Uncovering Nature Risks Through Geospatial Analysis

Key findings

- Asset managers, insurers, banks and other investors who conduct geospatial analysis may be better positioned to manage location-specific nature risks in their portfolios.

- We found that 41% of MSCI ACWI Investable Market Index physical assets face at least one high nature-related risk, with the most frequent category being air condition (22%), followed by water availability (11%) and timber provision (6%).

- While some nature risks affect operations broadly across sectors, other nature risks, such as soil condition or pollination, may appear minor at the portfolio level but are highly concentrated in specific sectors.

Nature loss is a rising risk to the global economy, disrupting supply chains, raising costs and slowing growth. Investors who use geospatial analysis — like asset managers, insurers and banks — are better positioned to manage these location-specific risks. We found that 22% of MSCI ACWI IMI assets faced high risks[1] from air condition, followed by water availability (11%) and timber provision (6%). While some nature risks cut across sectors, others — like soil condition or pollination — are concentrated and can hit specific industries hard.

We assessed exposure to nature-related risks of the physical assets directly operated by the constituents of the MSCI ACWI Investable Market Index (IMI) using the newly integrated WWF Biodiversity Risk Filter (BRF). Operations in the constituents' value chain were not considered. Overall, our analysis showed that 41% of the assets in the peer set were flagged for at least one high-risk nature category among our selection of BRF indicators. High risks indicate a combination of high dependency and being located in high-risk regions. For example, according to the BRF, assets located in areas with low water availability, combined with their operations' high dependency on water, are rated high-risk.

MSCI ACWI IMI constituents face different levels of risk across seven nature risks

Data as of April 16, 2025, based on WWF BRF and MSCI GeoSpatial Asset Intelligence Data. Peer set: physical assets operated by the constituents of the MSCI ACWI IMI, as of April 16, 2025. MSCI GeoSpatial currently provides BRF data on 456,636 assets linked to MSCI ACWI IMI constituents. These assets represent at least one location for 96% of issuers in the index. We note that certain asset types — such as offices and power plants — are currently better represented in our database compared to others, particularly those in the agricultural sector. Additionally, assets within the supply chains of constituents are not included in our database and were therefore excluded from the scope of this analysis. We recognize these limitations as opportunities for future improvement. As a result, our analysis should be interpreted as providing a lower-bound estimate of nature-related risks.

Identifying the most relevant nature risks

This distribution of nature risks for constituents of the MSCI ACWI IMI reflects the industries that make up the index and their related activities. Certain nature risks — such as pollination or soil condition — are highly relevant for agriculture and food production, but less so for other asset activities. Considering that agricultural activities account for less than 1% of total asset activities, this leads to a highly uneven distribution for these risks in our peer set. In contrast, office-related assets make up around 41%. Thus, risks relevant for office-based activities, such as water availability or air quality, could impact a broader range of assets in the portfolio.

While risks affecting a smaller share of assets may seem insignificant at the portfolio level, disregarding them can create blind spots in risk assessment. For instance, soil condition becomes a material risk when focusing on paper and forest production, where 88% of assets in the MSCI ACWI IMI are exposed to high risk, agriculture (83% assets at high risk) and land development and construction sites (65% assets at high risk).

Water availability and quality — a cross-sectoral risk

In contrast, water availability can be considered a systemic risk. Our analysis of water availability highlights its widespread relevance, with the majority of the assets of MSCI ACWI IMI constituents exposed to medium or high levels of risk. The largest proportions of assets facing high risks were in water utilities (64%), electric-energy production (63%, specifically geothermal and combustion-based), textiles (58%), metals and mining (57%), construction materials (55%) and agriculture (55%). These activities are highly dependent on water and are often located in regions with limited water quantity posing operational and business-growth risks.

Businesses face risks not only from water scarcity, however, but from poor water quality as well. Contaminated water may require costly treatment or render supplies unusable altogether. Many asset-activity types that are already highly exposed to water-availability risks — such as agriculture, water utilities, paper and forest products, hospitality services and food and beverages — face compounded risks from water-quality issues. For other sectors like mining and energy production, water scarcity poses a greater risk across assets, while water quality appears to be a lesser concern.

Asset activities with high water-availability and water-condition risks

Data as of April 16, 2025, based on WWF BRF and MSCI Geospatial Asset Intelligence Data. Peer set: assets of constituents of the MSCI ACWI IMI as of April 16, 2025. High risks defined by WWF BRF methodology. Source: MSCI ESG Research

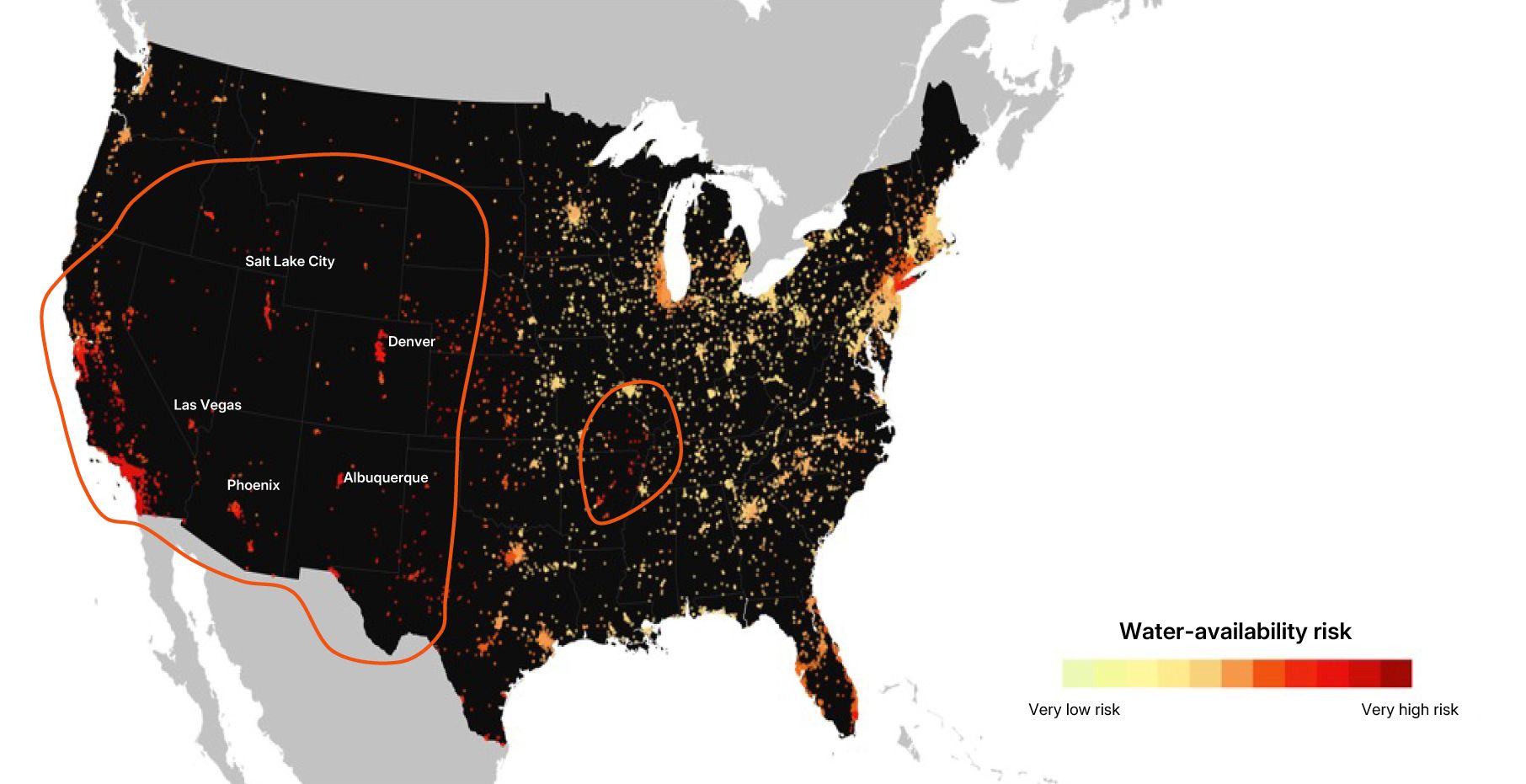

A deeper regional analysis can help investors uncover nature-related risks that may not be immediately apparent at the portfolio level. This can be illustrated by the example of the electronics- and semiconductors-manufacturing industry, which is water-intensive and depends heavily on water for cleaning, cooling and chemical processes. Globally, 25% of the industry's manufacturing sites operated by constituents of the MSCI ACWI IMI face high water-availability risks. A geographic breakdown can reveal regional hotspots. For example, WWF BRF data identifies high-risk zones in the United States — which may give investors pause as the country ramps up domestic semiconductor production.[2] Zooming in further shows spatial clusters of water-intensive activities that compete for water resources, which can further intensify water stress in already scarce regions, compounding the risk.

Where electronics and semiconductor firms are exposed to water-availability risks

Data as of April 2025. Assets of the electronics and semiconductor industry's water-availability exposure. Peer set: physical assets with electronics and semiconductor manufacturing asset activity part of the MSCI ACWI IMI as of April 16, 2025. Source: WWF BRF and MSCI GeoSpatial Asset Intelligence

Looking Ahead: Identifying nature risks with geospatial insights

Investors stand to benefit from integrating tools such as geospatial analysis into investment or credit decisions to manage nature risks in their portfolios. While portfolio-level risk assessments offer valuable insights, a more granular analysis focused on specific issues, industries and regions can reveal hidden risks that might otherwise be overlooked — yet have the potential to affect returns.

The relevance of location data has also been recognized by mandatory reporting regulations such as the EU's Corporate Sustainability Reporting Directive and voluntary disclosure frameworks such as the Task Force on Nature-related Financial Disclosures' framework. As a consequence, investors may face a growing need to perform geospatial analysis to uncover local nature risks.

Subscribe todayto have insights delivered to your inbox.

1 Risks defined by WWF BRF methodology: Assets with risk values above 3.4 (maximum 5) are considered at high risk, between 2.6 and 3.4 at medium risk and less than 2.6 at low/no risk (if an asset activity has no dependency on the respective risk category). The risk categories are a selection of the BRF with a focus on risks related to provisioning as well as regulating and supporting ecosystem service. Exposure of the physical assets operated by the constituents of the MSCI ACWI IMI. The WWF BRF combines geospatial datasets on the state of nature with ecosystem dependency of a given activity at asset level (asset activity). Source: MSCI ESG Research.2 Rachael Brown, "Inside the Battle to Boost US Semiconductor Manufacturing," Manufacturing Digital, March 10, 2025.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.