Office Property: The Rise of the Smaller Floorplate

The pandemic has had a profound impact on the office investment market, as the widespread adoption of hybrid work continues to drive occupiers to rethink their needs for physical real estate. According to the MSCI U.S. Quarterly Property Index for Q2 2023, office was the worst-performing segment for eight consecutive quarters, while the index's office vacancy rate1 rose to a new high of 16.2%.2 Global deal volume for offices, meanwhile, has declined to the lowest since the 2008 global financial crisis (GFC).

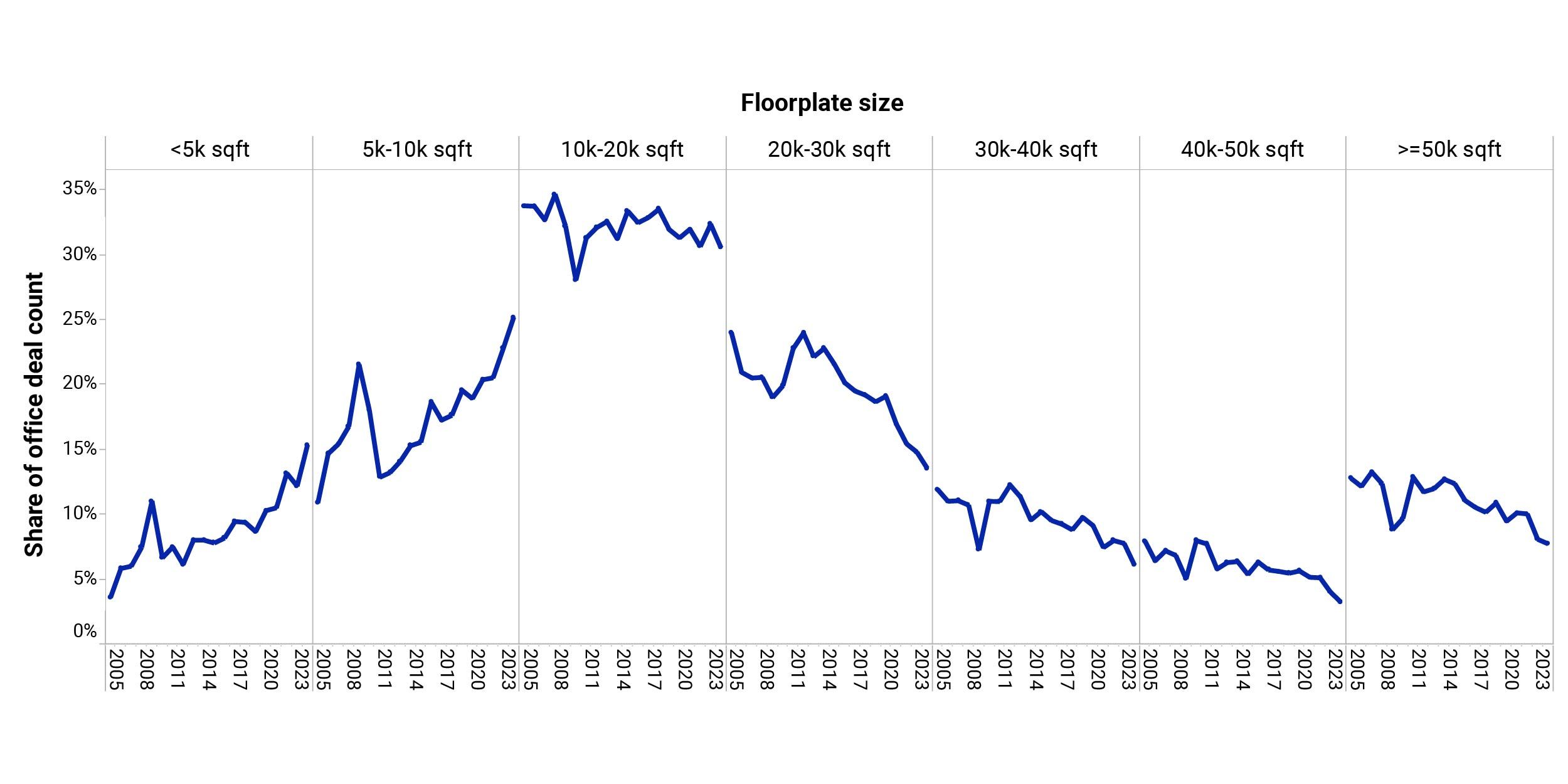

Evolving demand for offices can also be seen in the higher proportion of deal volume attributed to assets with smaller floorplates, or the leasable area per floor of a building. Offices with smaller floorplates can be better suited to residential conversion because of physical attributes like allowing for more natural light, though a variety of other factors could determine the feasibility of individual conversions.3

A spike seen before

There was a steady increase in the percentage of office transactions attributed to smaller floorplates in the U.S. since the GFC, and this trend has accelerated since the onset of the pandemic. We observed a similar trend across the U.K. and Europe's 20 largest metropolitan office markets, where the percentage of office transactions with floorplates smaller than 10,000 square feet increased from 43% in 2019 to 56% in 2023.

Given the step change the pandemic has brought to offices, it remains to be seen whether larger floorplates regain their share when deal activity recovers from the current ebb. During the GFC there was a similar spike in the share represented by smaller-floorplate buildings, but the trend normalized when the economy improved.

US sales leaned to smaller floorplates

Analysis excludes medical offices, showrooms, call centers, research-and-development buildings and data centers. Offices acquired with the intention of demolition, renovation or redevelopment excluded. Source: MSCI Real Assets

Subscribe todayto have insights delivered to your inbox.

Small Banks Falter in US Commercial-Property Lending

The share of the U.S. commercial-mortgage market captured by regional and local banks tumbled in Q2 of 2023, as the high-profile failure of several banks cast a cloud on lending activity. We show the retreat in both market share and in mortgage originations.

Looking for Loan Trouble

The timing of loan maturities could be key to determining which areas of U.S. commercial real estate may face trouble refinancing. We look at the markets for Manhattan offices and Dallas apartments to paint the picture.

Distress in US Commercial Property Increased Further

The office market was the largest source of distress in U.S. commercial property in the second quarter, ahead of retail and hotel, which had previously been the biggest contributors of troubled assets. We summarize our latest findings on distress.

1 As of Q2 2023, the MSCI U.S. Quarterly Property Index included 809 office standing investments.2 Since the index’s inception in Q1 1999.3 Jon Gorey, “Office-to-Residential Conversions Are on the Rise — What Does That Mean for Cities?” Lincoln Institute of Land Policy, May 16, 2023.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.