Commercial Property in Hurricane Ian’s Path

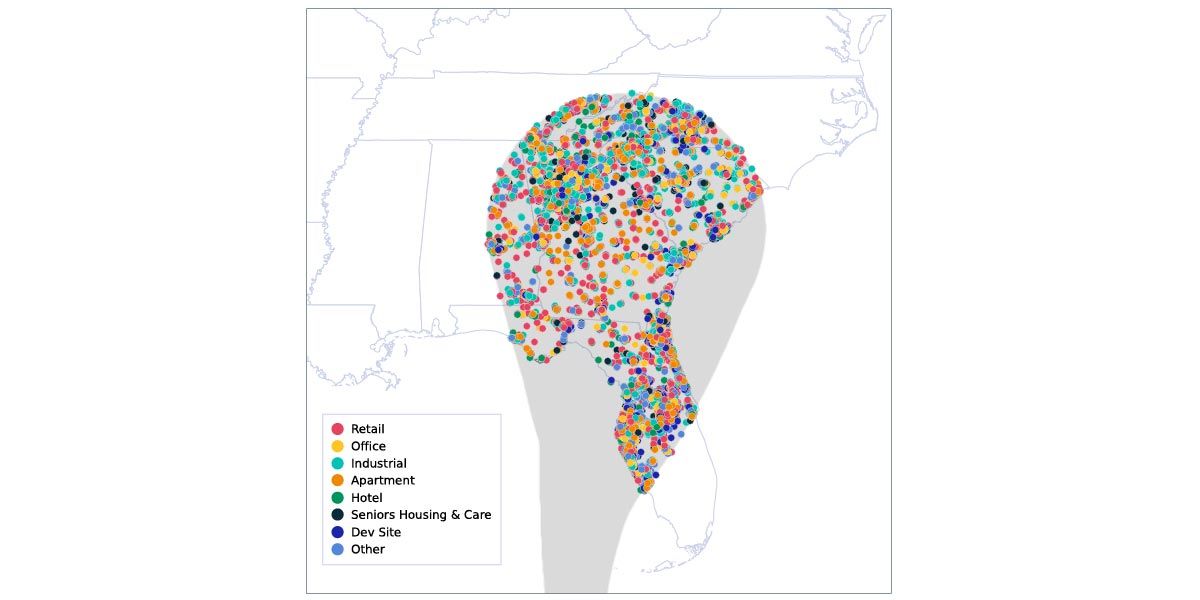

Hurricane Ian slams into Florida on Wednesday, putting lives and livelihoods at risk. The projected path of the storm five days into the future can help people mitigate some of these risks by knowing when to evacuate. Commercial real estate in the track of the storm can also be plotted.

There are assets with an estimated value of USD 1.5 trillion in Ian's five-day path forecast by the National Hurricane Center. The apartment sector has the highest dollar value of assets in the path of the storm, at an estimated USD 603 billion. Of those apartment properties, USD 10 billion may also face storm surge, which can cause extreme flooding and presents the greatest threat to properties and human life.

This aggregation of commercial real estate assets in the storm's path includes only institutional-quality properties priced USD 2.5 million and greater. There are other assets priced below that threshold that face similar risks.1

One can plan around the risks to commercial real estate in the face of such a storm. While it is impossible to attribute individual events to climate change, events like this storm are predicted to become more frequent and more intense, meaning that real estate investors face risks that must be mitigated.

Commercial real estate in predicted path of Hurricane Ian

National Hurricane Center predicted path as of Sept. 27.

Subscribe todayto have insights delivered to your inbox.

Net-Zero Alignment for Multi-Asset-Class Portfolios

Asset owners with net-zero pledges are committing to short- and medium-term carbon-footprint reduction targets for their portfolios.

Real Estate Climate Solutions

We help real estate investors integrate climate, performance and risk analysis to build more sustainable portfolios.

Measuring Climate Risk in Real Estate Portfolios

As a long-term asset class with fixed asset locations, private real estate may be especially vulnerable to both physical and transition risks from climate change.

1 Current estimated values of every asset are generated by taking the sale price or appraisal value at the most recent refinancing and moving that observation forward at the growth rates implied by the RCA commercial property price indexes (RCA CPPI) for the relevant property sector and location.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.