Updating the MSCI Agency MBS model for the COVID-19 crisis

- The coronavirus pandemic has put tremendous strain on the U.S. mortgage market, disrupting both primary mortgage originations and the secondary securitization market.

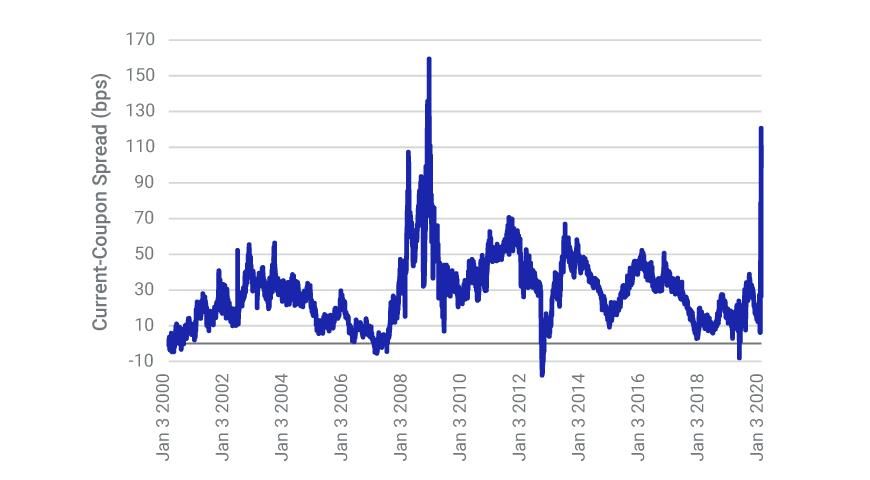

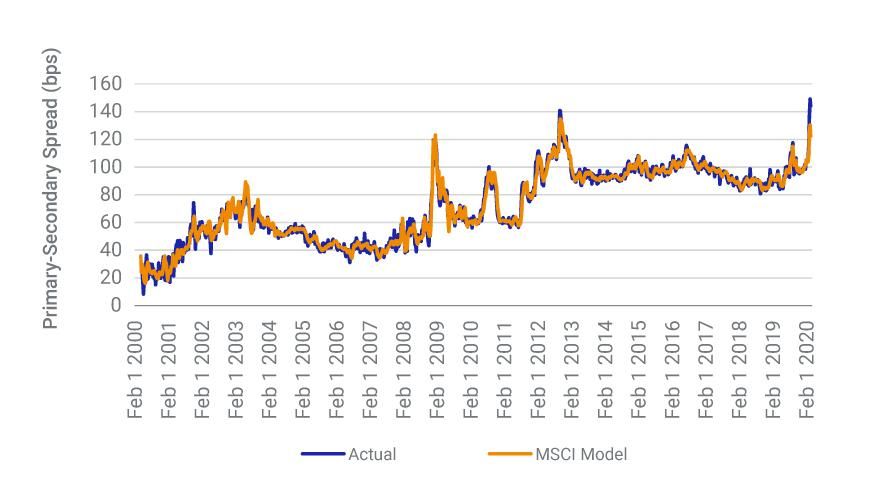

- Near-term prepayment speeds have been profoundly distorted — challenged by opposite effects from historically low interest rates and widespread public lockdowns and attendant economic disruption.

- We updated the MSCI Agency MBS Model to adjust for the near-term shocks and help clients manage this unprecedented risk.

- Housing turnover usually leads to early termination of the mortgage contract, because the house is sold. Open houses are being canceled across the country.5 Home sales could slow dramatically in the next few months, especially in areas with higher infection rates.

- Refinancing involves a large amount of paperwork to help homeowners achieve their goal of lower monthly payments. Although some technology-driven lenders and providers have digitized this process to a certain extent, some procedures still require manual in-office operations and even the physical presence of the borrowers and lender representatives (e.g., appraisers and closing agents). Various entities are currently working on the tactical solutions to alleviate the operational barriers.6

- Cash-out refinancing — in which the borrower replaces an existing mortgage with a mortgage with a larger balance and keeps the difference in cash — may be de-prioritized in the near term, as stricter paperwork is required to take out home equity. Cash-out activity nearly came to a halt during the previous global financial crisis (GFC).

- Technically, buyout occurs when agencies (or servicers, in the case of Ginnie Mae MBS) remove the loan from the MBS pool after a period of delinquency status. The payment-forbearance plan, which does not automatically trigger the buyout, is supposed to be a temporary relief for borrowers. Homeowners' financial hardship may not be totally relieved by the government rescue plan, which could lead to a higher mortgage-default rate months later.

Unnamed: 0 | MSCI 1.0 | MSCI 1.0.1 | MSCI 1.0.2 | MSCI 1.0.3 | MSCI 1.0.4 | MSCI 1.1 | MSCI 1.1.1 | MSCI 1.1.2 | MSCI 1.1.3 | MSCI 1.1.4 |

|---|---|---|---|---|---|---|---|---|---|---|

Unnamed: 0 MBS TBA | MSCI 1.0 OAS | MSCI 1.0.1 OAD | MSCI 1.0.2 Convexity | MSCI 1.0.3 1- YR CPR | MSCI 1.0.4 LT CPR | MSCI 1.1 OAS | MSCI 1.1.1 OAD | MSCI 1.1.2 Convexity | MSCI 1.1.3 1 -YR CPR | MSCI 1.1.4 LT CPR |

Unnamed: 0 UMBS 2.5 | MSCI 1.0 48.7 | MSCI 1.0.1 3.62 | MSCI 1.0.2 -2.38 | MSCI 1.0.3 17 | MSCI 1.0.4 11 | MSCI 1.1 55.7 | MSCI 1.1.1 4.19 | MSCI 1.1.2 -2.84 | MSCI 1.1.3 10 | MSCI 1.1.4 10 |

Unnamed: 0 UMBS 3.0 | MSCI 1.0 54.4 | MSCI 1.0.1 2.08 | MSCI 1.0.2 -1.70 | MSCI 1.0.3 34 | MSCI 1.0.4 18 | MSCI 1.1 67.7 | MSCI 1.1.1 2.67 | MSCI 1.1.2 -2.59 | MSCI 1.1.3 22 | MSCI 1.1.4 15 |

Unnamed: 0 UMBS 3.5 | MSCI 1.0 48.1 | MSCI 1.0.1 1.45 | MSCI 1.0.2 -0.81 | MSCI 1.0.3 40 | MSCI 1.0.4 29 | MSCI 1.1 67.4 | MSCI 1.1.1 1.86 | MSCI 1.1.2 -1.34 | MSCI 1.1.3 32 | MSCI 1.1.4 25 |

Subscribe todayto have insights delivered to your inbox.

Yu., Y. 2018. “MSCI Agency Fixed Rate Refinance Prepayment Model.” MSCI Model Insight.2Zhang, D., Yu, Y., Voros, M., and Biro, I. 2020. “Agency MBS Current Coupon Calculation from TBA Prices.” MSCI Model Insight.3Yu, Y. and Zhang, D. 2019. “MSCI Current Coupon Models: Model Risk Premium in a Risk-Neutral Model.” MSCI Model Insight.4Yu, Y. 2018. “MSCI Primary-Secondary Mortgage Spread Model.” MSCI Model Insight.5Lansner, J. “Coronavirus cutback: California Realtors told to stop home showings, open houses.”, March 20, 2020.6Mollot, S. “Cuomo allowing virtual notarizations during crisis.” , March 22, 2020.

“FHFA Directs Enterprises to Grant Flexibilities for Appraisal and Employment Verifications.” Federal Housing Finance Agency, March 23, 2020.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.