Real Assets in Focus: Grappling with Higher Interest Rates

Key findings

- Interest rate hikes across the world abruptly ended the long period of ultra-low rates that had boosted the allure of commercial real estate.

- Global deal activity in 2023 fell by almost one-half relative to 2022, to the lowest level in a decade.

- For deal activity to recover, buyers and sellers would need to become more aligned on pricing amid the higher-rate environment.

The year 2023 proved to be a tough 12 months for the global real estate market, the toughest perhaps since 2009. For an asset class that had become an alternative to fixed income during the extended period of low rates that were the result of the 2008 global financial crisis (GFC), the rapid change in monetary policy came as an unwelcome surprise.

The immediate consequence of this inflation-driven hike in central bank rates was to make large swathes of the commercial real estate market look overpriced. Average Central London office yields were around 350 basis points (bps) greater than U.K. 10-year bonds at the end of 2021; just nine months later this gap had narrowed to around 30 bps. A similar dynamic played out across other European, North American and most Asia-Pacific markets.

The pricing standoff

Higher interest rates and the resultant higher cost of capital meant that prospective buyers of real estate had to rapidly reassess the price at which they were willing to commit to the market. However, property owners tend to be far slower to revalue their assets, and this can lead to a standoff, with buyers and sellers unable to meet on pricing. This stalemate means market liquidity starts to drain away as fewer assets trade, and it does not return until either buyers or sellers start to shift their reserve prices, or sellers are forced to bring assets to market, for example, through a distress process.

In a slow-moving, structurally illiquid market like real estate, this process of repricing and recalibration can take a long time. In 2022, global commercial-property deal volume fell by 17% to USD 1.18 trillion and by the end of last year it had fallen again, by 48%, to USD 615 billion, marking the lowest level of deals since 2012.

Global deal activity has suffered

Deals USD 10 million and greater, excluding development sites.

Markets that that boomed in the immediate aftermath of the COVID-19 pandemic have experienced the sharpest slowdown. For example, German deal volume has fallen by 75% from its post-pandemic peak, Swedish deal activity by 74% and U.S. volume by 64%.

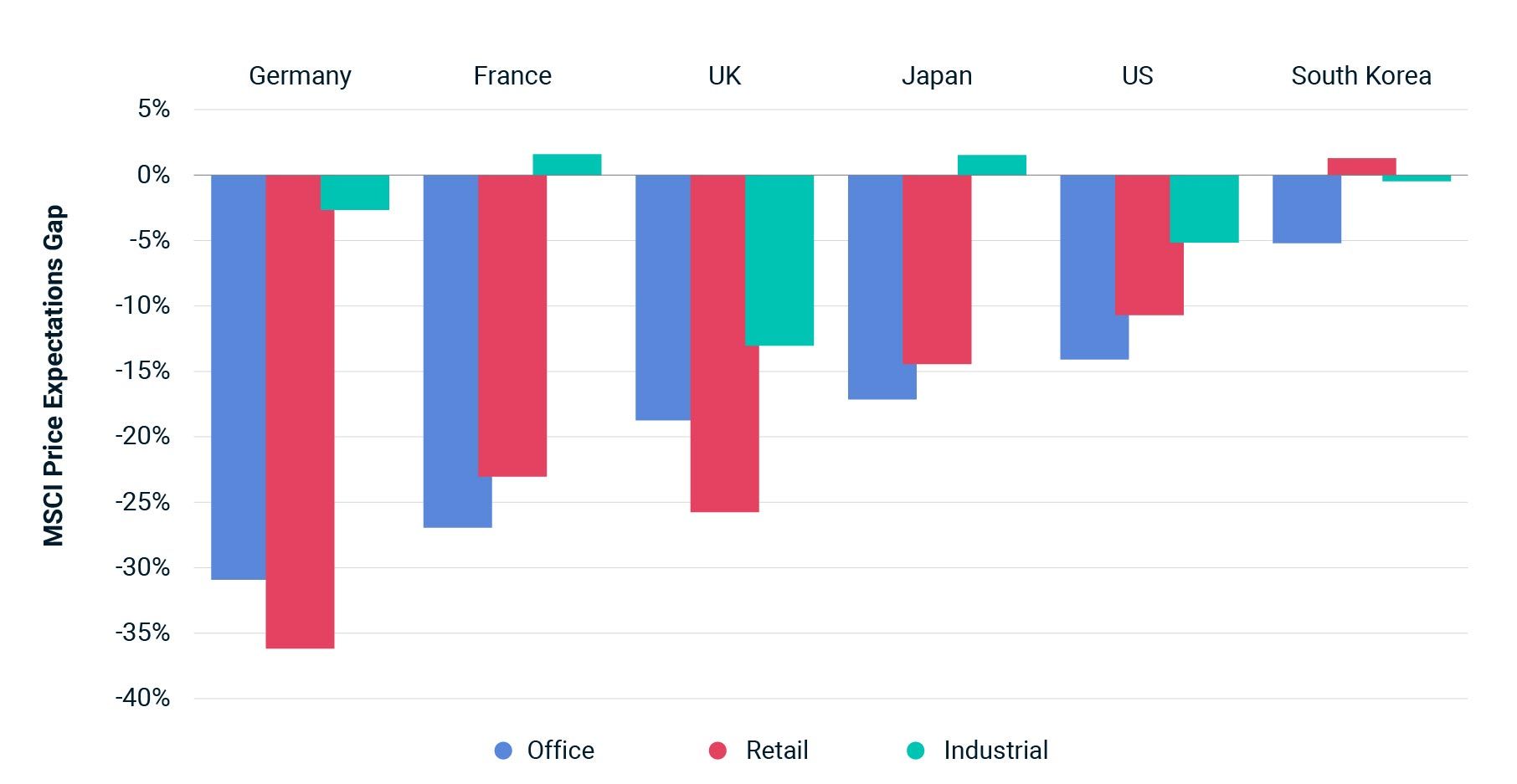

The illiquidity in global capital markets can also be quantified through the MSCI Price Expectations Gap, which shows how much reserve prices would have to move for market liquidity to return to the long-run average. This gap stands at -14% for U.S. offices, -31% for German offices and -32% for Australian retail, for example. The outturn is even worse at a city level in some cases, with offices in the German A Cities at -41% and those in the City of London at -37%.

Additional woes for office

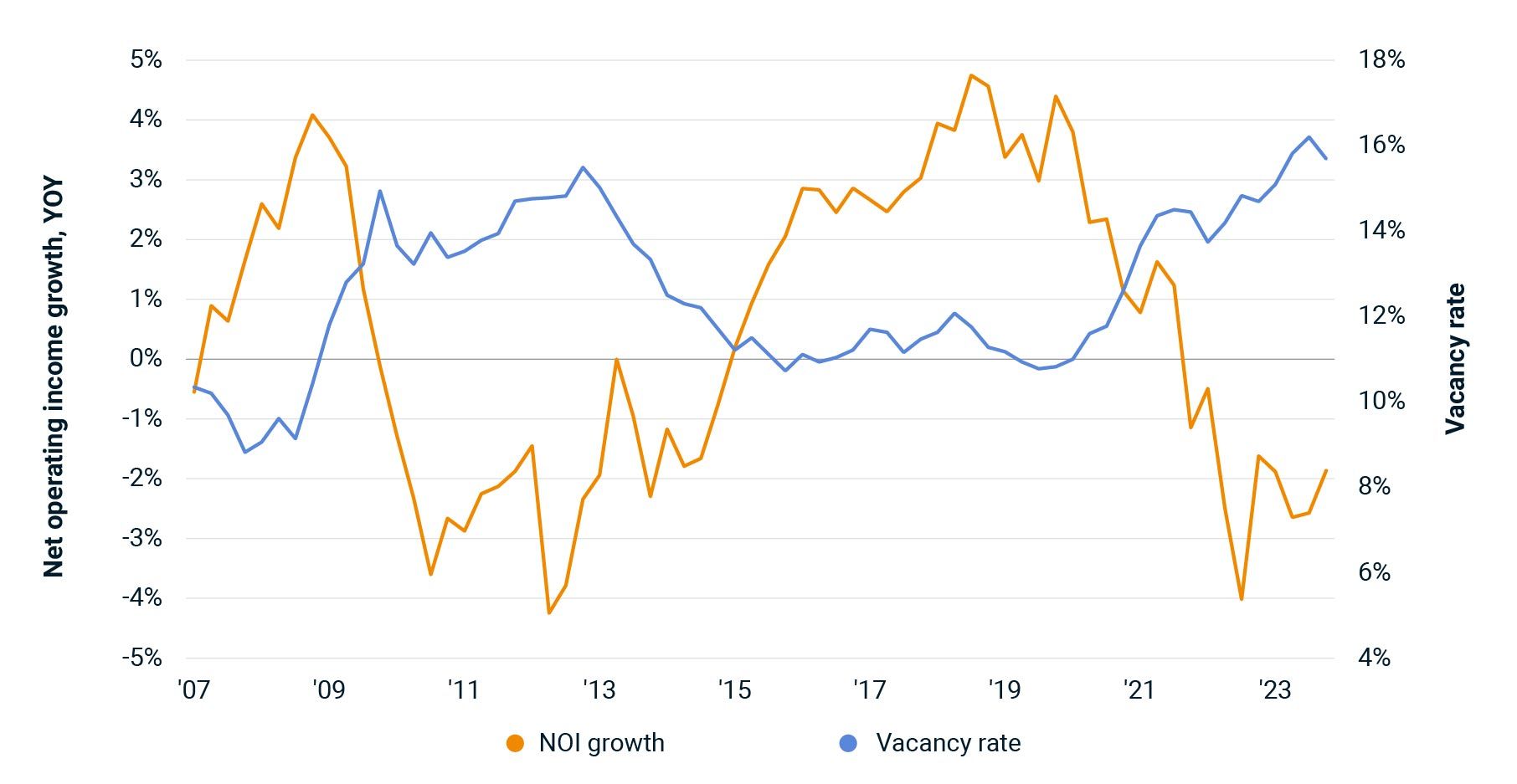

There is still uncertainty around the use of office space moving forward, with arguments made in the industry both for and against the asset class. It is clear though that office workers are spending more time at home than they were prior to the pandemic. The adjustment of businesses to the new environment has impacted occupier markets, with rising vacancies and falling rents. For example, the MSCI UK Quarterly Property Index showed a U.K. office vacancy rate of almost 16% at the end of 2023, which is higher than prior cyclical peaks in 2012, 2009 and 2005. As a consequence, growth in net operating income (NOI) for U.K. offices has been negative since December 2021 and capital values have fallen 26% in the last 18 months.

UK offices under pressure

Source: MSCI UK Quarterly Property Index

Other developed office markets face similar challenges, as both the shift to hybrid work and the issue of technical obsolescence (namely, occupiers and owners striving for net-zero goals) have contributed to the negative outlook. There is a subsegment of office properties — largely new, well-located and well-amenitized buildings — that remain desirable. However, properties such as these are in the minority and for the rest of the market the future remains uncertain.

Indeed, there have been mounting concerns over property distress and the impact this may have on lenders exposed to poor-performing segments. Data from MSCI Mortgage Debt Intelligence shows distress in the U.S. office market at a post-GFC high at the end of 2023, with more than USD 35 billion of outstanding distress and another USD 55 billion of potential distress.

Notwithstanding the issues in the office market, there are pockets of outperformance in real estate, and some segments have continued to attract investor interest. For example, the modelled price gap for industrial property is generally more moderate than it is for office and retail, at -5.2% in the U.S., -2.7% in Germany and +1.5% in Japan as of the end of 2023. These numbers imply a market approaching equilibrium, which cannot be said for much of the global office market. Leading global commercial-property investors such as GIC, Blackstone Inc., Prologis Inc. and CBRE Investment Management continued to add to their industrial portfolios in 2023, albeit at a reduced rate versus prior years.

Degrees of difference in buyers' and sellers' pricing views

Living in a higher-rate world

For the transaction market to revive without current owners accepting a significant price decline, it will likely require a downward shift in interest rates, which would ease some of the pressures being exerted on the market. There are widespread expectations that rates will start to come down in 2024 as inflation moves towards long-term targets, but there are substantial risks to these forecasts, not least geopolitical tensions in the Middle East.

Some positivity comes from the REIT market, as total returns in MSCI's liquid indexes for U.K. and U.S. turned positive at the end of 2023. This may presage some improvement in the direct property market if the historical relationship between the two metrics is a guide.

Even if rate cuts do materialize it does not automatically mean a return to the post-GFC boom period; however, data shows that some of the greatest returns are made during periods of uncertainty and dislocation, and 2024 could be a time of opportunity for those with flexible capital to deploy. Perhaps the longer-term challenge for the real estate industry is how to keep the investment case compelling in a new era where rates will likely settle at a higher level than the period 2010 to 2022, and where investors will demand more from their property portfolios.

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.