The New ‘Amazon Effect’: Corporates Pushing Corporates for Net-Zero Supply Chains

Video

December 1, 2021

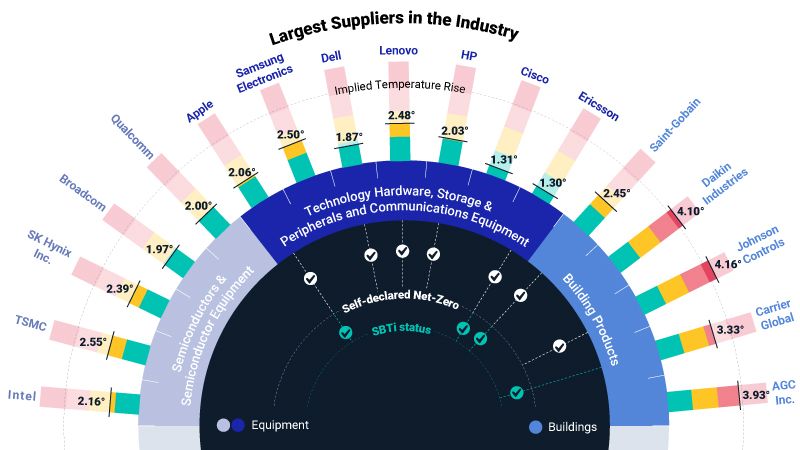

Everyone buys from Amazon, but who does Amazon buy from? In corporate board rooms the world over, the push to set a net-zero target is eliciting a common refrain: What do we do about our suppliers? Value chain interdependency means decarbonization interdependency, too. As the world's big companies work to go net-zero, downward emissions pressure may become as familiar to suppliers as downward price pressure. The chart below shows how the top upstream suppliers to the big four cloud service companies (Amazon, Microsoft, Alphabet and Alibaba) stack up when it comes to carbon emission abatement. The top bar charts are the companies' Implied Temperature Rise¹; a company has a white check connected to its name if it has declared a net-zero commitment²; and a green check if the company has a decarbonization target (different than a net-zero target) approved by the Science Based Targets Initiative (SBTi)³.

1 MSCI Implied Temperature Rise (ITR) model estimates what temperature rise would occur in 2100 if the whole economy had the same over/undershoot level of greenhouse gas (GHG) emissions versus a carbon budget, as the company analyzed (based on the most recent Scope 1-3 projected emissions). 2 Self-declared Net Zero: The company has published a 'Net-Zero' GHG emissions commitment. 3 SBTi status: The SBTi is an organization supported by CDP, the UN Global Compact, WRI and WWF. Approved status refers to companies that have had their decarbonization targets reviewed and validated by SBTi. Decarbonization is reducing GHG emissions, net-zero is staying within a 1.5oC carbon budget that keeps a portfolio's carbon footprint zero on a net basis. Companies in the table are selected as the largest industry constituents of the MSCI ACWI Index by revenues. Source: MSCI ESG Research LLC as of Nov. 18, 2021.

Subscribe todayto have insights delivered to your inbox.

2022 Trends to Watch

Ten trends for the coming year that could shape the risk profile for investors.

Private-Company Emissions Under Public Scrutiny

Critics charge that privately-held companies are an opaque refuge for carbon-intense assets. But the jury is out because private equity funds aren't saying.

The Story Behind ESG Trends

10 Year Anniversary – What Can The Past Tell Us About The Future?

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.