Labeled Bonds: Quarterly Market Overview Q3 2023

Research Paper

December 12, 2023

Preview

In our quarterly series dedicated to labeled bonds, we break down the latest issuance trends and the overall market by multiple bond and issuer characteristics to identify key developments in this rapidly growing and increasingly diverse market.

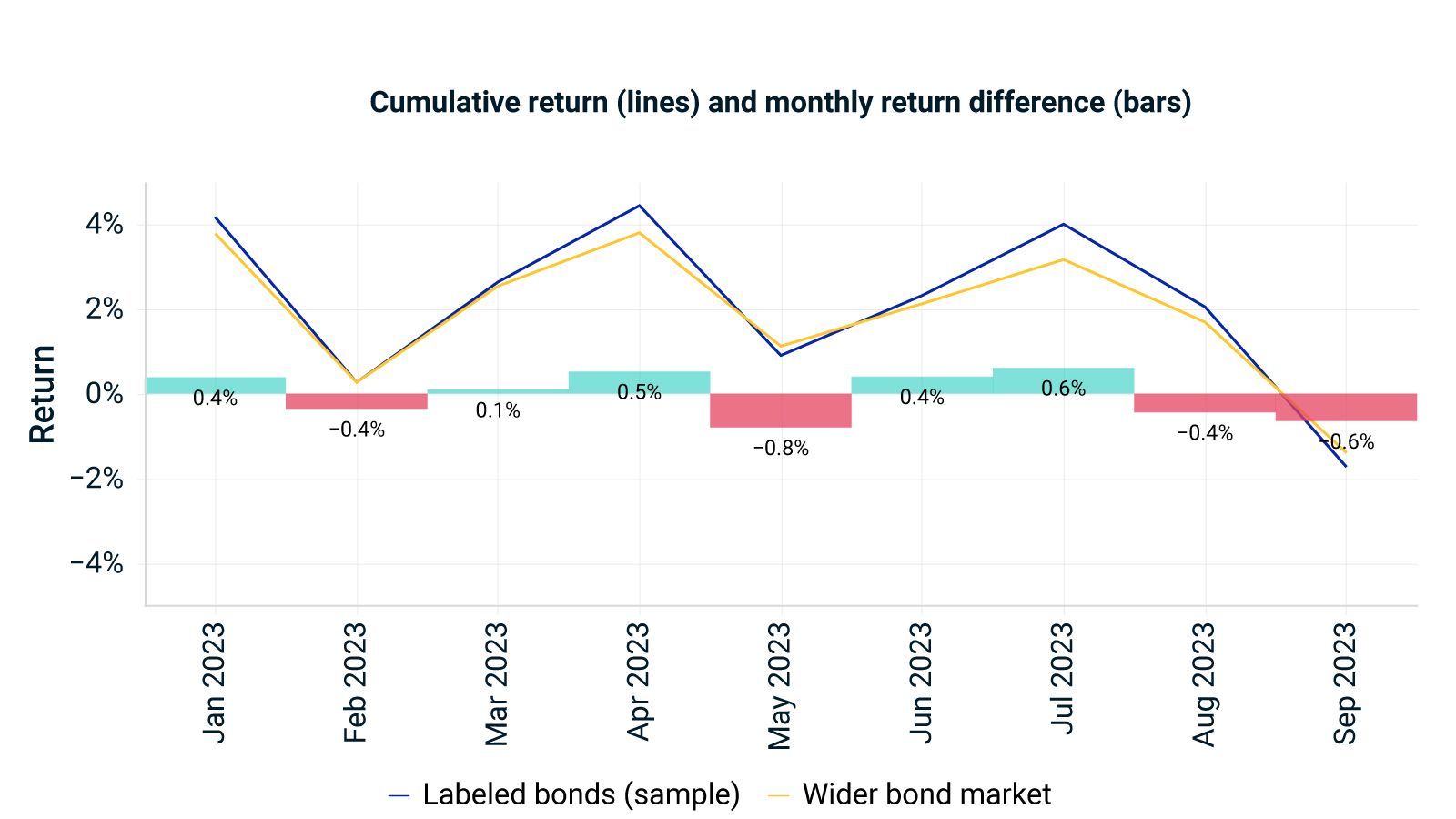

We also examine labeled bonds' recent performance versus the wider bond market. The sampled labeled bonds moved largely in line with the market in the first nine months of 2023, with somewhat amplified differences in performance during market down- and upturns.

Cumulative return and monthly return difference (labeled bonds vs. wider bond market)

"Wider bond market" refers to bonds that were constituents of MSCI Government, Provincial and Municipal and Corporate Bond Indexes during the study period (n=13,278). "Labeled bonds (sample)" refers to labeled bonds included in these MSCI bond indexes during the study period (n= 864). Performance attribution was conducted using the MSCI Fixed Income Factor Model in MSCI's BarraOne® risk- and portfolio-management analytics platform. Past performance does not indicate future returns. Data as of Sept. 29, 2023. Source: MSCI ESG Research

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

Labeled-Bond Issuance and Cost of Debt

We explore three reasons why issuers typically issue labeled bonds: financing impact projects, financing their own environmental goals and building rapport with sustainability-oriented stakeholders.

Sustainable-Debt Issuers on a More Credible Decarbonization Path, but Is It Enough?

Corporate decarbonization targets without capital commitments can lack credibility, and issuers of labeled corporate bonds led other bond issuers on climate targets.

Labeled Bonds: Quarterly Market Overview Q2 2023

We assess the latest trends in labeled bonds, from the overall market to specific bond and issuer characteristics, to identify key developments in the rapidly growing and increasingly diverse labeled-bond market.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.