London and Paris Offices: Green Premium Emerges

Analysis of prices paid by investors for offices in London and Paris, Europe's largest property markets, shows a premium has emerged for buildings that have sustainability ratings from organizations like the Building Research Establishment (BREEAM), U.S. Green Building Council (LEED) and GBC Alliance (HQE), versus those that have not yet achieved these standards.

Calculating green buildings' price premium

Our analysis uses a hedonic model that controls for some of the factors that impact office prices — building age and size, submarket location and a general quality component indicated by the price per unit. To run the analysis, we introduced a sustainability-rating variable into the model, which means we can look at the pricing outturn for similar buildings with and without a rating. This helps address the view that assets with environmental ratings tend to be of better quality, meaning it can be difficult to isolate it as the reason for any perceived outperformance.

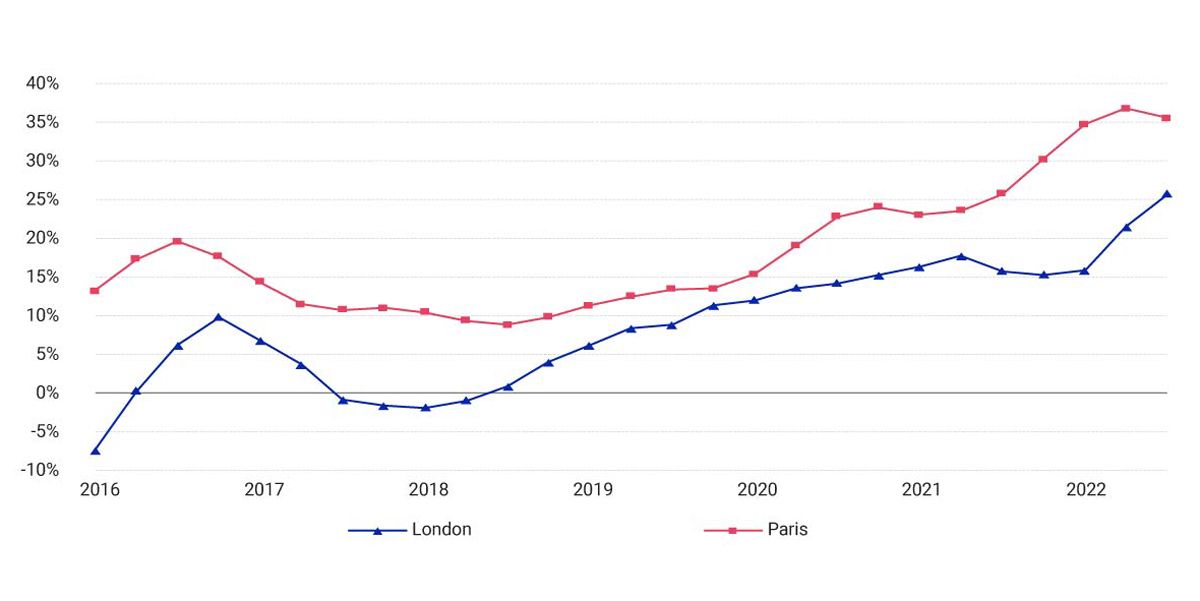

In London, a substantive gap appeared from early 2019 onward, which underlines this is the point at which the industry started to address sustainability issues in a serious way. The gap has accelerated through the last two quarters to stand at more than 25%, as buyers put even greater emphasis on buildings that meet their and their occupiers' requirements. In fact, many of the world's biggest property owners have ambitious carbon-reduction targets and intend for their portfolios to become net-carbon-neutral in the medium term.1

For Paris, the gap emerged in 2016, but has also grown significantly since 2019 and now stands at more than 35%. A premium at this level shows a considerable bifurcation in the market — and one that may continue, given the ongoing emphasis on decarbonization of property portfolios.

Sale-price gap between offices that have and don't have sustainability ratings

London sustainability ratings are based on offices that have either BREEAM or LEED ratings; Paris based on BREEAM, LEED, HQE and BBC certifications.

Subscribe todayto have insights delivered to your inbox.

Implementing Net-Zero: A Guide for Asset Owners

Pension funds, sovereign-wealth funds, insurance companies and other institutional owners of capital are committing to reduce financed emissions across their portfolios.

Real Estate Pricing Could Mask Climate-Change Risk

Real estate investors are increasingly aware of the risks posed by climate change, but they may not realize just how much the potential risks vary, even for a relatively homogeneous group of assets.

Price Growth for US Property Ebbed, Deal Volume Fell

The pace of growth in U.S. commercial property prices slowed in September to the weakest annual rate since early 2021.

1 “Nuveen Real Estate commits to net zero carbon global portfolio by 2040.” Nuveen, March 16, 2021.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.