in the MSCI UK Property Index (13,130 assets with USD 281.2 bn capital value).5As of Dec. 21, 2018.6“Risk of Flooding from Rivers and Sea.” Environment Agency, June 17, 2019.7The resolution of the flood-risk data from the Environment Agency dataset is based on 50- x 50-meter cells.8“The Thames Barrier: How the Thames works, and when it is scheduled to close.” Environment Agency, Sept. 13, 2019.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.