Using MSCI GeoSpatial as a Proxy for Climate-Related Insurance Underwriting

Climate scenario analysis is increasingly becoming a global supervisory expectation for financial institutions.1 For example, in August 2022, the European Insurance and Occupational Pensions Authority (EIOPA) published application guidance on climate-change materiality assessments and climate-change scenario analysis. Such guidance encourages EU-based insurance companies to integrate the use of climate-change scenarios in their own risk and solvency assessment (ORSA).2

Use of proxy data in financial-impact analysis

EIOPA's application guidance suggests the translation of material climate risks faced by insurers into financial impacts using climate scenarios from the Intergovernmental Panel on Climate Change (IPCC) and/or the Network of Central Banks and Supervisors for Greening the Financial System (NGFS).

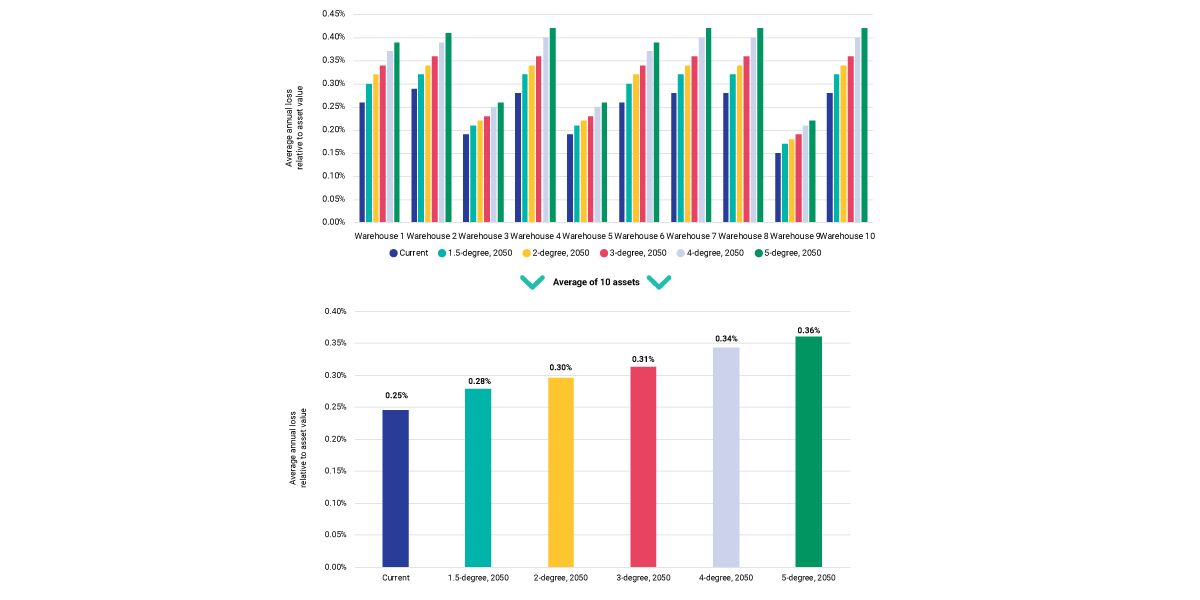

For property insurance, financial-impact analysis can be conducted using proxies derived from the MSCI GeoSpatial Asset Intelligence dataset.3 To illustrate application of such proxy, we found 10 assets tagged as "warehouse" in the city of Shanghai, where exposure to tropical cyclones is significant.4 Average annual loss (AAL) from tropical cyclones was calculated as a percentage of asset value of these warehouses for each of the selected IPCC or NGFS scenarios using the MSCI Tropical Cyclone Risk Model.5 By averaging these relative losses, insurance companies could gauge risks for similar warehouse assets in Shanghai in their underwriting portfolios. Such a proxy process could be replicated for their geographic regions and for other asset types such as manufacturing facilities, hospitals and gas stations.

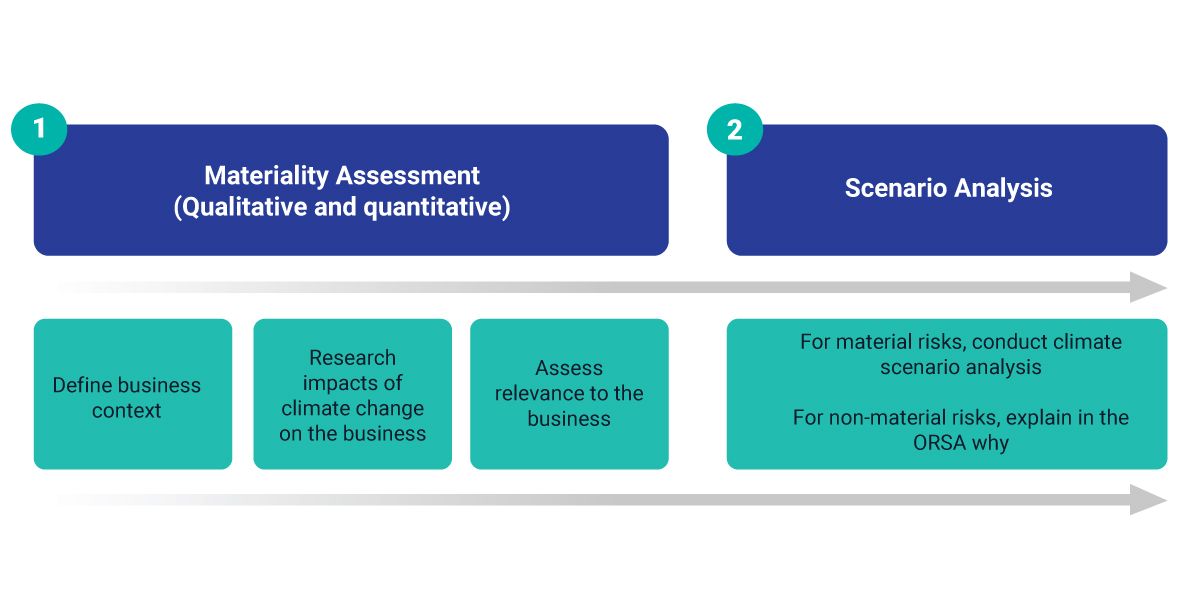

Illustrative steps of climate scenario analysis in insurance underwriting

Adapted by MSCI ESG Research based on EIOPA’s “Application guidance on running climate change materiality assessment and using climate change scenarios in the ORSA” (August 2022). Data as of July 1, 2024. Source: MSCI ESG Research

Example of proxying asset damage using assets in MSCI GeoSpatial Asset Intelligence

Data as of July 15, 2024. The chart captures average annual loss as a percentage of asset value from tropical cyclones for warehouse assets in Shanghai. 1.5-degree scenario is NGFS REMIND Net Zero 2050 scenario. 2-degree scenario is NGFS REMIND Below 2-Degree scenario. 3-degree scenario is NGFS REMIND Current Policies scenario. 4-degree scenario is IPCC SSP 3-7.0 scenario. 5-degree scenario is IPCC SSP 5-8.5 scenario. Current view is in year 2023. Source: MSCI ESG Research

Subscribe todayto have insights delivered to your inbox.

Risk Management in Climate-Related Underwriting

Climate change is exacerbating extreme weather events. What impact has this had on the insurance market and how can insurers assess the impact of hazards and climate scenarios on their portfolios?

Navigating the Financial Risks of Flooding - MSCI

Assessing the widespread exposure and varying characteristics of coastal, fluvial and pluvial flooding is imperative for financial institutions to understand and manage the potential financial impacts of different flood types.

Extreme Weather Unlikely to Revert to the Mean - MSCI

Physical risk from climate change has started to affect nearly every region of the world, from the four hottest days on record occurring in a row this month to more frequent, more intense storms.

1 “Climate Scenario Analysis by Jurisdictions,” Financial Stability Board, November 2022.2 “EIOPA guidance on climate change scenarios in the ORSA: Using MSCI Climate Value-at-Risk,” MSCI ESG Research, June 2023 (client access only). ORSA is an important process for insurers to gain a comprehensive understanding of their solvency position, capital allocation and adequacy of risk-management practices.3 MSCI GeoSpatial is a global dataset containing information on physical assets owned or operated by public and private companies. As of June 2024, MSCI GeoSpatial includes about one million individual assets linked to 70,000 companies. MSCI ESG Research plans to expand the dataset in future releases, both in terms of issuer coverage and in assets that are not yet captured. General limitations of this dataset include data inaccuracy, unavailable data, asset-related transactions and land-use changes.4 Tropical cyclones’ physical-hazard-exposure score is 85 (current view) out of 100. Physical-hazard-exposure percentile score (0-100) is part of MSCI GeoSpatial Asset Intelligence. A score of n for an asset in the corresponding region implies the asset experiences more tropical cyclones than n% of the assets in the reference dataset (i.e., assets in the MSCI ACWI Index under current climate conditions).5 The MSCI Tropical Cyclone Risk Model uses natural-catastrophe model CLIMADA in combination with climate-model-based projections of tropical-cyclone frequencies and intensities to model current and future tropical cyclones.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.