Flooding’s Rising Threat to Real Estate

Recent events in Valencia, Spain, have again highlighted the devastating impact of flooding, as well as the unescapable fact that extreme-weather events, often characterized by more intense and unpredictable rainfall patterns, are becoming more common — exacerbating the risks associated with pluvial flooding (from extreme rainfall) in particular. Properties located in the flood-affected areas of Valencia were ranked in the top quartile of current and future risk from pluvial floods in the MSCI Climate Value-at-Risk model, and combined with unexpected, heavy rainfall, the area experienced a major economic and humanitarian crisis.1

As opposed to coastal flooding (from high tidal water and storm surges) or fluvial flooding (from rivers overflowing their banks), assets don't need to be near rivers or coasts to be affected by pluvial flooding, which can affect broader expanses of urban areas, leading to more widespread damage. Given the extensive and increasing exposure, it is important for investors to assess and understand the potential asset- and portfolio-level financial impacts of all three flood types.

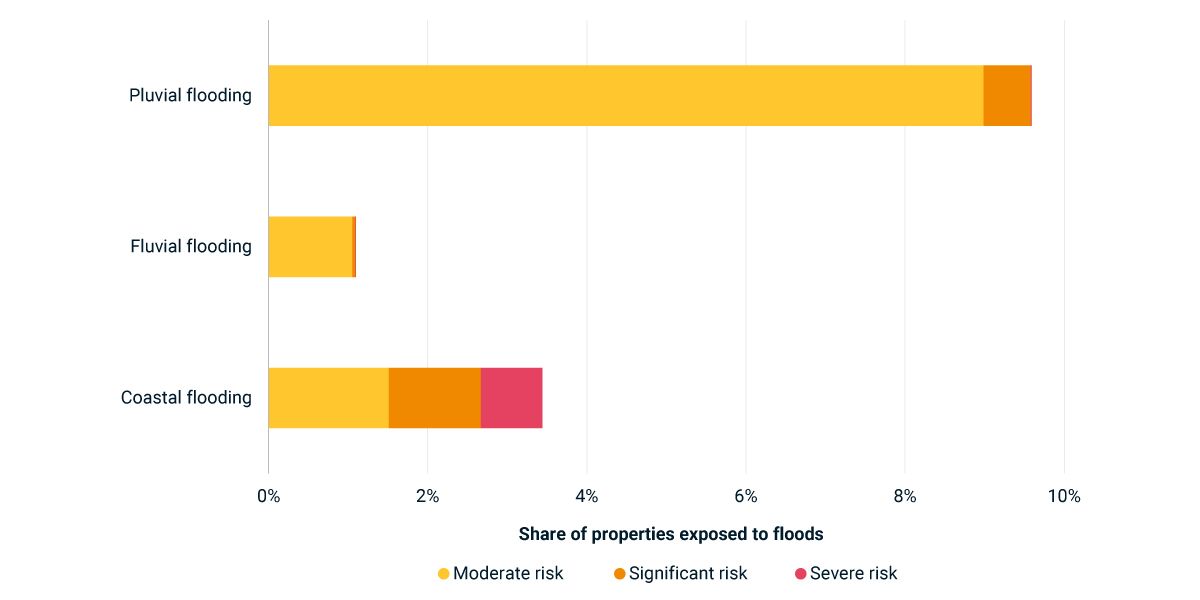

We analyzed a global sample of more than 50,000 property assets to estimate what percentage of properties were exposed to which type of flooding, and to what extent, under a 3 degrees C global-warming scenario. While individual assets can be more severely affected by fluvial and coastal flooding, the impact is often limited to specific floodplains or coastal areas. Our analysis indicates that 1 in 10 properties (9.6%) faced at least a moderate risk of damage due to pluvial flooding, compared to 1 in 29 for coastal flooding and 1 in 91 for fluvial flooding.2

Pluvial flooding puts significantly more properties at risk vs. coastal and fluvial flooding

Percentage of properties exposed to flood types by severity, based on MSCI Climate Value-at-Risk as of December 2023. The physical-risk impact of an asset is quantified by assessing the exposure of a property to a hazard and computing the costs associated with that risk using vulnerability functions specific to the real-estate market. Based on a REMIND Current Policies scenario and 3°C warming.

Subscribe todayto have insights delivered to your inbox.

Navigating the Financial Risks of Flooding

Assessing the widespread exposure and varying characteristics of coastal, fluvial and pluvial flooding is imperative for financial institutions to understand and manage the potential financial impacts of different flood types.

Double Trouble: Exposing the Risks of Hurricanes Helene and Milton

Historic estimated losses from two recent hurricanes highlight the importance of understanding asset locations that face intensifying climate impacts.

Scenario Analysis

Quantify and understand the financial risks of climate change and take necessary action for portfolio performance optimization, risk management and regulatory reporting purposes

1 “Spain flooding death toll climbs to 217 as cleanup efforts in mud-soaked streets continue,” ABC News, Nov. 3, 2024.2 Moderate risk is defined as more than 0.5% and below 5% of capital value at risk, significant risk as 5% to 25% and severe risk as more than 25%.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.