MSCI Private Capital Benchmarks Summary Q4 2024

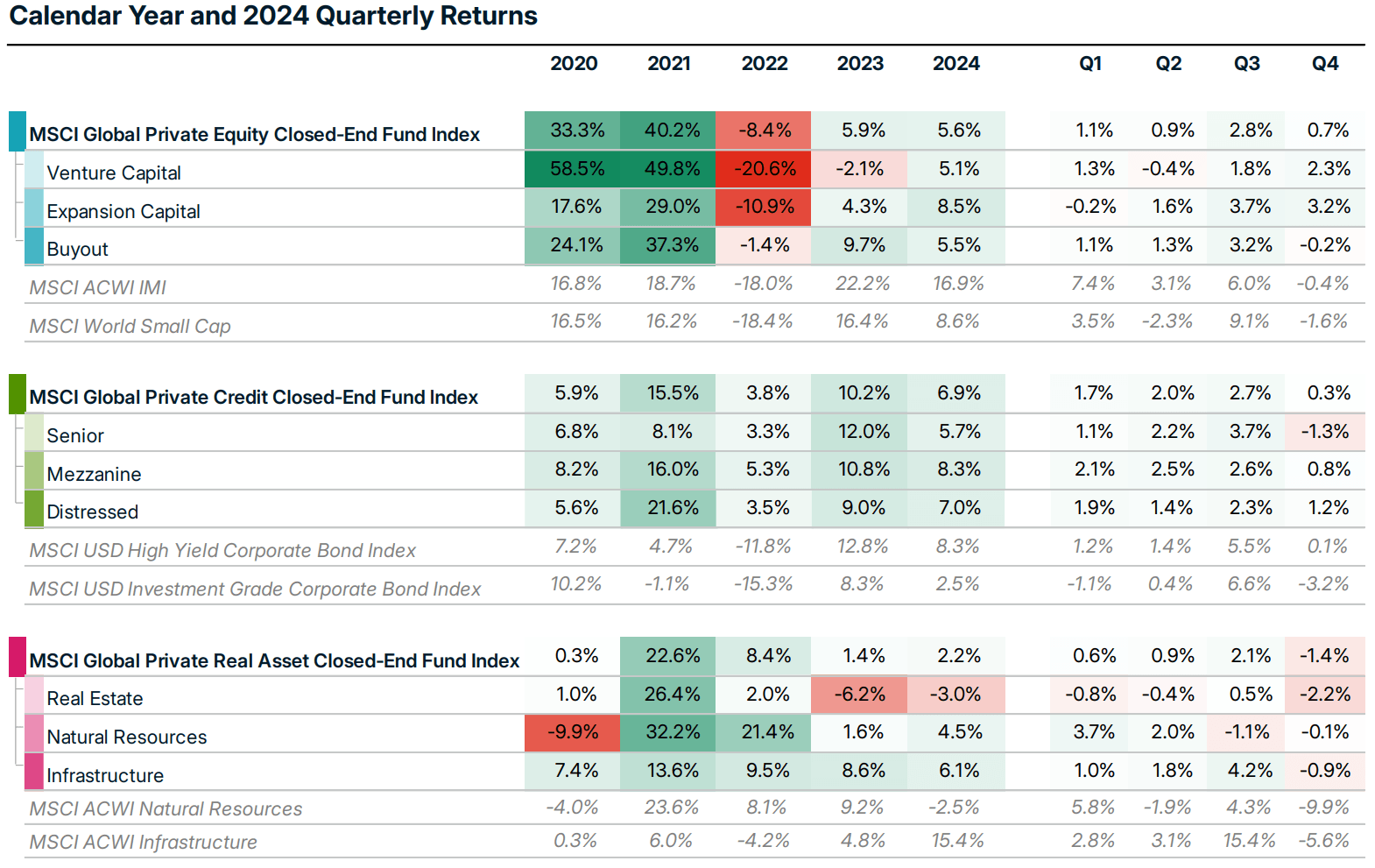

- On performance: Across major strategies, private real assets improved in 2024 though continued to lag private credit and private equity.

- On capital flows: Total fundraising slowed across strategies during 2024, while dry powder as a share of capitalization dipped to a decade low.

- On cash flows: Net cash flows for private capital inched closer to breakeven in 2024, though distribution rates remained weak.

Read the full paper

Provide your information for instant access to our research papers.

The Cornerstones of Benchmarking Private Capital

Troubling Signals for Private-Equity Exits

Recent trends in the buyout exit market show that assets are being sold at lower median-valuation multiples, despite stronger margin growth and reduced leverage. Hidden pressure points lurk. Limited partners may wish to look beyond net asset values.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.