Fed Chair Powell: See You in September

At last week's Federal Open Market Committee (FOMC) meeting, Federal Reserve Chair Jerome Powell continued to talk tough on inflation. He said repeatedly that the Summary of Economic Projections (SEP) from the June meeting still reflected the Fed's thinking. What's more, the median projection among the meeting's participants had the federal-funds rate rising to 3.4% by the end of 2022 and to 3.8% by the end of 2023.

What does the market say?

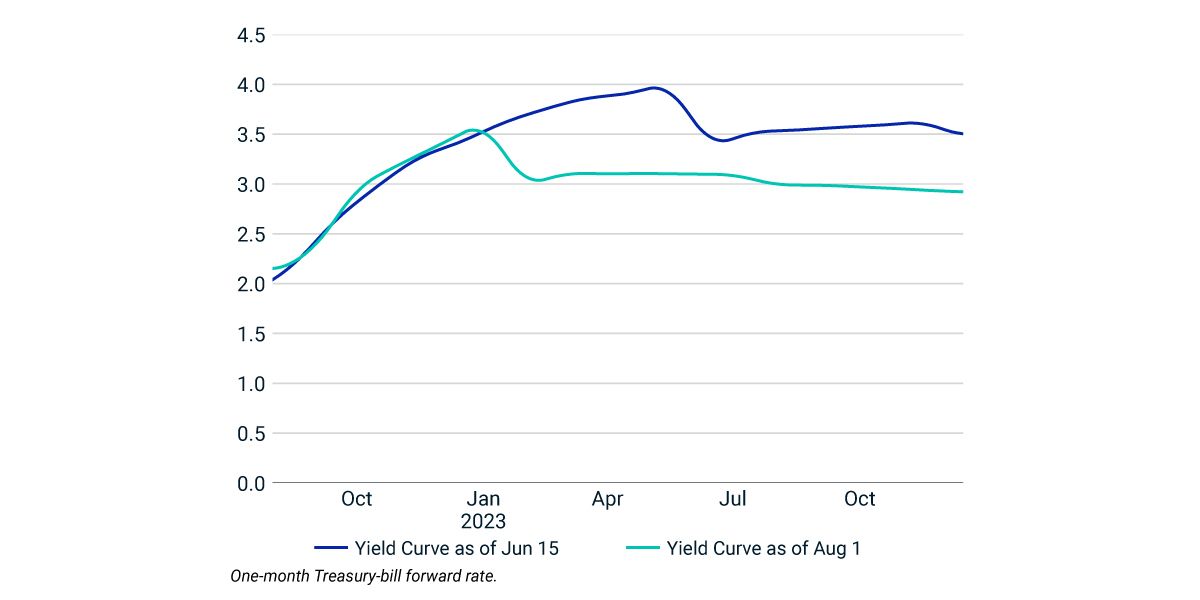

As shown below, the market view on rates has changed considerably. While the FOMC seems poised to continue raising rates, the bond market is increasingly skeptical that the Fed will continue hiking into 2023. The Treasury yield curve on June 15 (the SEP's publication day) suggested a moderately aggressive Fed, with the 1-month T-bill forward rate rising in 2022 and peaking in May 2023. In contrast, the yield curve on Aug. 1 suggested a decidedly more dovish Fed, with the 1-month T-bill forward rate peaking in December 2022.

Yield curves for both dates suggest the possibility of rate cuts in 2023. Further, the 1-month T-bill forward rate was either the same (using the June 15 yield curve) or lower (using the Aug. 1 curve) than at the beginning of 2023 — in contrast to the Fed's SEP projections, which show a 40-basis-point increase in the fed-funds rate in 2023.

The road ahead

The Sept. 20-21 FOMC meeting may present a bigger challenge for the Fed than the latest meetings. Amid growing concern of recession, the Fed and Powell will have to make tougher choices between growth and inflation. The Fed may continue to focus on battling inflation, but its credibility with investors could be harmed by the current disconnect between the committee's rhetoric and forward-market pricing — which, in turn, could lead to market volatility. We'll learn in September and beyond.

Forward rates: Lower and peaking earlier

Subscribe todayto have insights delivered to your inbox.

Government-Bond Yields and Inflation

Inflation expectations based on the prices of government bonds have sharply risen since January, as military conflict in Ukraine increased in likelihood and then turned into an all-out war.

Fed Policy and the Specter of Stagflation

A surprisingly high U.S. inflation reading was released ahead of the June 14-15 meeting of the Federal Reserve’s Federal Open Market Committee, and equity and bond markets reacted by selling off sharply.

ECB, FOMC, Find Out What It Means to Me

As inflation continues to plague the EU and U.S. central bankers announced their latest moves to fight back.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.