Is the Market Ripe for Stock Picking?

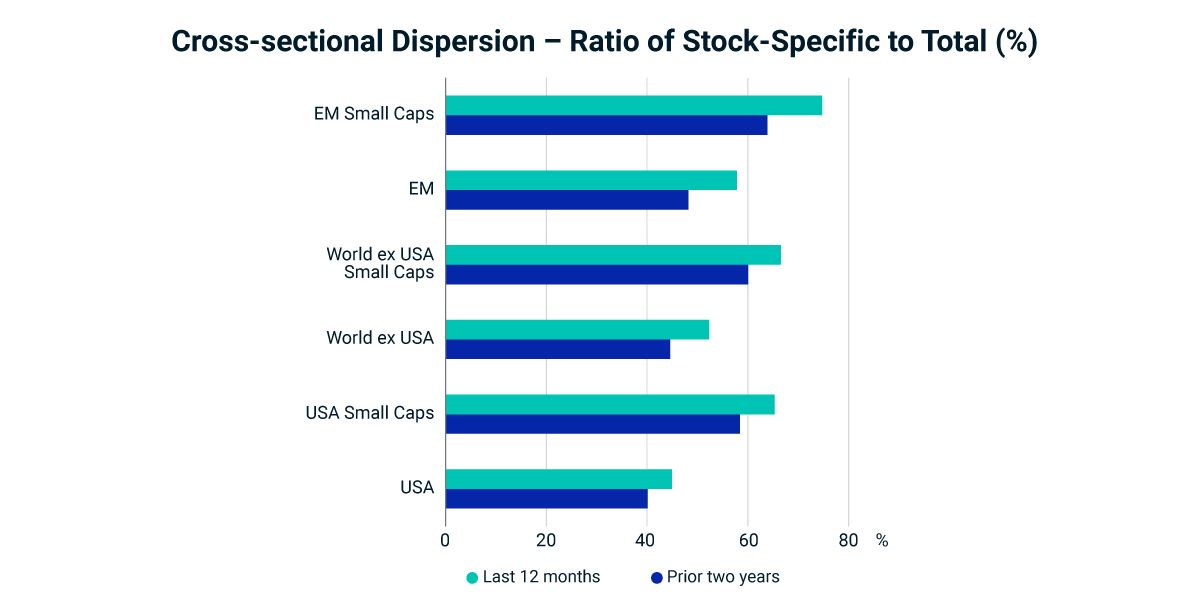

Through cross-sectional dispersion of stock-specific returns, we see that the opportunity for active managers to outperform the market through stock selection has increased over the past 12 months (as compared to the prior two years). Cross-sectional dispersion of returns measures volatility across equities over a single period. Total cross-sectional dispersion can then be decomposed into different sources of risk, including country/market, industry, style factors and stock-specific risk.

The intensity of dispersion

The ratio of dispersion resulting from stock-specific factors as a percentage of the total has increased over the past year relative to the prior two years. Generally, if this dispersion is low, then most stocks behave similarly, leaving limited opportunity for active managers to outperform the market through stock picking. Conversely, when dispersion has been relatively high, opportunities for stock selection have increased potential.

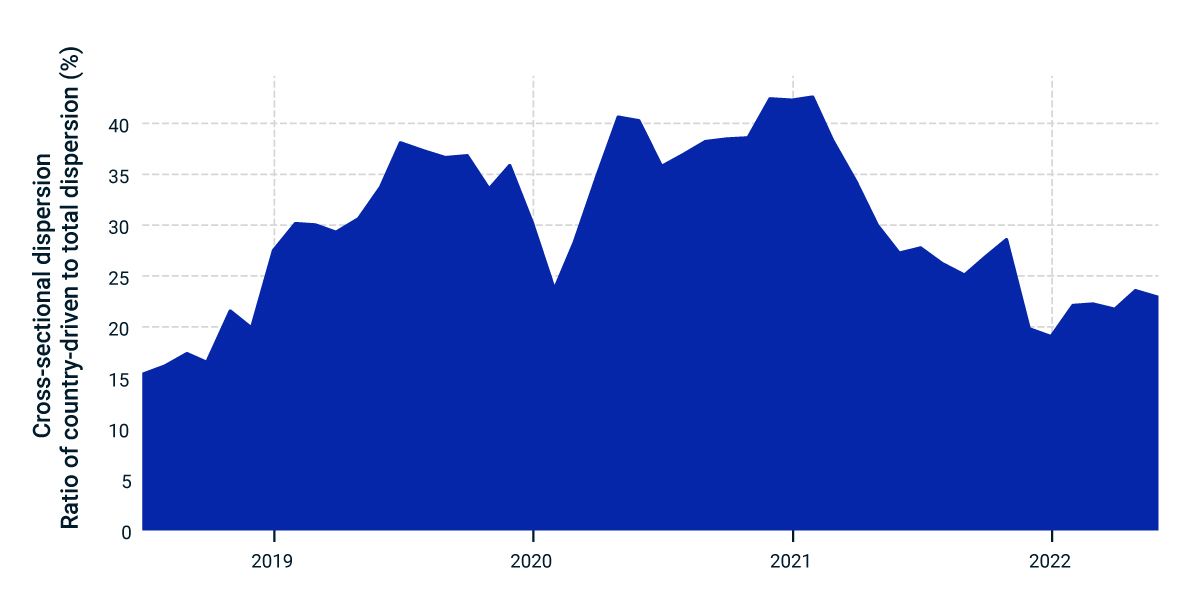

Market influence has diminished

Different equity-market segments, including the U.S., world ex U.S. and emerging markets, as well as varied size segments within these markets, are representing increased opportunities for active managers to outperform the broader market. One explanation for this is the broader equity market's waning influence in driving the performance of individual stocks. In fact, according to MSCI USA Index data, the U.S. market had been the driver of more than 40% of the cross-sectional dispersion when it peaked in early 2021, but that is now down to nearly 20% as of the end of May.

Dispersion has increased over the last year

Cross-sectional volatility average. Period ending May 31, 2022. Monthly data from MSCI U.S. Total Market Equity Model for Long-Term Investors, MSCI Global Total Market Equity Model for Long-Term Investors and MSCI Emerging Market Model for each corresponding region.

Broad market less impactful on stocks since early 2021

Based on the performance of the MSCI USA Index. May 31, 2018, to May 31, 2022.

Subscribe todayto have insights delivered to your inbox.

The Dispersion of Stock Returns

Cross-sectional volatility (CSV) measures the opportunity in stock selection as defined by the dispersion in stock returns.

Stock Crowding Shifts… Again

The U.S. stock market has plunged 15% to start the year, while growth stocks have fallen even farther. Many firms are suffering through historic drawdowns and a resetting of their valuations.

Markets in Focus: Half-Time – Keeping it Real and Defensive

Global equities were down 20% in the first half of 2022 – the worst six-month start to a year since 1975. For the second quarter of 2022, the MSCI Enhanced Value and High Dividend Yield Indexes delivered positive active returns across regional markets.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.