Red Sea Disruptions Could Dampen the European Economy

The recent attacks in the Red Sea have led to shipping disruptions and increased costs; on routes between Asia and Europe the costs have more than doubled.1 According to research by the International Monetary Fund, when global freight rates double, inflation tends to pick up by 70 basis points (bps) in the subsequent 12 to 18 months.2 Furthermore, prolonged disruption in the Red Sea may force some European companies to downsize or halt production altogether.3 Many investors are considering if and how this all could affect the European Central Bank's (ECB's) policy-rate trajectory.

We examined two possible downside-risk scenarios related to surging freight costs:

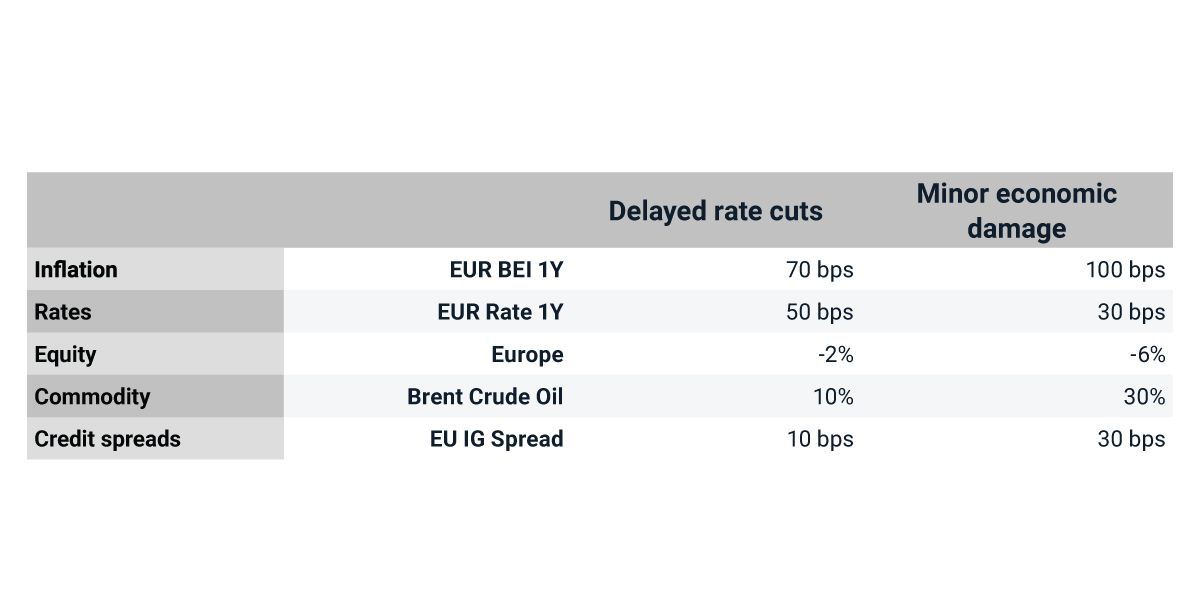

- Delayed rate cuts: Higher freight costs push up inflation and ECB rate cuts are not expected before the third quarter of this year. The impact on the economy and risk assets is muted.

- Minor economic damage: Surging freight costs contribute to higher inflation but also cause some damage to the European economy. The ECB rate cuts come later than current market expectations, but sooner than in the first scenario because of the economic slowdown.

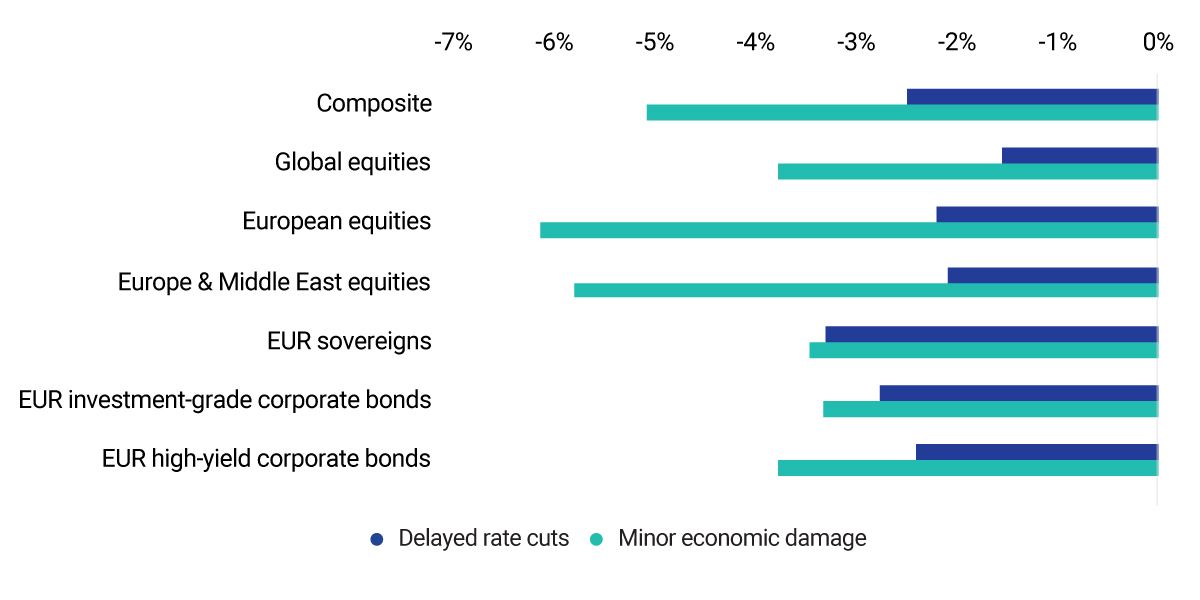

Impact to portfolio values under our scenarios

Portfolio impact of the scenarios based on market data as of Feb. 5, 2024. Portfolio results are relative to EUR base currency. EUR sovereigns, equities and corporate bonds are represented by MSCI indexes. The composite portfolio is 60% European public equities, 20% EUR sovereigns, 10% EUR investment-grade bonds and 10% EUR high-yield bonds.

Our scenario assumptions

These scenarios are not forecasts, but hypothetical narratives of how surging freight costs could affect multi-asset-class portfolios. MSCI clients can access BarraOne® and RiskMetrics® RiskManager files for these scenarios on the client-support site.

Subscribe todayto have insights delivered to your inbox.

China’s Role in Supply-Chain Strategies

Are parts of the global supply chain more reliant on China than other parts? We explore which industries and themes may be more dependent on China from a manufacturing-ecosystem and raw-resources perspective.

Macro Scenarios in Focus: Adapting to the New Normal

Markets seem to be priced for a soft landing, in which inflation returns closer to target levels and recession is avoided. We also consider two potential downside-risk scenarios: a hard landing and a resurgence of inflation.

Investment Trends in Focus: Quarterly Roundtable Q1 2024

Ashley Lester and team help investors find the connections between — and evaluate the risks and potential opportunities of — AI, geopolitics and the effects of climate change, as well as the growing importance of private capital and continued influence of monetary policy.

1 Based on “Red Sea Shipping Disruption News & Updates,” by Freightos, Feb. 1, 2024.2 Yan Carrière-Swallow et al., “How Soaring Shipping Costs Raise Prices Around the World,” International Monetary Fund, March 28, 2022.3 Robert Wright, Laura Onita and Peter Campbell, “European manufacturers and retailers face ‘chaotic’ period after Red Sea attacks,” Financial Times, Jan. 21, 2024.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.