Small Caps’ Revenue Exposure and the Global Recovery

The volume of world merchandise trade fell by 5.3% in 2020, while travel services were down by 63%, according to estimates by the World Trade Organization (WTO). Nonetheless, the WTO expects recovery from the pandemic's effects to be swift, with regional differences, and world merchandise trade volume to increase by 8.0% in 2021.

But even before the pandemic, global trade had shown signs of slowing, and the growth trend appeared to be flattening. There were several reasons, from increased political nationalism to environmental and social concerns. Also, as emerging economies develop, there has, historically, been a shift from capital-intensive to service-based activities, which are less dependent on imports and trade.

At a company level, smaller firms have tended to be more domestically driven than larger ones, as they may engage less in cross-border trade. One helpful way of visualizing this trend is looking at the sources of a company's revenue to see how much is domestically vs. internationally sourced.

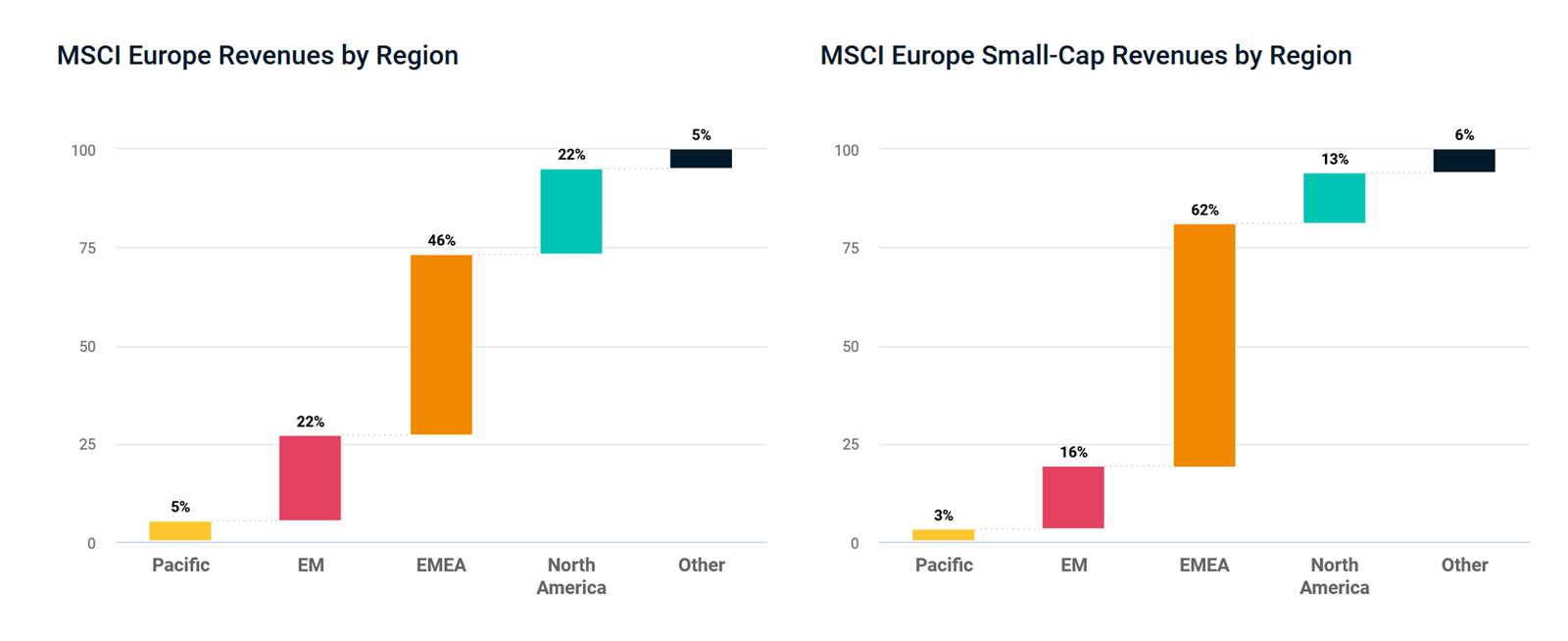

The chart below draws on MSCI Economic Exposure data to show the breakdown of revenues by region of origin for the MSCI Europe and the MSCI Europe Small Cap Indexes. We can see that the small-cap index had greater exposure to revenues that originated in the region (62% vs. 46% for MSCI Europe.

While much has changed since the start of the pandemic, if the recovery continues to be more domestically driven, with government-support schemes for smaller businesses and companies rethinking global supply chains, it may be worth monitoring this trend.

Revenue Sources: Europe vs. European Small Caps

Source: MSCI, data as of March 31, 2021. "EMEA" includes all countries classified as developed markets in Europe and the Middle East. "Other" includes all countries classified as frontier or standalone markets.

Subscribe todayto have insights delivered to your inbox.

Global Investing Trends to Watch

Investing globally can help investors work toward global diversification, tap into new opportunities for growth and harness the potential in the rise in importance of emerging markets.

Risk and Volatility in Small Caps

We recently looked at small caps through the lens of historical performance during economic recovery. To complement that analysis, we look at total risk or volatility.

Diversifying with Small Caps

When investors are considering adding new types of investments to their portfolios, they examine not only the risk and return profiles of those new allocations, but also whether they might add diversification benefits.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.