Global Property Returns Ebbed with Currency a Consideration

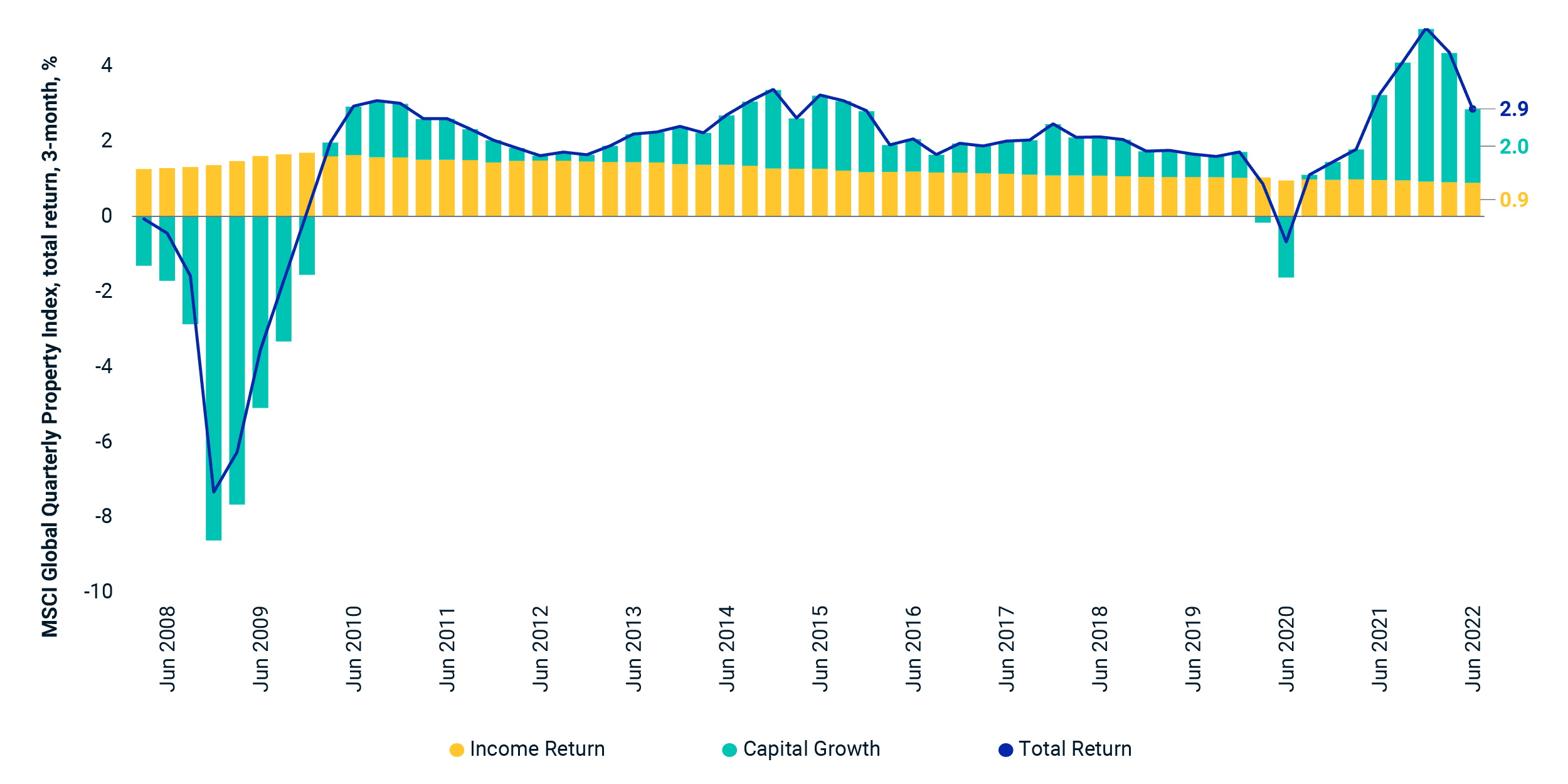

Global real estate returns decelerated to 2.9% quarter-on-quarter in local-currency terms in the three months ended June 2022 amid rising inflation and interest rates in most key markets. This was the second consecutive period of slowing returns after the MSCI Global Quarterly Property Index reached a record-high quarterly return of 5.0% at the end of 2021.

The index's all-asset quarterly total return comprised capital growth of 2.0%, which has halved since Q4 2021, and income return of 0.9%. The slowdown in returns was reported across property types and geographies as 44 of the index's 57 country-and-sector combinations registered deceleration in capital growth quarter-on-quarter.

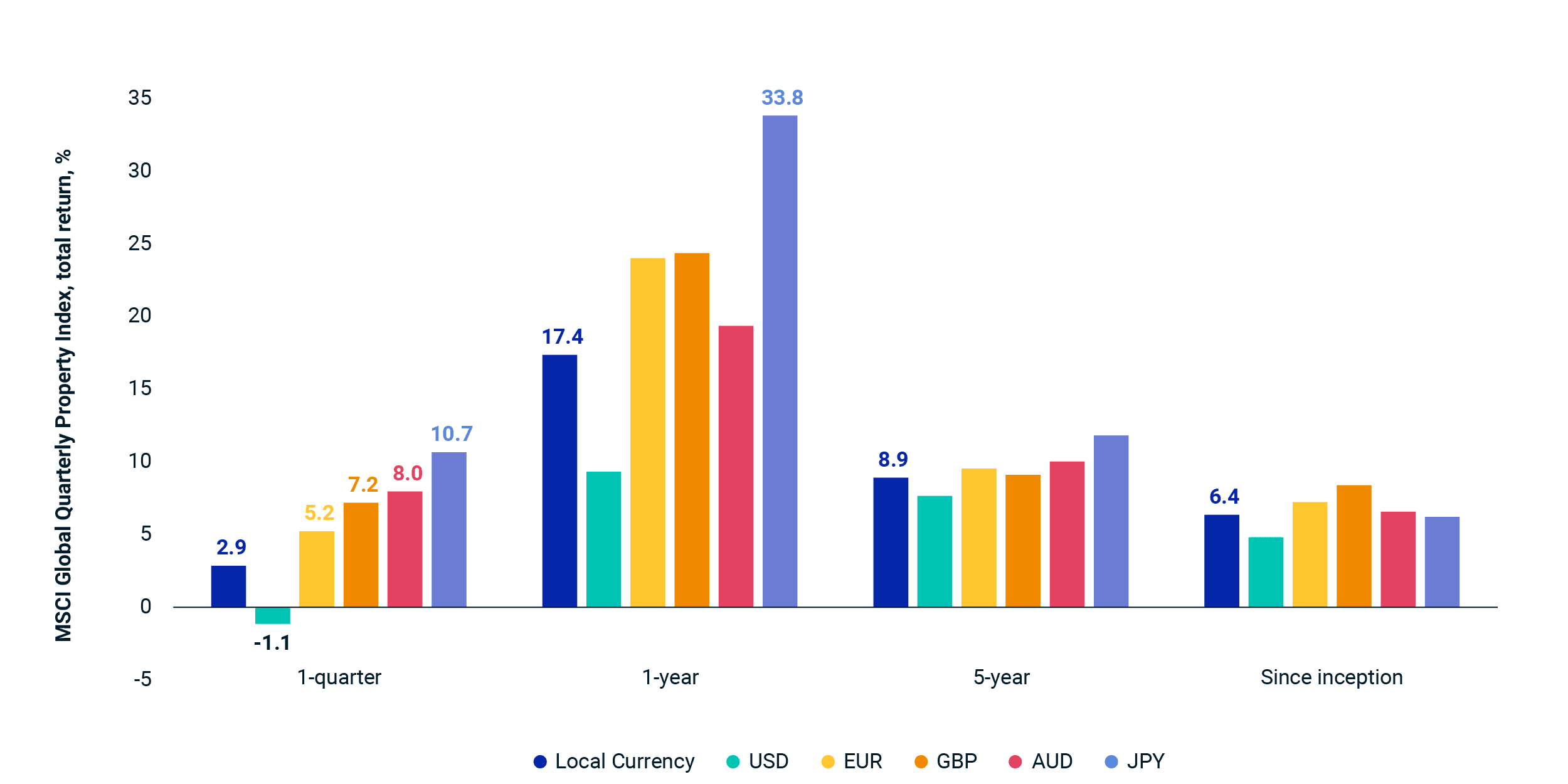

For cross-border investors, foreign-exchange movements were an additional factor to consider as the major currencies all experienced sharp shifts in the year through June. The euro recently receded to parity versus the U.S. dollar while the pound and yen both fell to multi-decade lows. Consequently, the index's quarterly, local-currency return of 2.9% translated into a 10.7% gain for yen-denominated investors while those investing in U.S. dollars recorded a 1.1% decline.

Total returns slipped again in the second quarter

The strength of the dollar was a consideration

MSCI Global Quarterly Property Index quarterly returns start March 2008. Returns for 5-year and since inception are annualized. Data to Q2 2022.

Subscribe todayto have insights delivered to your inbox.

Did Closed-End Real Estate Funds Add Value?

Global real estate markets enjoyed their strongest returns since the 2008 global financial crisis (GFC) as they bounced back from COVID-19-induced weakness last year.

Global Real Estate Returns at a Turning Point?

Global real estate returns accelerated to 17.8% on a 12-month rolling basis in the first quarter of 2022 despite the growing headwinds of geopolitical tensions and associated rising inflation and interest rates, the debut results of the MSCI Global Quarterly Property Index show.

How US Real Estate Purchases Changed During the Pandemic

Comparing broad-market purchase activity in 2019 to that in 2020-2021, we observed a shift away from sectors like retail, office and hotel/hospitality and toward sectors like industrial and residential.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.