Four Key Metrics Behind Long-Term EM Stock Growth

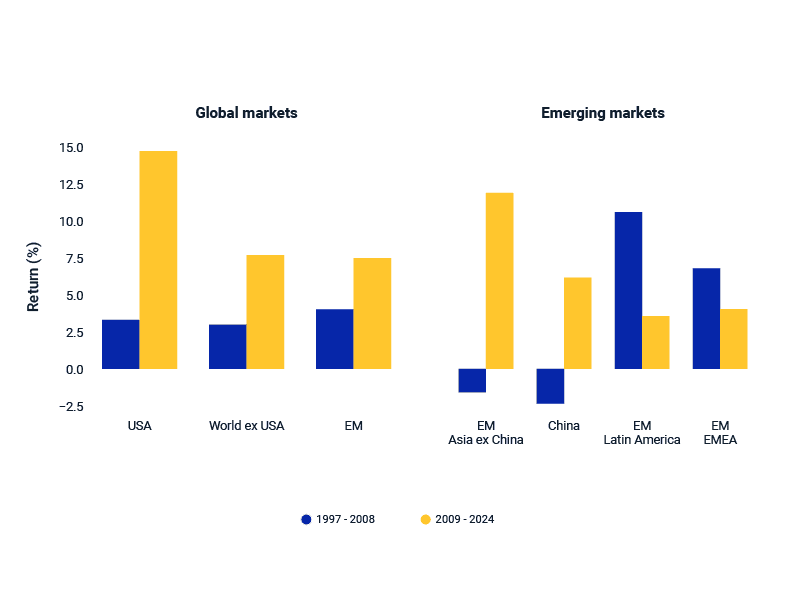

Emerging-market (EM) equities have underperformed those in the developed markets (DM) since the global financial crisis (GFC) in 2008, reversing the trend of the preceding decade. We sought reasons for this turn of events and why certain EM stocks were able to outperform after the GFC.

Long-term compounders bucked trend of headline EM underperformance

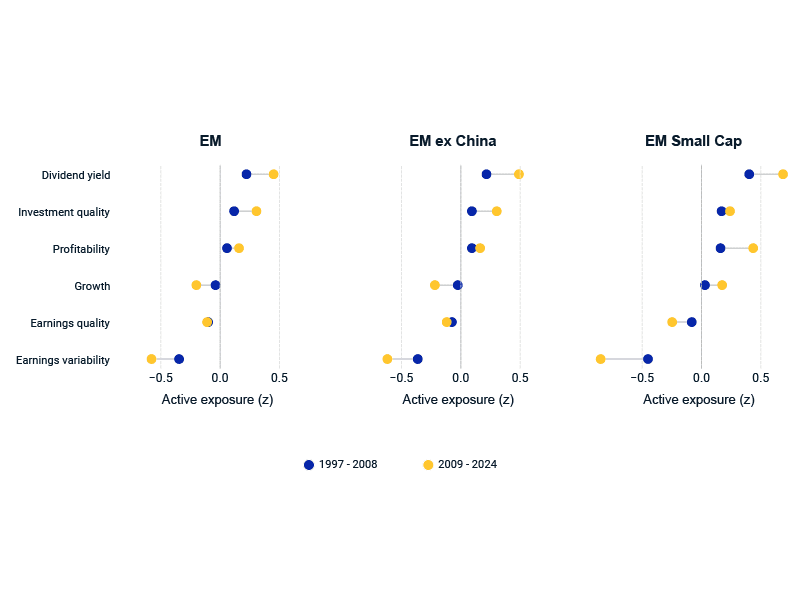

Drawing on nearly 30 years of index- and stock-level returns, and leveraging a new MSCI equity factor model, we identified shared fundamental attributes — profitability, stable cash flows and disciplined capital allocation — of these EM success stories, which we call "long-term compounders." Across the broad EM universe, as well as EM ex China and EM small-cap stocks, dividend yield, investment quality, profitability and low earnings variability were most associated with long-term compounders.1

The overall underperformance of EM in the post-GFC period can be chiefly explained by a disconnect between topline economic growth and per-share returns. Our research shows that despite a rising share of global GDP and a larger universe of listed securities, persistent share dilution and sagging profitability have been a return drag on EM stocks.

Asia EM outpaced EM in Latin America and EMEA after GFC

China's significant weight in EM indexes, combined with its lower returns, explains a large part of MSCI's headline EM equity indexes' underperformance since 2009. In contrast, EM Asia ex China — led by India, Taiwan and Korea — has been competitive with U.S. equities, powered by growth-oriented tech stocks. The region's strength marks a turnaround from the 1997-2008 period when the Asian currency crisis resulted in capital flight, currency devaluation and slow economic growth that weighed on stock returns.

Identifying EM compounder stocks using fundamental metrics such as profitability, yield, capital control and earnings stability may suggest opportunities for active managers (fundamental or systematic), while also suggesting sensible tilts for indexed-based investors.

Long-term compounders shared dividend yield, investment quality, profitability and low earnings variability

Exposures are based on the MSCI EMEFM. End-of-month exposures are averaged from Dec. 31, 1996, to Dec. 31, 2008, and from Jan. 31, 2009, to Dec. 31, 2024. Exposures are the quintile spread, where quintiles are based on return contributions. The regional universes are represented from left to right by the MSCI Emerging Markets, MSCI Emerging Markets ex China and MSCI Emerging Markets Small Cap Indexes, respectively.

EM equities trailed DM equities after the GFC

Annualized returns are gross in USD from Dec. 31, 1996, to Dec. 31, 2008, and from Dec. 31, 2008, to Dec. 31, 2024. The regional markets are represented by the MSCI USA, MSCI World ex USA, MSCI Emerging Markets, MSCI Emerging Markets Asia ex China, MSCI China, MSCI Emerging Markets Latin America and MSCI Emerging Markets EMEA Indexes, respectively. The period analyzed is the longest common history for the indexes.

Subscribe todayto have insights delivered to your inbox.

Long-Term Investing in Emerging Markets

Some emerging-market (EM) stocks have bucked the trend of underperforming headline EM indexes following the 2008 global financial crisis. We used nearly 30 years of index- and stock-level returns to identify their shared fundamental attributes.

Factor Indexes

MSCI Factor Indexes are designed to help investors seeking to build resilient portfolios and capture opportunities. The indexes aim to explain the drivers behind investment outcomes in a scalable, transparent and cost-effective manner.

Exploring Factor Investing in Emerging Markets

Following up on a recent MSCI survey that revealed uncertainty among investors about the comparative risk-and-return benefits of EM and DM factor investing, we simulated the performance of six common EM factor indexes over the last two decades.

1 We define the universes as being the constituents of the MSCI Emerging Markets, MSCI Emerging Markets ex China and MSCI Emerging Markets Small Cap Indexes.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.