Dispersion in China’s Onshore Equity Market

Perhaps looking for potential opportunity from China's reopening and its low historical correlation with global equity markets, foreign investors have reentered the China onshore market in droves. The net foreign inflows to China A shares through Stock Connect, in the year to date through April 28, exceed the total annual net inflows of 2022 — with January's USD 19.4 billion of inflows almost 50% higher than the previous monthly record set in 2017.1

Were stock-picking opportunities more apparent in certain parts of the market?

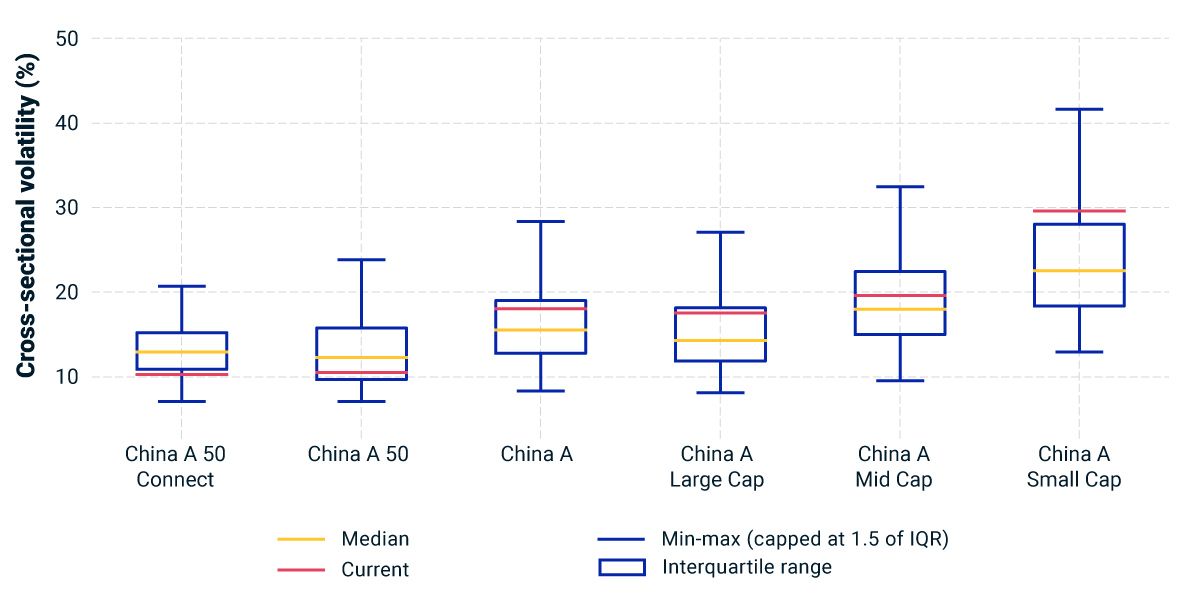

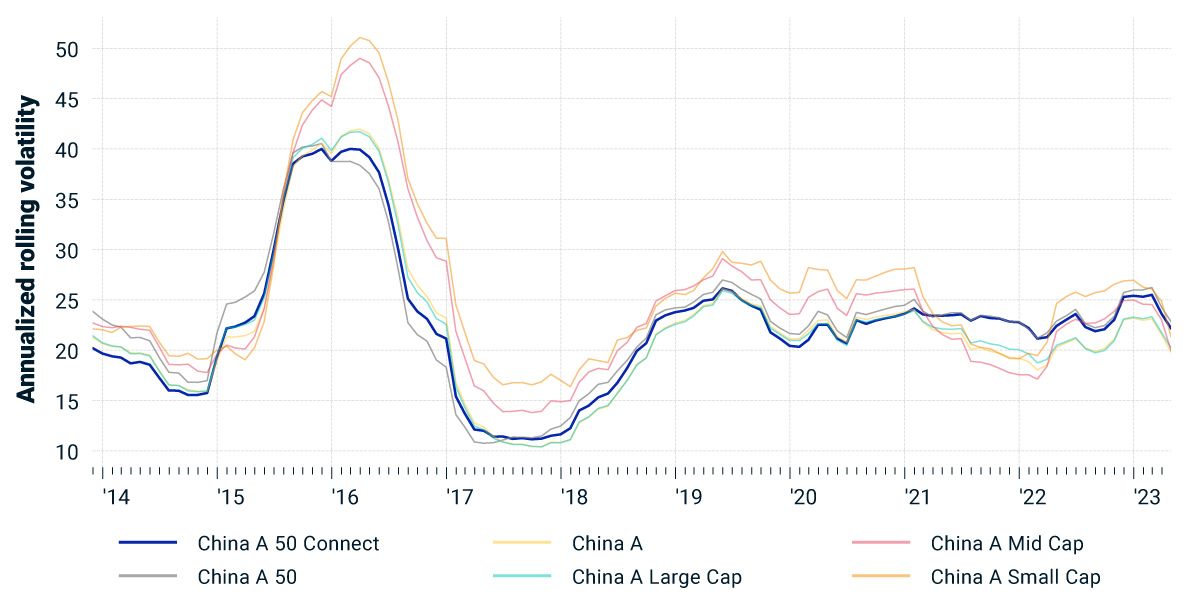

We found that the small- and mid-cap segments of the China onshore market had a higher dispersion of returns (as measured by cross-sectional volatility, or CSV) historically, compared to larger size segments. Moreover, while smaller stocks in the onshore market historically were much riskier than larger stocks, they had similar levels of volatility as the mega- and large-cap segments, as of the end of April.

Tracking these potential opportunities could help investors as they determine how best to allocate assets to and within China.

China A equity market’s CSV by size segments

Based on weighted cross-sectional standard deviation of trailing-three-month returns from Nov. 30, 2012, to April 30, 2023. The MSCI China A Onshore Small Cap Index is used to represent China A small caps.

China A-share annualized rolling volatility by size segments

Based on daily returns from Nov. 30, 2012, to April 30, 2023. The MSCI China A Onshore Small Cap Index is used to represent China A small caps.

Subscribe todayto have insights delivered to your inbox.

European Equities: A Door to China’s Reopening?

Could investors participate in China’s reopening other than by directly investing in China shares? We looked at 14 European equity markets and compared their economic exposure to the Chinese economy.

The Integration of China Onshore and Offshore Equities

While the MSCI China Index declined 21.8% in 2022 and underperformed the MSCI EM ex China Index by 3%, the return dispersion within the Chinese equity market was also noticeable.

How Extreme Temperatures May Affect Chinese Companies

In the face of rising temperatures in China, comprehensive adaptation and response plans are crucial to mitigate the physical risks of extreme heat, especially for more exposed regions.

1 ”Foreigners Scoop Up China Shares with January Inflow at Record.” Bloomberg News, Jan. 30, 2023.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.