What the rise in policy uncertainty might mean for institutional portfolios

Blog post

December 8, 2016

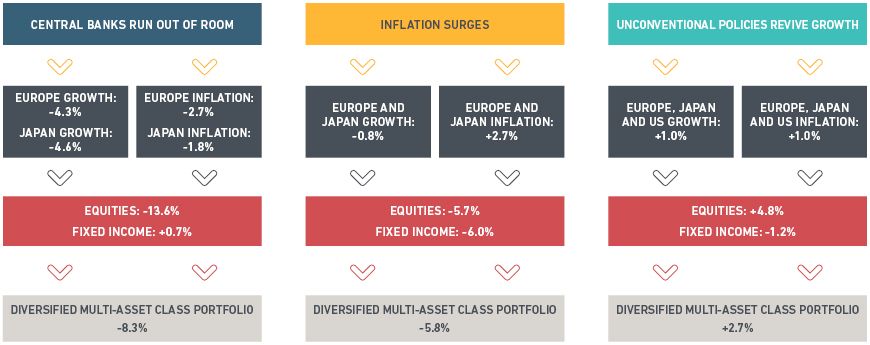

A year that was marked by the United Kingdom's vote to leave the European Union and the United States' surprise election of Donald J. Trump as president is ending with policy and geopolitical uncertainty emanating from both sides of the Atlantic that could impact economies, markets and portfolios globally. How can institutional investors address unconventional monetary and fiscal policies worldwide?

The key trends:

- Yields on government debt in the U.S. have increased since the election, reflecting market expectations of higher inflation in anticipation of a fiscal boost that could increase government borrowing.

- Investors are confronting uncertainty about the nature of complementary fiscal interventions, a rise in systemic and geopolitical risk stemming from fragile banks in Europe, an increase in protectionist sentiment, the prospect of increased borrowing in the U.S. and Europe, and questions about the health of China's corporate-debt and property markets.

Further reading:

Scenarios, Stress Tests and Strategies for Fourth Quarter 2016

What might U.S. trade barriers might mean for global equities?

What do factors tell us about regime change in U.S. stocks following the election?

How a banking crisis in Italy could impair European and global portfolios

What the rise in populism may mean for your portfolio

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.