ESG Credentials: How Have Small Caps Stacked Up?

As more investors incorporate ESG considerations into their investment decisions, some companies have changed their behavior, which has led to changes in their ESG profiles.

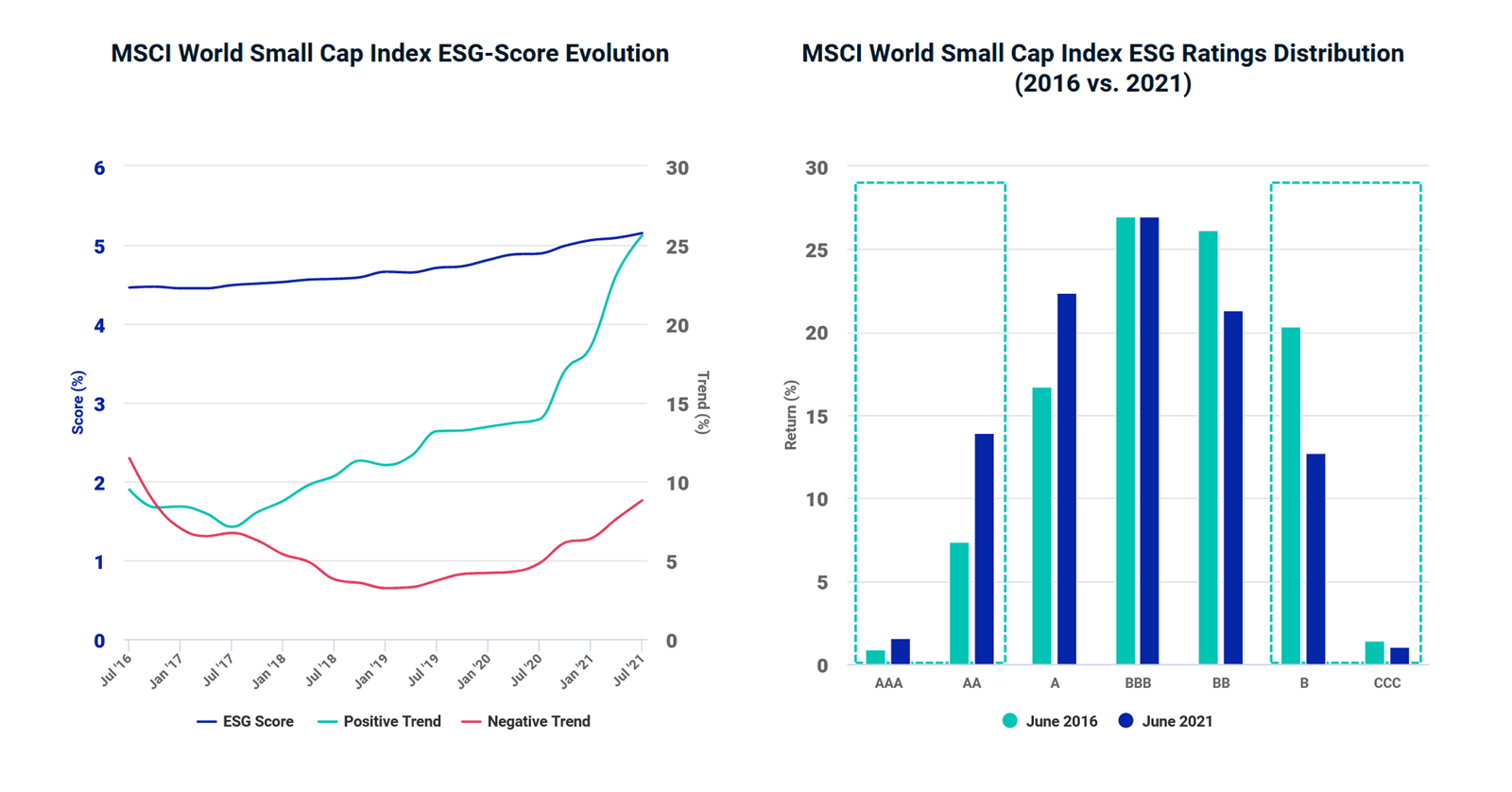

While smaller companies still trailed their larger-cap peers on the ESG front as of June 2021, our analysis clearly shows improvement. The industry-adjusted ESG score of the MSCI World Index was 6.20, but the MSCI World Small Cap Index's score rose to 5.15 from 4.38 over the last five years. The MSCI ESG score for an index ranges from 10 (best) to 0 (worst) and is a weighted average that indicates how well companies in the index manage their most material ESG risks and opportunities relative to their industry peers.

Additionally, we've seen a positive trend in individual companies' MSCI ESG Ratings (which rate on a scale from AAA through CCC) that appears to have picked up pace in recent times. In June 2021, more than 25% of companies in the MSCI World Small Cap Index showed an upgrade in their rating versus the previous year, compared to only 9% in June 2016. The proportion of index constituents exhibiting an MSCI ESG Ratings drop, on the other hand, has been low and stable.

The result is that, as of June 2021, around 15% of MSCI World Small Cap Index constituents were ESG leaders (AAA through AA) and 13% ESG laggards (B through CCC), compared to 8% and 22%, respectively, back in June 2016.

Although ESG data disclosure may be sometimes scarcer for smaller companies, as investors continue to engage with companies, and the use of alternative sources by providers like MSCI continues to grow, so will the robustness of ESG scores and profiles for companies of all sizes.

For an overview on the MSCI ESG Ratings' methodology, click here.

ESG in Small Caps

Subscribe todayto have insights delivered to your inbox.

Global Investing Trends

Investing globally can help investors work toward global diversification, tap into new opportunities for growth and harness the potential in the rise in importance of emerging markets.

Bringing a Style Lens to Small Caps

Another way to deepen our understanding of small-cap stocks is to look at them through a style-factor lens.

Addressing the Lower Liquidity of Smaller Stocks

Investability and tradability, are two vital touchstones of our Global Investable Market Indexes (GIMI) construction methodology.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.