Measuring Tax Alpha

Research Paper

August 15, 2024

Preview

Wealth managers can use the concept known as tax alpha in conjunction with their existing performance-attribution framework to explain a client's after-tax performance. Often the framework requires their making several assumptions with no clear guidance about how to specify them.

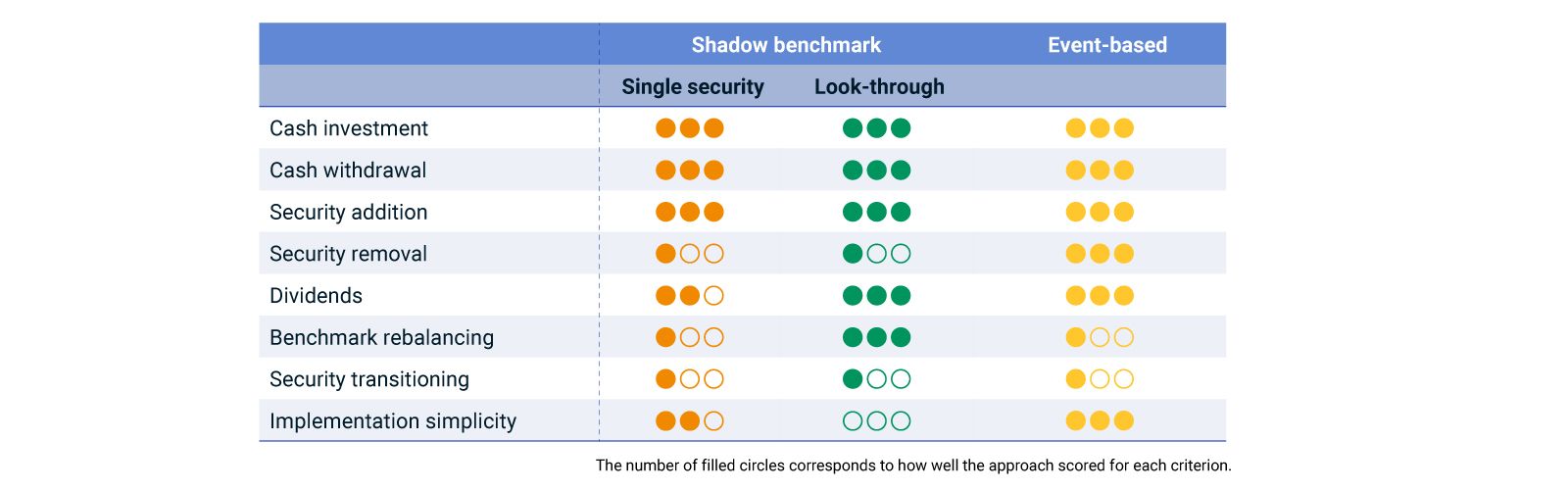

We propose two frameworks for the calculation of tax alpha — a shadow benchmark and an event-based approach — to provide transparency around an after-tax attribution calculation. The main difference between them is the choice of the reference portfolio. The approaches also differ in how they model client-directed actions, dividend payments and benchmark rebalancing. We further develop two versions of the shadow-benchmark approach. The following exhibit compares the approaches.

©2024 With Intelligence. Republished with permission from the Journal of Wealth Management, from: Laszlo Arany, Laszlo Hollo, Joseph Wickremasinghe and Raina Oberoi, "Measuring Tax Alpha," Journal of Wealth Management 27, no. 2 (fall 2024).

Comparing how well the approaches meet the reference-portfolio assumptions

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

Quantitative Investment Solutions

MSCI Quantitative Investment Solutions (QIS) offer hosted, scalable, and easy-to-integrate optimization solution that Asset Managers can use to help construct tax optimized and personalized portfolios in line with each of their clients' financial objectives.

A Roadmap to Personalizing Model Portfolios: Scaling with Purpose

High-net-worth investors are seeking portfolios tailored to their financial goals, personal values and tax situation. Wealth managers need scalable solutions. We explore using factor, thematic and sustainable investing to customize portfolios.

What Connects Correlation and Tax-Loss Harvesting?

Selling a capital asset at a loss to reduce your tax liability is one side of the coin. The other side is thoughtfully selecting the security that replaces it.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.