Deal Activity for Global Commercial Property Dropped

Higher financing costs driven by rapid rises in interest rates and concerns over economic growth constrained global acquisitions of commercial property in the third quarter. Compared with the same period a year ago, deal activity fell by 30% to USD 236.2 billion.

The outlook for global property investing has deteriorated throughout 2022, but the lag between macro events and the direct property market means the impact of these changes has only more recently started to feed through.

Double-digit declines

In the Americas, deal volume dropped by 21% in the third quarter. In Europe, the Middle East and Africa (EMEA), the decline was 44%; and in the Asia-Pacific region, activity fell by 38%. (For comparisons across regions, we aggregate transactions of income-producing properties priced USD 10 million and greater.)

Nine of the 10 most active investment markets in the world during the third quarter were U.S. cities, with Los Angeles at the top of the ranking. London was ranked ninth.

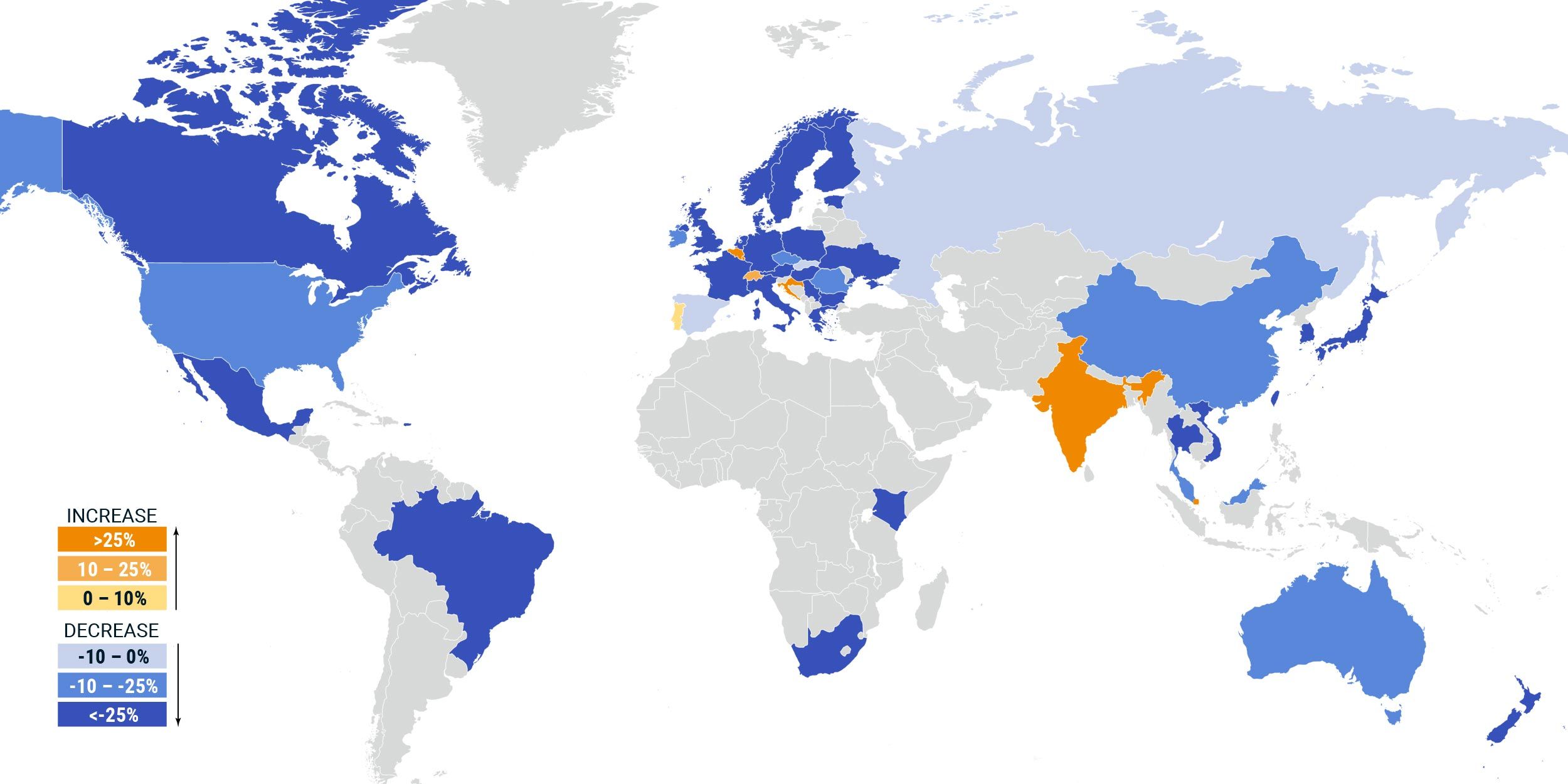

How deal activity in commercial property changed globally

Change in deal activity in Q3 2022 versus Q3 2021; deals priced USD 10 million and greater; income-producing properties only.

Subscribe todayto have insights delivered to your inbox.

A Correction in US Commercial Real Estate

The U.S. market for offices has slowed, with sellers hesitant to take a loss and buyers sitting on the sidelines.

Price Growth for US Property Ebbed, Deal Volume Fell

The pace of growth in U.S. commercial property prices slowed in September to the weakest annual rate since early 2021.

European Listed Real Estate Fell Below March 2020 Lows

War and the associated energy crisis, recession fears, decades-high inflation and rising interest rates have been weighing on European real estate.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.