After US Election, Regional Options Reflect Changing Risks

Since the U.S. election, the MSCI USA Index has posted a 4.8% return versus the MSCI ACWI ex USA Index, which fell by 2.0%, for a quarter-to-date loss of -5.7%.1 Against that backdrop, a clear divergence in traded regional options in maturities and relative implied-volatility levels has emerged.

In late Q3, after Japan's Black Monday and the Chinese stimulus package, the share of short-term maturities for options linked to the MSCI Emerging Markets (EM) Index increased, consistent with tactical positioning. But in Q4, the share of options with one- to 12-month maturities has risen by 10 percentage points.

Similarly, in Q4, the share of three- to 12-month maturities of options linked to the MSCI EAFE Index has risen to 19% from 8%, consistent with managing longer-term risks, such as possible new U.S. tariffs and ongoing geopolitical uncertainty. In contrast, demand trends across U.S. option maturities has been steady in 2024, with only a modest 2% increase in the share of short-dated options (< one month) this quarter.

EAFE volatility has recently outpaced US vol

The MSCI EAFE and MSCI EM Indexes have weakened in USD terms, posting quarter-to-date returns of -5.9% and -7.7%, respectively, although implied-volatility levels have been muted.

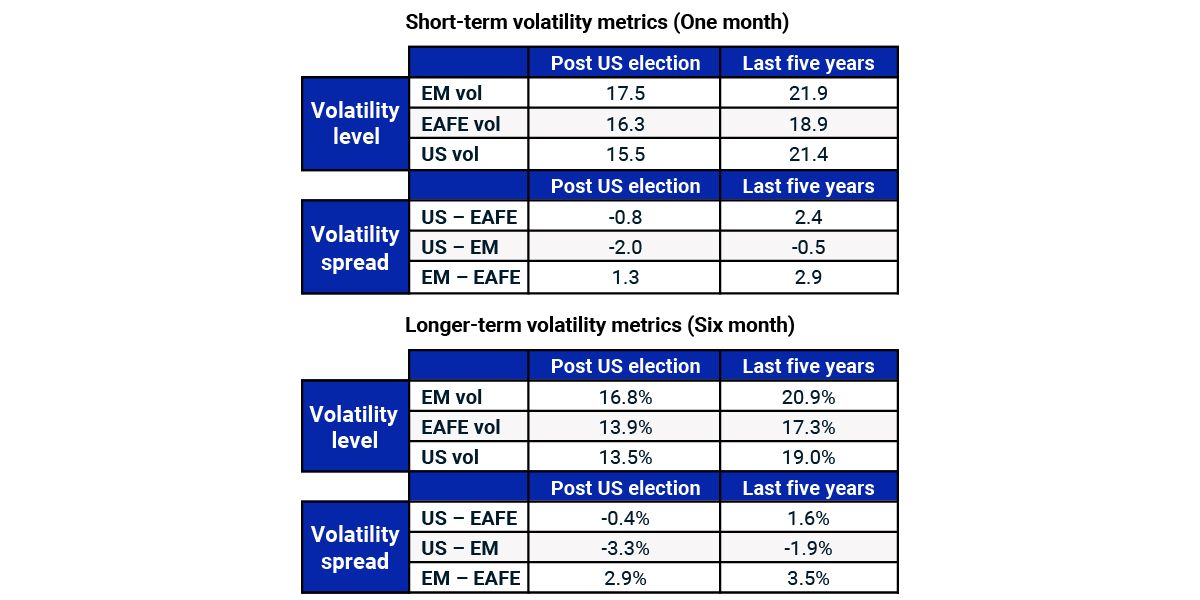

Post-election MSCI EAFE Index volatility (measured by VXMXEA) has been higher than U.S. volatility (tracked by VIX), compared to the five-year average, potentially affecting regional relative-value trades. For example, investors with short exposure to U.S. volatility and long exposure to EAFE volatility, may be reconsidering positioning given changing market dynamics.

We observed these patterns in one- and six-month volatility measures. An increasing preference for longer-dated options, which align with heightened investor risk aversion, coupled with diverging regional spreads, warrants monitoring. MSCI will continue to assess developments and provide insights to help investors more effectively navigate changing regional-market relationships.

Higher demand for intermediate-maturity options in EAFE and EM in Q4

Loading chart...

Please wait.

Three-month rolling average of the percentage of options volumes in different maturity buckets for options linked to the MSCI EAFE, MSCI EM and S&P 500 Indexes. Source: OptionMetrics

Spread between EAFE and US volatility reversed sign after the US election

Data as of Nov. 29, 2024. Short-term implied volatilities for EM, EAFE and U.S. are represented by the VXMXEF, VXMXEA and VIX index levels, respectively. Longer-term implied-volatility metrics, expressed as percentages, are based on the average implied volatility of 182-day at-the-money call and put options. Source: Cboe, OptionMetrics

Subscribe todayto have insights delivered to your inbox.

Regional Index Options Could Cushion Equity Drawdowns

Implied volatility, based on at-the-money options, rose in early September in several regional markets. Put-option premiums, below their five-year median, suggest protection against rising volatility could potentially still be attained at lower cost.

Systematic Options Strategies Linked to Regional Indexes

Our analysis of data spanning the last 18 years indicates that systematic options strategies linked to the MSCI EAFE and MSCI Emerging Markets Indexes have consistently exhibited lower risk and lower drawdowns compared to their parent indexes.

Sector-Balanced Futures – One Way to Manage Chinese Equity Exposure

Rising volatility since late September’s stimulus announcement by the Chinese government has motivated some to reassess the current opportunities and risks in Chinese equities. We analyze one tool at investors’ disposal.

1 All returns quoted are in gross USD. We define the post-election time period as Nov. 5 to Nov. 29, 2024.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.