Assessing Exposures and Risks in the Middle East

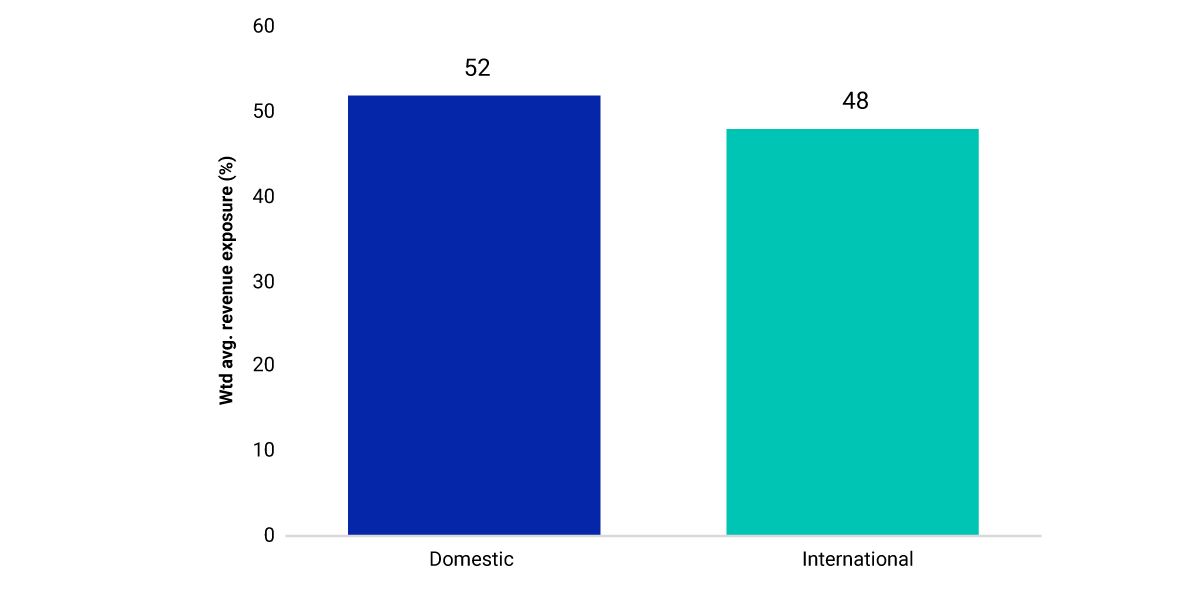

The economic exposures (i.e., source of revenues) of multinational companies extend beyond their country of domicile. Consequently, economic activity beyond their domestic borders can impact their financial operations. As of Sept. 29, 2023, the international exposure of the MSCI ACWI Investable Market Index (IMI) was 48%, underscoring the importance of monitoring economic exposures and understanding the related risks in global investment portfolios.

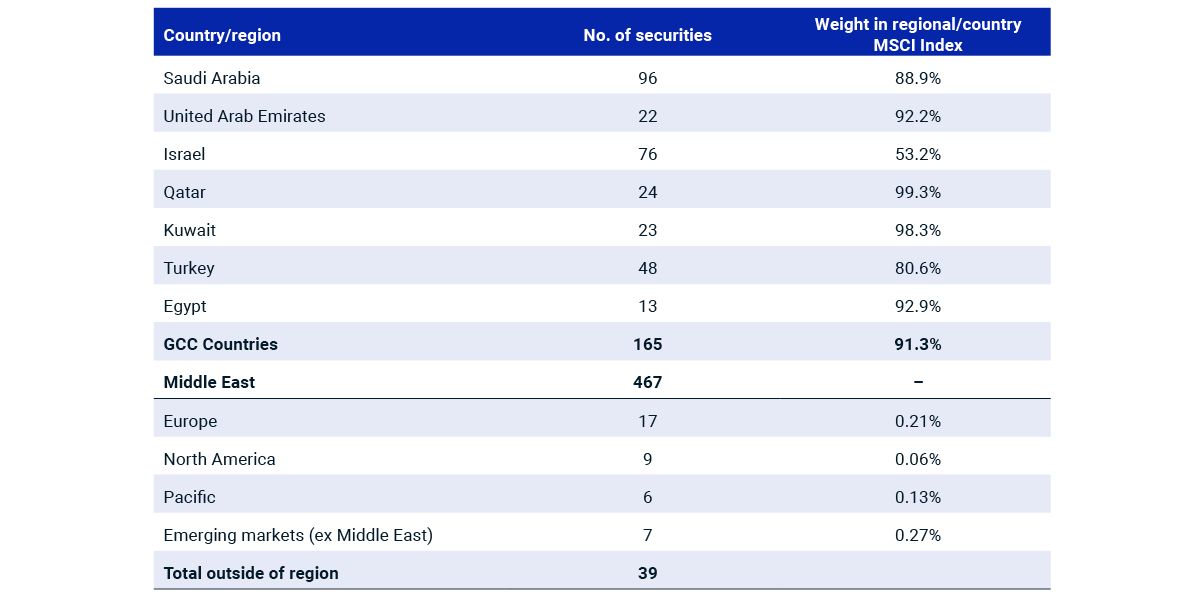

Geopolitical events tend to have a spillover effect on multinational companies in the affected geographic region. In light of the Israel-Gaza crisis, we looked at the exposure of companies in the MSCI ACWI IMI to the Middle East.1 Using MSCI Economic Exposure data, we focused on those that generated more than 20% of their revenues in the region. We found that most of these companies are domiciled in the Middle East, which suggests a largely localized impact.

Spillover effects beyond the region appear limited

The regional exposure varied by country, however. For example, Saudi Arabia-domiciled companies with significant Middle East exposure accounted for 89% of the MSCI Saudi Arabia Index, and companies domiciled in the United Arab Emirates (UAE) with significant Middle East exposure accounted for 92% of the MSCI UAE Index.

Thirty-nine companies in the MSCI ACWI IMI domiciled outside of the Middle East derived more than 20% of their revenues from the region. The weight of these companies in their respective country or regional index was quite low, suggesting that the economic spillover effects from the Israel-Gaza crisis would likely be contained within the region and not widespread. For example, companies in developed Europe with a greater than 20% exposure to the Middle East represented 0.21% of the MSCI Europe Index in terms of market capitalization. The majority of the 39 companies were domiciled in developed Europe, with others domiciled in North America and the Pacific and in emerging markets other than the Middle East.

Revenue exposure data can inform the investment decision-making process and could be a valuable tool for managers in estimating and managing the exposure of their portfolios to geopolitical risks.

Domestic vs. international exposure of the MSCI ACWI IMI

Data as of Sept. 29, 2023. Revenue exposure is a weighted average across index constituents.

Companies in the MSCI ACWI IMI with more than 20% of revenues from Middle East

Data as of Sept. 29, 2023. Revenue exposure is a weighted average across index constituents. GCC countries belong to the Gulf Cooperation Council.

Subscribe todayto have insights delivered to your inbox.

Economic Exposure in Global Investing

As companies expand their footprint globally, the geographic distribution of their revenues evolves over time and their economic exposures may diverge from their country of domicile and primary listing. We believe that this raises a critical issue for institutional investors.

How Do Small Caps Fit into a Deglobalized World?

In response to deglobalization, multinational corporations are making changes to their logistics networks. Using MSCI Economic Exposure data, we examine how small-cap stocks around the world may be impacted.

Who Benefits from Rewiring Supply Chains?

Certain industries are more susceptible to the effects of deglobalization. We explore how investors can identify potential beneficiaries of global supply-chain realignment considering industry, thematic and structural characteristics.

1 The countries we classify as the Middle East are Bahrain, Egypt, Iraq, Israel, Jordan, Kuwait, Lebanon, Oman, Palestine, Qatar, Saudi Arabia, Syria, Turkey, UAE and Yemen.\xa0

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.