Russian Government Bond Market Flashes Distress

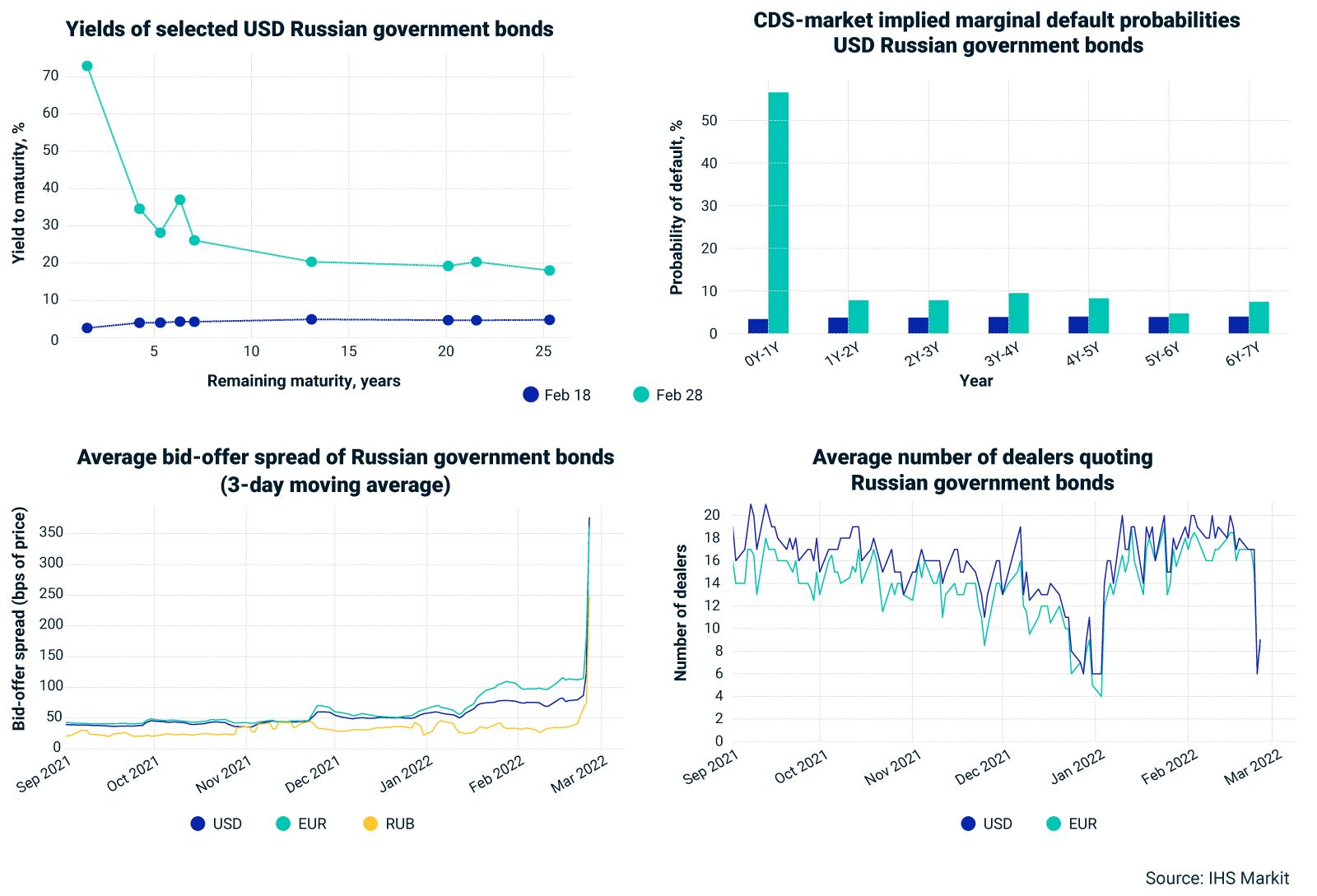

Signs of distress are everywhere in the Russian bond market following the Russian invasion of Ukraine and the imposition of sanctions on Russia. A dramatic inversion of the dollar-denominated Russian government curve highlights the concern investors have of a near-term default. The credit default swap (CDS) market shows that the 1-year implied default probability is now a striking 56%, up from 3% prevailing just before the start of the conflict last week. Beyond the next year, the CDS market shows a much lower level of implied default probability, underscoring how default risk is front loaded in the current market.

Liquidity conditions for Russian debt have also seriously deteriorated, as illustrated below and in the latest edition of the MSCI Liquidity Risk Monitor . Bid-offer spreads have increased very significantly, with debt issued in hard currencies more significantly impacted than bonds denominated in rubles. Besides increasing bid-offer spreads, the number of dealers quoting Russian government bonds has decreased sharply. Investors may face difficulty liquidating their positions and may incur excessive transaction costs.1

We will, as with all aspects of the financial ramifications of this crisis, continue to monitor markets and investor reaction.

Subscribe todayto have insights delivered to your inbox.

Research and Insights

Our investing insights explore the topics that matter most, whether on climate and ESG, current market trends or global investing and risk management across asset classes.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.