Price Growth for US Commercial Property Slowed Further

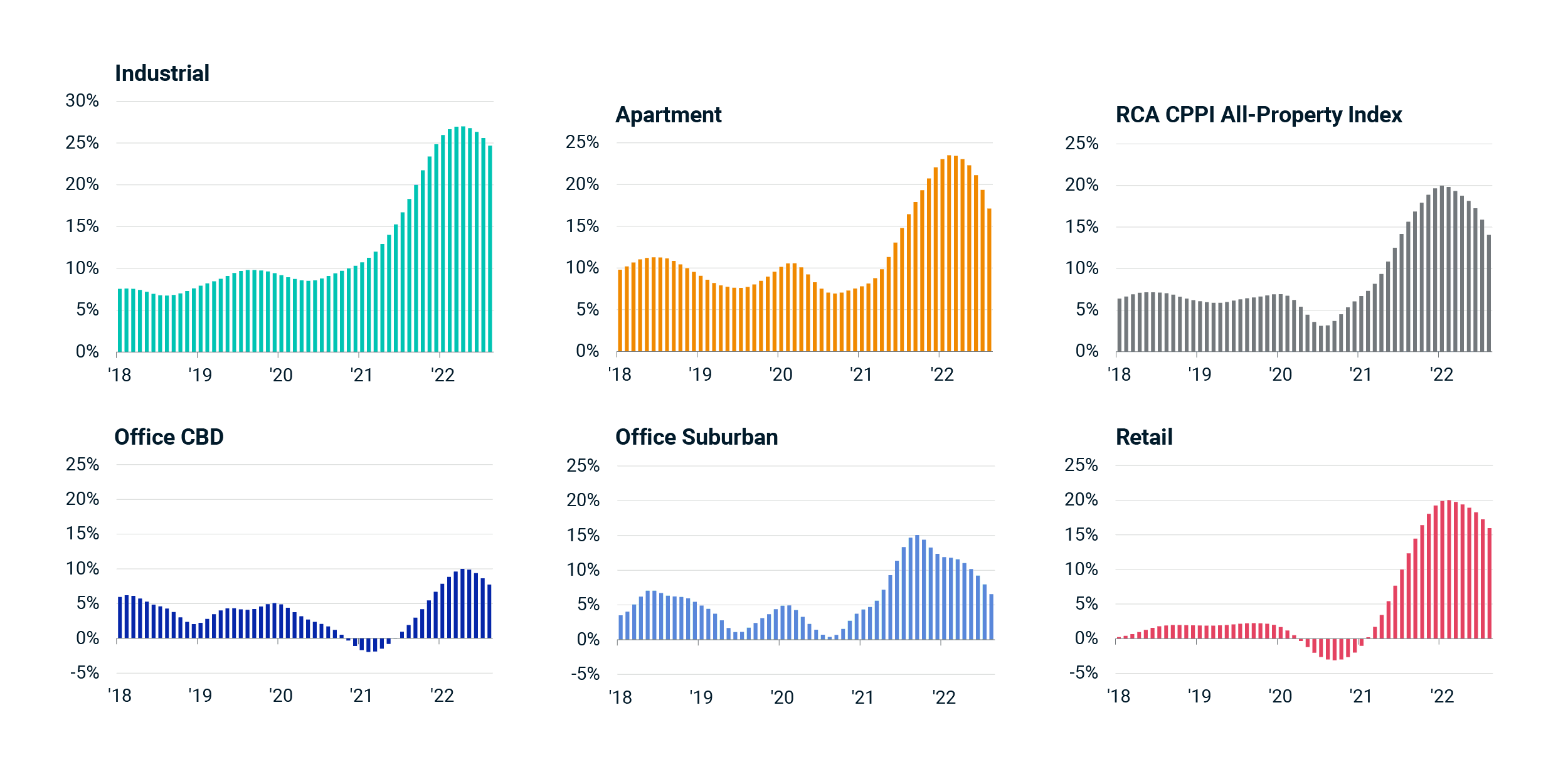

The prices of U.S. commercial properties that sold in August continued to climb but at a slower pace than seen in recent months. The RCA CPPI National All-Property Index increased 14.0% from a year prior, down from the record-high 20.0% rate at the start of 2022 and marking the seventh consecutive month of decelerating growth.

Trading of U.S. properties such as offices, apartment buildings and warehouses has also weakened amid investor caution due to higher lending rates and economic concerns. Deal volume for August totaled $42.9 billion, a 41% decline on the same period a year ago.

Industrial outpaced other property types

All the property-type indexes showed prices growing in August but at slower annual rates. For the industrial sector, this slower rate of growth still came in at 24.7%, easily outpacing the other major sectors. Prices for suburban offices increased only 6.6% from a year ago and for offices in central business districts prices gained 7.7%. Apartment prices climbed 17.1% and retail 16.0%.

Annual change in US commercial property pricing

RCA CPPI (Commercial Property Price Indexes)

Subscribe todayto have insights delivered to your inbox.

Global Real Estate Mostly Resisted Headwinds

The myriad headwinds that the global commercial real estate market has faced in 2022 might have slowed transactions.

Dorothy Didn’t Say, ‘There’s no Place like the Office’

Investors in commercial real estate are confronting the lingering effects of COVID-19 on what being an "office worker" means.

How US Real Estate Purchases Changed During the Pandemic

One notable consequence of the COVID-19 pandemic was a shift in real estate investors’ preferences.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.