Fund ESG Transparency Q3 2021 Spotlight: Thematic Funds

Research Paper

October 29, 2021

Preview

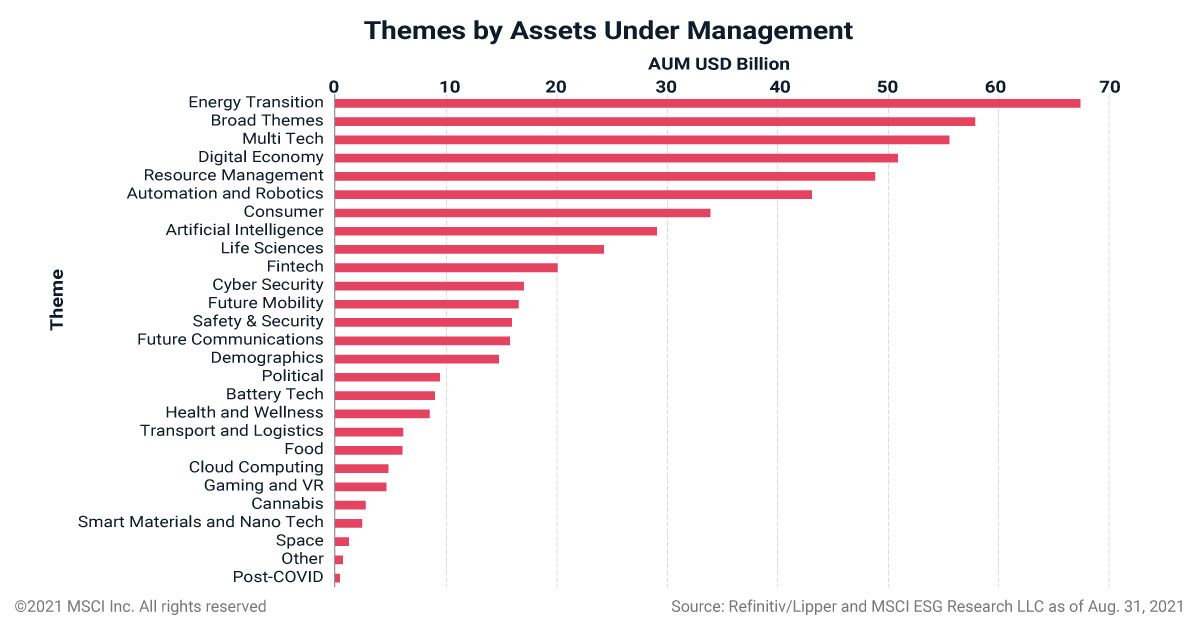

Thematic funds aim to invest in long-term trends that can range across social, environmental and technological realms, from millennial consumption to cloud computing. They have experienced strong inflows over the past four years, with assets under management quadrupling from under USD 150 billion in 2017 to over USD 600 billion, as of August 2021. In this quarterly report, we examine the ESG characteristics of this fund universe.

Source: Refinitiv/Lipper and MSCI ESG Research LLC as of Aug. 31, 2021

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

Fund ESG Transparency — Q2 Spotlight: Mutual Funds

ESG funds account for just 4.3% of the mutual-fund universe, totaling over USD 2 trillion. But they are growing in number, and their use as an ESG integration tool is also becoming more established. We take a deeper look at this subset in this quarterly report.

Fund ESG Transparency: Quarterly Report 2021

ESG ETF strategies saw record inflows in 2020, driven by demand from asset owners looking to increase ESG integration and transparency across their portfolios.

The 20 Largest ESG Funds

You can use the interactive chart to compare the carbon intensity and stock allocations across the 20 largest ESG funds in our coverage universe.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.