Do Birds of a Feather Flock Together?

Twitter is now a private firm following its acquisition, and it has been removed from MSCI's Global Standard Indexes. However, it will still be impacted by many of the same economic forces as those that affect publicly traded, new-media stocks. And based on recent earnings announcements from firms such as Meta Platforms Inc., those economics could be worsening.

Assessing flight patterns

Traditionally, stock pickers have used analyses such as comparable metrics to identify opportunities. Yet it can be challenging to find peers for firms with revenue models like digital advertising, which might not fit neatly into a single industry.

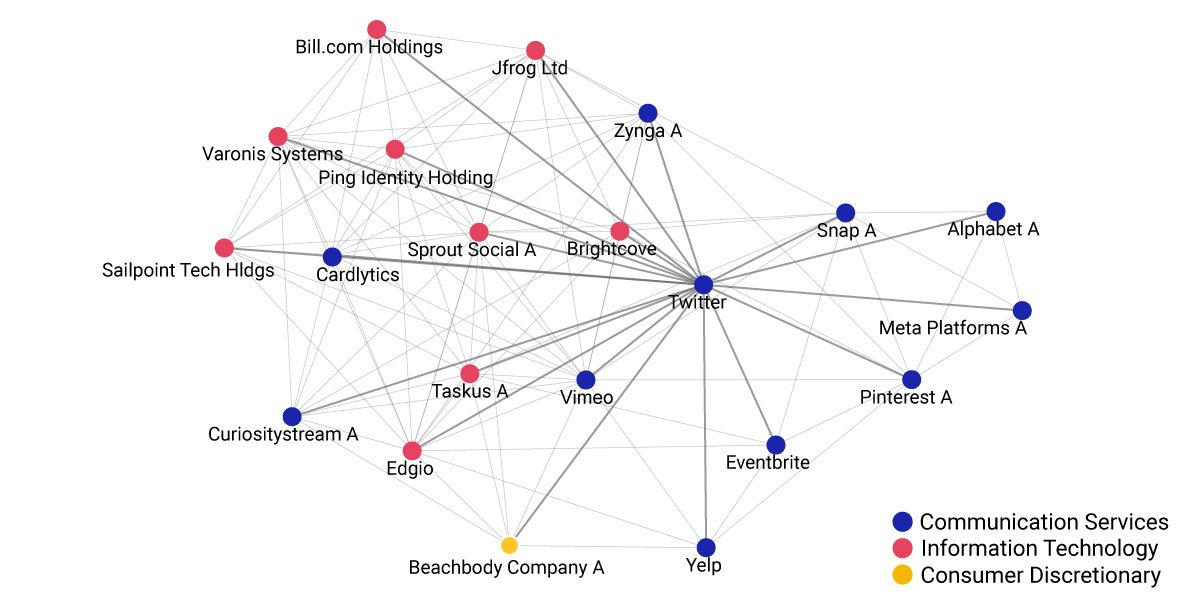

Using MSCI's Peer Similarity Scores to identify Twitter-like firms, we reduced more than 2,500 companies in the MSCI USA Investable Market Index to the 20 most similar firms (shown in the left plot). The peers spanned the communication-services, consumer-discretionary and information-technology sectors, highlighting how alternative methods of firm classification can augment traditional methods, such as the Global Industry Classification Standard (GICS®)1 framework.

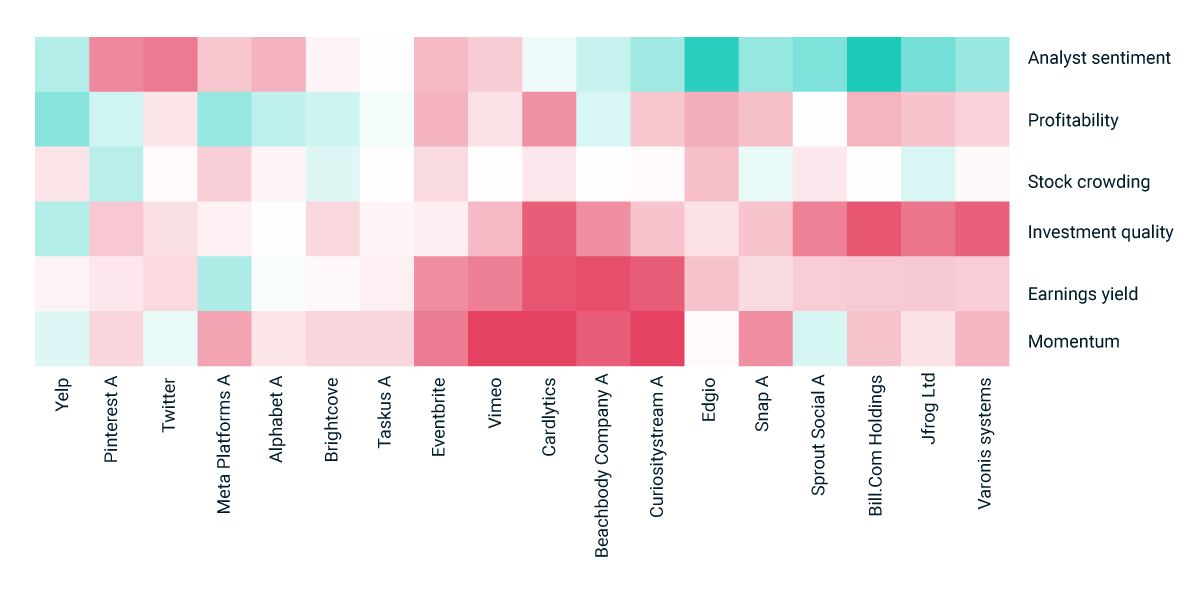

The market's souring mood on these firms is shown in the right plot, with recent stock momentum turning mostly negative. Investors throughout the year have shed firms with deteriorating profit margins and dilutive share issuances in the flight to high-quality stocks. Valuations were also much higher than that of the market, but the stocks were not particularly crowded, given they had already fallen so far throughout the year. Finally, we found that equity analysts' sentiment was bullish for smaller firms such as Snap, yet bearish for the larger advertisers including Meta, Alphabet Inc. and Twitter. Although sentiment is not part of the peer-group construction, it can nonetheless complement it.

The top Twitter peers

Top 20 peers of Twitter based on MSCI Peer Similarity Scores as of March 31, 2022, prior to the announcement of Twitter’s acquisition. Scores are based on return correlations, ESG profiles, news co-mentions, financial fundamentals and 10-K business descriptions.

Fundamental-metrics heat map

Exposures are as of Oct. 31, 2022, from the MSCI Global Equity Factor Trading Model. Red and green shades indicate negative and positive exposure, respectively. Note that some firms from the March peer group have since been delisted or acquired as of October 2022.

Subscribe todayto have insights delivered to your inbox.

Innovation Investing and Equity Allocations

An expanding investor appetite for innovation has led to the creation of investment vehicles that focus on both innovation-driven themes and companies through a variety of approaches.

Markets in Focus: Is the Beta Pendulum an Edge or Hedge?

Global equities were down 6.7% in the third quarter of 2022.

The Impact of High Inflation on Equities

Inflation in the U.S. and in many other countries has accelerated for more than a year, as the U.S. consumer price index reached 8% earlier this year and has remained around that level.

1 GICS® is the industry-classification standard jointly developed by MSCI and S&P Global Market Intelligence.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.