Momentum’s Tryst with Tech

The frenzy around artificial intelligence (AI) this year led investors back to many of the growth-oriented tech stocks they sold in 2022 amid high inflation and restrictive monetary policy. This, in turn, has propelled the performance of these stocks. Recent 13F filings by hedge funds reveal sizable positions in AI-focused companies such as Microsoft Corp. and Nvidia Corp.1

The MSCI USA Momentum Index will reflect this shift

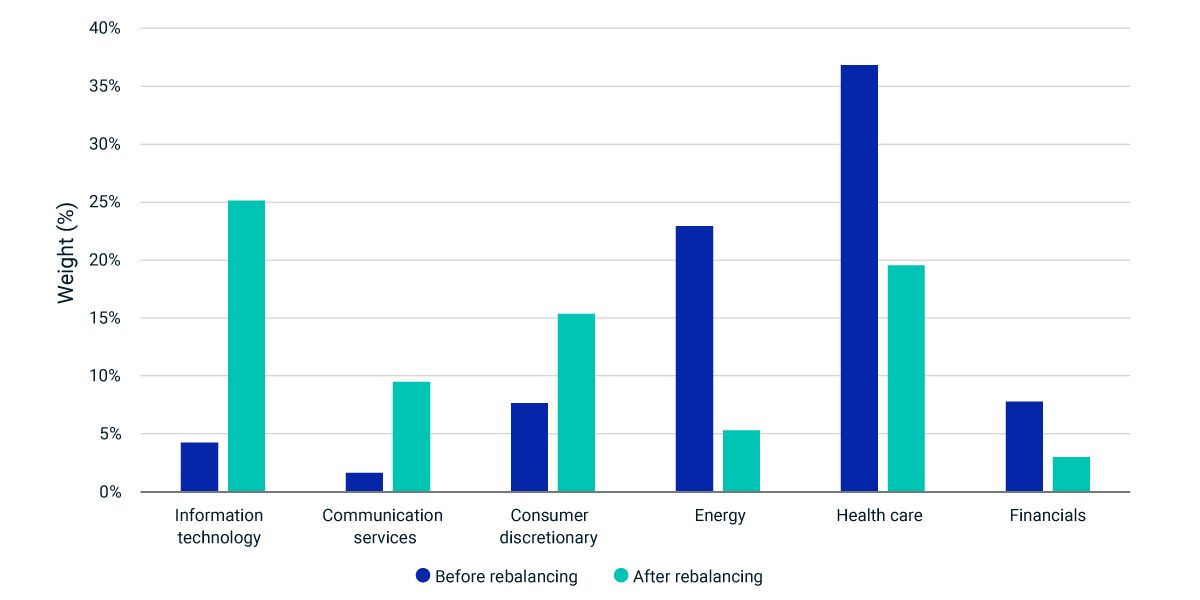

As part of MSCI's May 2023 index review (which will be effective June 1), the MSCI USA Momentum Index will on average rebalance out of value and into many growth stocks, including some firms with an AI presence. The weight of companies in the index that overlap with those in the MSCI ACWI IMI Robotics and AI Index will increase from 4% to 30% as a result of the rebalancing. The MSCI USA Momentum Index will shed recently fallen energy and health-care stocks and add software, semiconductor and media companies. The turnabout is acute: Turnover will be 67% — greater than its long-term historical average — and the index will see 83 companies replaced out of 125. Additionally, the rebalance will drop large positions in UnitedHealth Group Inc. and Chevron Corp. and add Microsoft, Nvidia and Meta Platforms Inc. at 5% each.

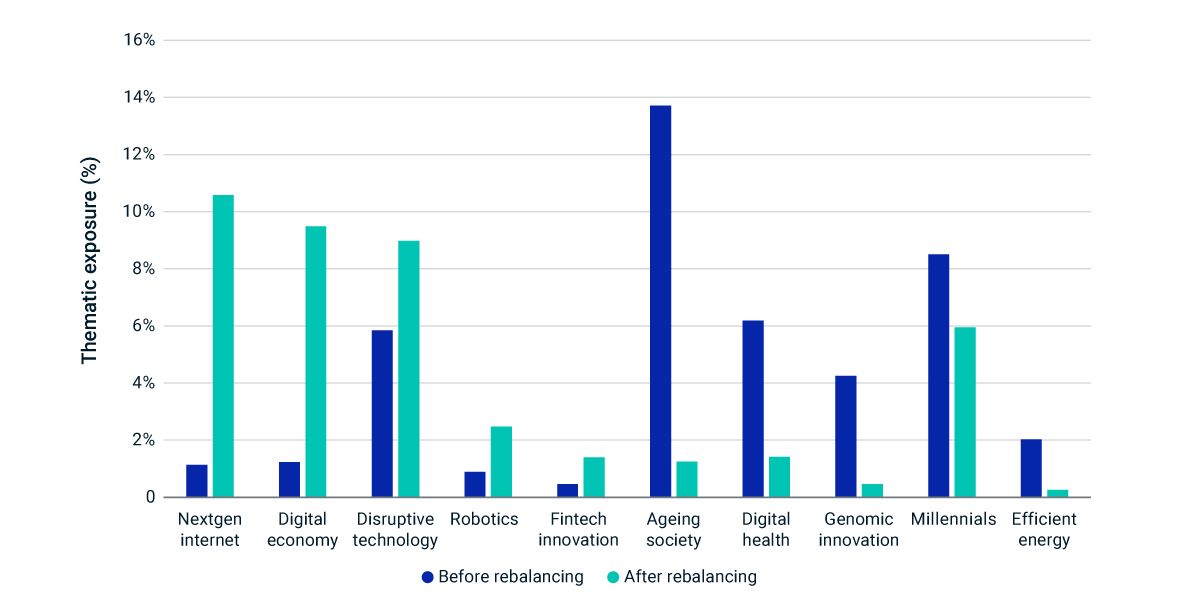

The thematic footprint also reveals dramatic change. The MSCI USA Momentum Index will move away from societal and health-care themes, including aging society, while also shedding many digital-health and genomics firms. On the other hand, the index will gain exposure to tech-related themes such as internet innovation, digital economy and disruptive technology.

In short, the index will do what it is designed to do: rotate out of securities that have underperformed recently and into those with recent outperformance.

MSCI USA Momentum Index changing its sector stripes

MSCI USA Momentum Index adding tech themes

Subscribe todayto have insights delivered to your inbox.

The World After COVID-19: Exploring the Market’s Digital Makeover

The global equity market’s exposure to the digital economy has nearly doubled since 2016, indicating a significant shift in alignment with this long-term trend.

Markets in Focus: Factor Valuations and the New Rate Regime

The global market rallied in Q1 2023, with the MSCI ACWI index up 7.4% for the quarter, led by quality stocks.

The Rise and Fall of Big Tech

Big Tech has had an outsized influence on U.S. equity markets and its slide has largely been driven by eight stocks spanning three sectors.

1 ”Wall Street Breakfast: 13F Season.” Seeking Alpha, May 16, 2023.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.