What Can Capex Reveal About Emissions Reductions?

Key findings

- Measuring progress toward climate targets by only examining emissions trends during interim years may provide an incomplete picture due to the long-term nature of these goals.

- Companies with climate targets have tended to direct more capital expenditure (capex) to activities designed to mitigate climate change or for renewable-energy generation than companies without targets, especially within utilities.

- Investors assessing the transition readiness of portfolio companies through capex data should consider sectoral and regional variations to more effectively apply investment and engagement strategies.

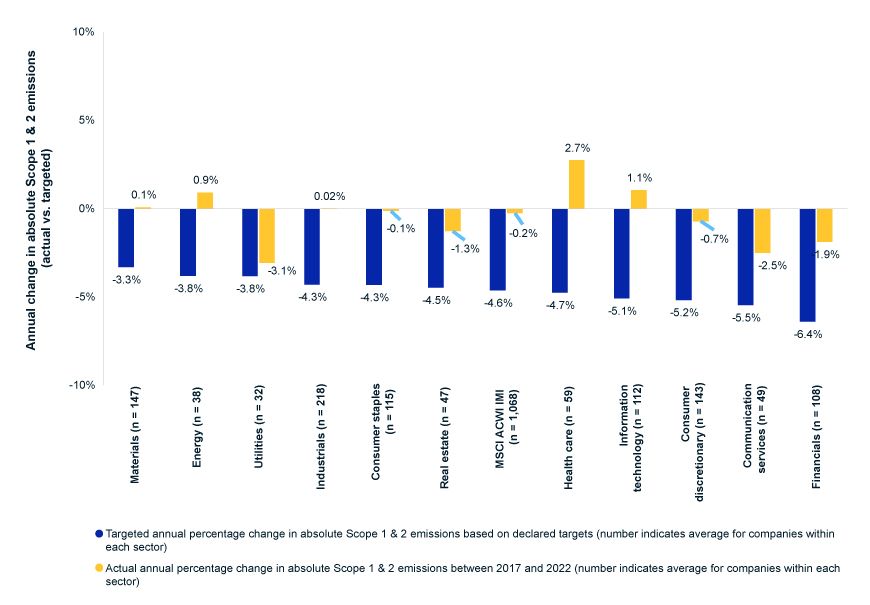

Our research found that 5,099 constituents (58%) of the MSCI ACWI Investible Market Index (IMI) had an active climate target. Our analysis showed that emissions-reduction trends for Scope 1 and 2 emissions lagged stated emissions-reduction targets across all sectors for fiscal years (FY) 2017 through 2022.[1] Emissions rose for companies in the materials and energy sectors during this period and while companies in the utilities sector reduced emissions at the highest rate, they still lagged their stated targets on average.

Emissions-reduction progress lagged companies' own targets

The chart shows data for 1,068 companies that were constituents of the MSCI ACWI IMI. For the analysis, companies selected set an absolute active target in FYs 2017-21 with emissions coverage above 90%. The blue bars show the annual reduction in Scope 1 and 2 emissions that these companies need to achieve based on declared targets. The yellow bars indicate the actual annual reduction these companies were able to achieve in FYs 2017-22. For details, refer to MSCI Climate Targets and Commitments Dataset. Data as of July 26, 2024. Source: MSCI ESG Research

Recently, the lack of progress on emissions reduction and the climate-target backtracking by companies such as Shell plc and Air New Zealand Ltd. have raised questions about the credibility of corporate commitment to decarbonization.[2, 3] Given the recency of targets (75% of targets were declared in FY 2020 or later), the long time frames (85% of targets apply to FYs 2030-40) and business disruptions during the COVID-19 pandemic, assessing decarbonization intent by solely looking at emissions trends may not provide a complete picture and investors may need to consider other factors.

Show us the money — capex data may provide a clearer picture

Despite investor concerns, setting targets is an important step toward reducing emissions and can be followed by various strategies, such as allocating capital resources to new infrastructure and technologies that drive emissions reductions. The transition, however, especially in high-intensity sectors, takes time and immediate emissions reductions may not occur. Capex allocations may, therefore, provide an important and more accurate signal in the interim to assess progress.

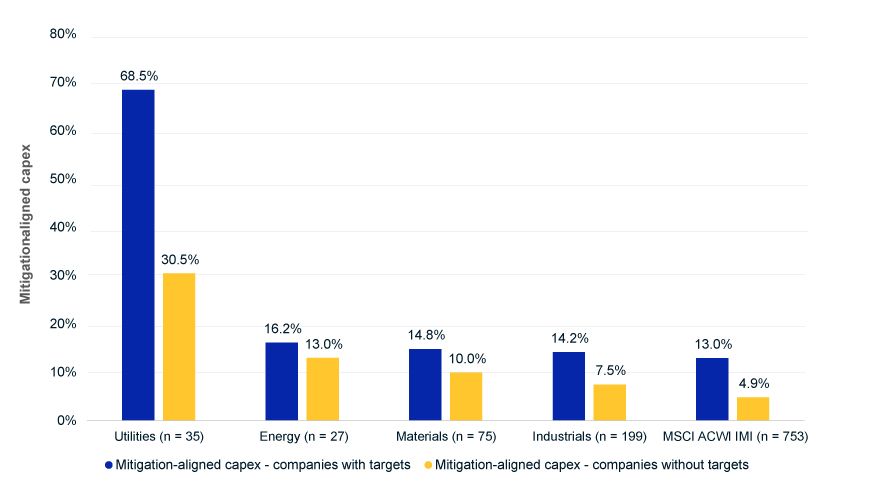

Using two datasets, we compared companies with and without climate targets to assess their capex plans. First, using the data available in the MSCI EU Sustainable Finance Package, we analyzed the reported percentage of capex for activities aligned with the "climate-change mitigation" objective of the EU Taxonomy for 753 EU-domiciled companies that were constituents of the MSCI ACWI IMI.[4] Aligned capex includes areas such as renewable-energy infrastructure, energy-efficiency improvements and development of low-carbon transportation. Across sectors with high emissions intensity, we found that companies with climate targets allocated a higher portion of their capex to aligned activities, compared to sector peers without such targets. Utilities companies with targets, on average, allocated 68.5% of capex to activities aligned with climate-change mitigation compared to 30.5% among peers without a target. While the differences were less stark in other high-intensity sectors, we did observe more capex allocation toward aligned activities for companies with an active target.

Capex allocation toward climate-change mitigation

Based on data available in the MSCI EU Sustainable Finance Package. Analysis based on data disclosure of 753 EU-domiciled companies that were constituents of the MSCI ACWI IMI. Data as of July 15, 2024. Source: MSCI ESG Research

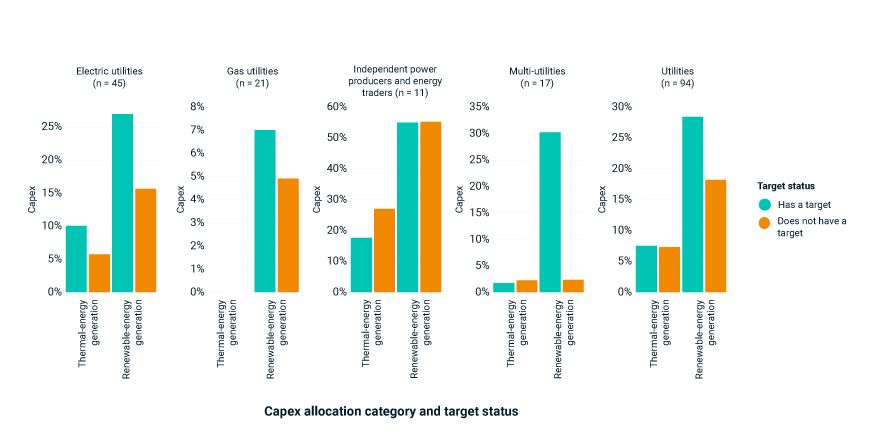

Capex for renewable-power generation was higher for utilities with targets

The second dataset we used enabled us to compare thermal and renewable-power-generation capex for both EU and non-EU-domiciled utilities companies. For disclosed capex plans (FY 2020 and later), utilities companies with a climate target allocated more capital toward renewable-power generation compared to peers without a target. Among the 51 utilities with a target that were constituents of the MSCI ACWI IMI, the average capex allocation toward renewable-power generation was 28%, against an average of 18% among the 43 utilities without targets. Companies in the sub-industries of independent power producers and energy traders and multi-utilities allocated the most capex to renewable power, although we observed a clear distinction in capex allocation within those multi-utilities companies that had a target versus those that did not.

Utilities' capex allocation toward renewable and thermal power

The chart shows capex data collected for 94 utilities that were constituents of MSCI ACWI IMI. Data for companies with multiple years of capex information was averaged. Companies in water utilities and renewable electricity were not included in the analysis. Data as of May 23, 2024. Source: MSCI ESG Research

At the regional level, we noted similar trends for issuers based in EMEA and the Americas. Companies in these regions with one or more targets invested greater amounts in renewable-power generation and less in thermal-power generation compared to peers without targets. Companies based in Asia Pacific, however, showed the opposite trend: those with a target had allocated more capex to thermal and less to renewable power.

Looking ahead

Our analysis shows that setting emissions-reduction targets is associated with higher capex allocation toward low-carbon activities. Investors may benefit from incorporating this information into their assessment of a company's intention to decarbonize. Transition-focused investors can use capex information as a tool for engagement and investment, supporting both managed phaseouts and low-carbon technology investments.

Data availability is limited, however, because voluntary and granular capex-data disclosures are not widespread. Active investor engagement can effectively encourage companies to provide more-detailed capex information alongside emissions data and other climate-related metrics.

Subscribe todayto have insights delivered to your inbox.

1 We define sectors following the Global Industry Classification Standard (GICS®). GICS is the global industry classification standard jointly developed by MSCI and S&P Global Market Intelligence.2 Josh Gabbatiss, “Shell abandons 2035 emissions target and weakens 2030 goal,” Carbon Brief, March 14, 2024.3 João da Silva, “Air NZ becomes first big carrier to drop climate goal,” BBC, July 30, 2024.4 Climate-change mitigation is one of the six objectives that classify whether an economic activity qualifies as environmentally sustainable. Nonfinancial companies under the purview of the EU Taxonomy regulation are required to disclose capex data aligned with the taxonomy.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.