Labeled Bonds Quarterly Market Overview Q2 2023

Research Paper

August 31, 2023

Preview

In our quarterly series dedicated to labeled bonds, we break down the latest issuance trends and the overall market by multiple bond and issuer characteristics to identify key developments in this rapidly growing and increasingly diverse market.

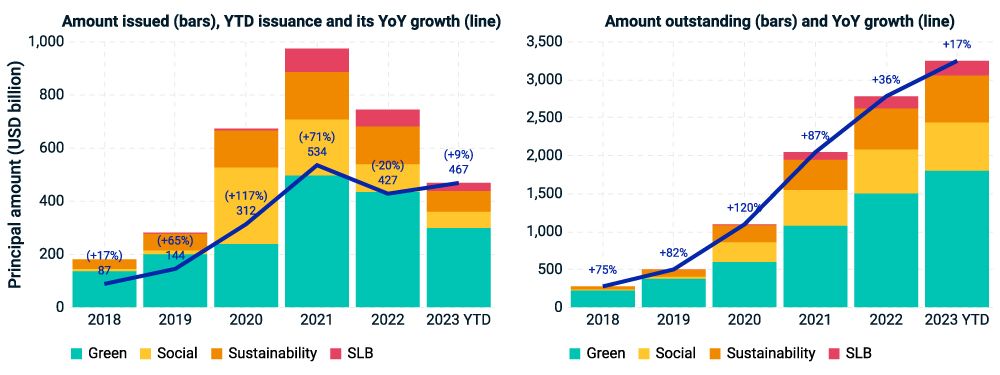

The market added USD 172 billion (net) worth of labeled bonds during the second quarter of 2023, bringing the total outstanding amount to USD 3.2 trillion at the end of the quarter. Looking at issuance trends over the last five years, we estimate full-year issuance for 2023 between USD 0.8 and 1 trillion, subject to market conditions which may be stressed by the possibility of recession in several major economies.

Gross labeled-bond issuance and amount outstanding (last five years and year to date)

Data as of June 30, 2023. SLB = sustainability-linked bonds. Source: Refinitiv, MSCI ESG Research

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

Labeled-Bond Issuance and Cost of Debt

Given the rapid growth and increased presence of corporate issuers in the labeled-bond market, we outline the main reasons issuers may choose to issue these instruments.

Green Bonds and Climate — Towards a Quantitative Method

Participants in the green-bond market have traditionally examined a green bond's "use of proceeds" to check the legitimacy of these projects and whether the bond was created in line with the Green Bond Principles.

Labeled Bonds: Quarterly Market Overview Q1 2023

In our quarterly series dedicated to labeled bonds, we break down the latest issuance trends and the overall market by multiple bond and issuer characteristics to identify key developments in this rapidly growing and increasingly diverse market.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.