Loss Harvesting – No Longer Just a Year-End Exercise

Tax-loss harvesting (offsetting realized gains and losses to maximize after-tax return in a given tax year) for individual investors no longer needs to be considered a manual year-end exercise. Modern portfolio-management systems can now help seize market opportunities for these investors as they arise — and keep portfolios aligned with their personal goals — while taking advantage of loss-harvesting opportunities as they occur throughout the year.

We examined the after-tax performance and tracking error (TE) of two loss-harvesting strategies for a hypothetical U.S. taxpayer invested in the broad U.S. equity market. The strategies compare traditional year-end loss harvesting (year-end) versus continually realizing capital losses at each rebalance (continuous). We assume they are funded with USD 10 million in cash.1

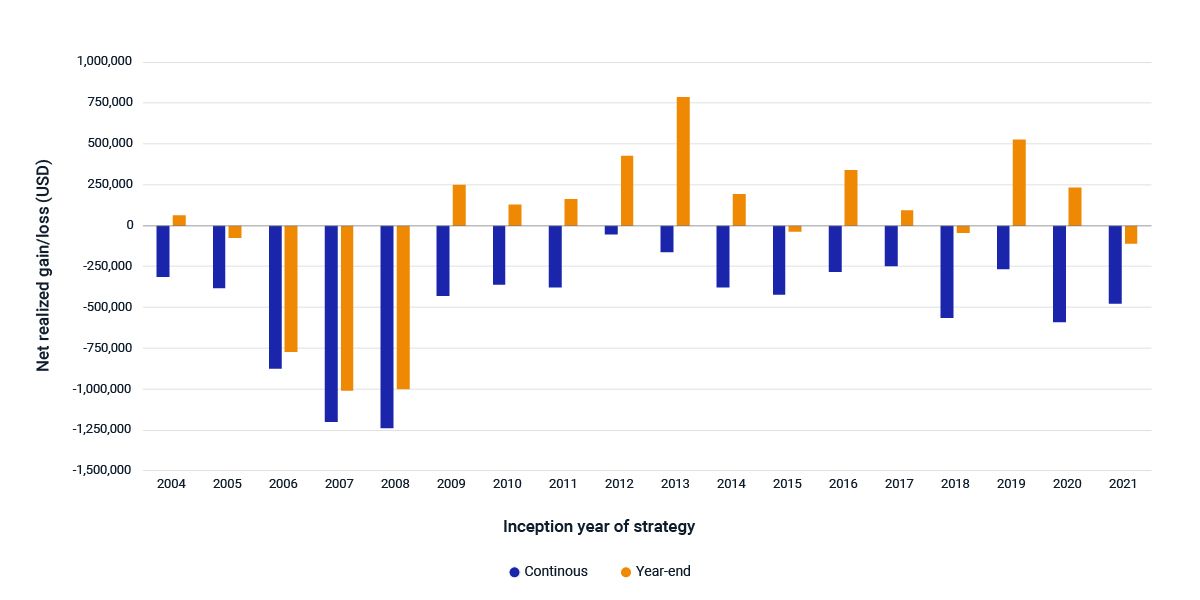

Over our analysis period, the continuous loss-harvesting strategy generated about USD 400,000 of realized losses annually, averaged over all inception years.2 The year-end strategy generated net realized losses for the strategies that started between 2005 and 2008 because of market declines during the 2008 global financial crisis (GFC). For all other inception years, the year-end strategies generated a net realized gain. Only the continuous strategy, which harvests losses at every rebalance, reliably generated a net realized loss for each vintage year. Outside the GFC years, harvesting losses only at year-end did not generate sufficient losses to offset all gains harvested earlier in the year.

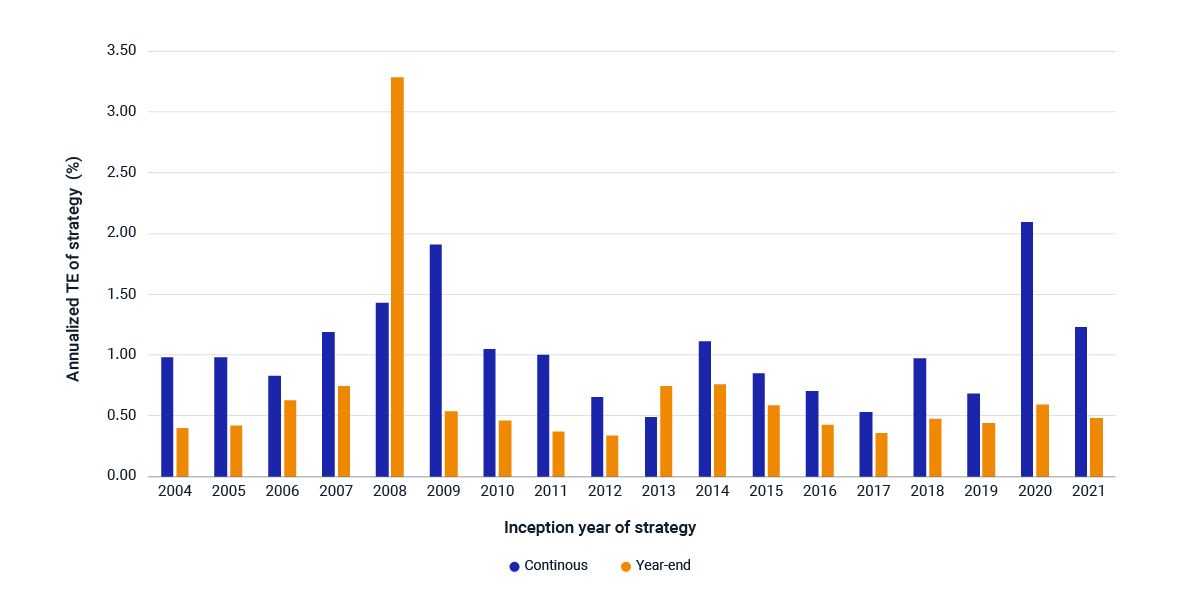

Harvesting realized losses can increase TE because it may cause portfolios to diverge from their benchmarks.3 In our study, the continuous strategy often had higher TE compared to the year-end strategy, with a maximum difference of just over 2% a year.4 In considering the continuous approach, wealth managers and their clients may wish to weigh the increased TE against its potential tax benefits.5

Continuous loss harvesting more reliably generated an annual net realized loss

Data from January 2004 through December 2023. The mean annual gain or loss is calculated for each inception year over the strategy’s three-year holding period.

But continuous harvesting was also associated with higher tracking error

Data from January 2004 through December 2023. The annualized forecasted TE for each inception year is averaged over the strategy’s three-year holding period.

Subscribe todayto have insights delivered to your inbox.

Measuring Tax Alpha

The concept of tax alpha can help a wealth manager explain a client’s after-tax performance. In a new article in the Journal of Wealth Management, we propose two frameworks for the after-tax calculation used to measure tax alpha.

The Power of Rules: Model Portfolios and Wealth Management

For wealth managers and financial advisers seeking customized solutions to meet growing client demand, rules-based management approaches for model portfolios may offer opportunities to improve on traditional management approaches.

Talking Taxes This Week? Plan Now for 2024

Tax-loss harvesting is one strategy individual investors can use to help reduce tax liability and improve after-tax return. It may result, however, in high turnover and tracking error, lowering return. Balancing these factors for each taxpayer is key.

1 Our calculations are for cash-funded portfolios over three-year holding periods beginning in January of each year between 2004 and 2021, with quarterly rebalances. Each strategy runs three years, so that, for example, the 2008 vintage is active from January 2008 through December 2010. We do not apply a constraint to TE in order to better understand the full impact of loss harvesting on this measure.2 In this example, long- and short-term losses are combined for ease of comparison.3 We show forecasted TE, calculated using the MSCI Barra USSLOWL risk model.4 In 2008, given the steep market decline, the year-end strategy's TE was double that of the continuous strategy, yet still resulted in lower losses.5 Increasing the frequency of rebalancing would have increased the difference between the year-end and continuous strategies. Rebalancing a portfolio more frequently during the year (and including loss harvesting at the time of each rebalance) creates more opportunities for losses to be realized and can help avoid potential concentration that could occur if realizing all losses at year-end.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.