Better Together: Policy Benchmarks, Active Equity and ESG

Research Paper

January 25, 2021

Preview

As we've previously demonstrated, incorporating firm-level ESG characteristics into portfolio construction can preserve, and even improve, risk and return relative to the broad market. Here we follow up by asking how an allocator can integrate ESG considerations efficiently across multiple portfolios in its equity program.

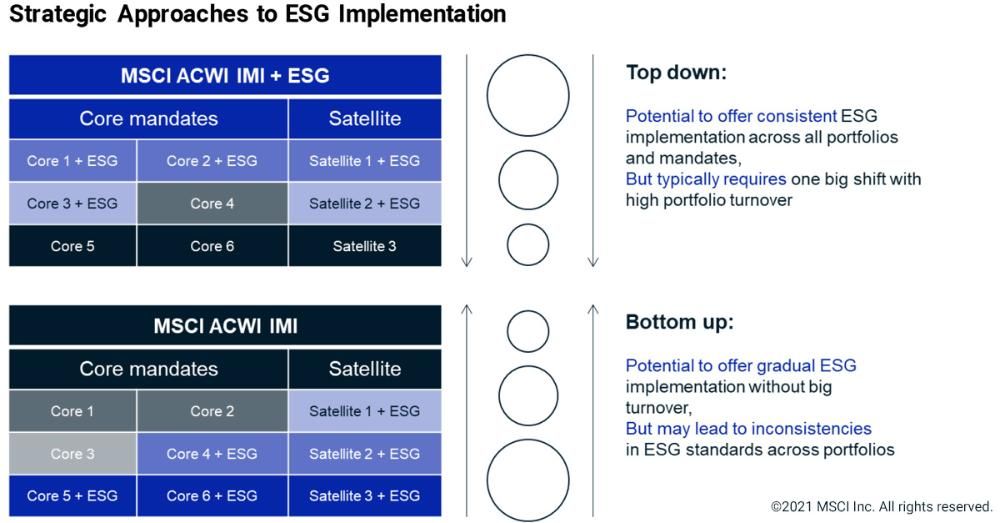

We use a "bottom-up" implementation, a gradual, mandate-by-mandate approach that leaves the policy benchmark unchanged, and a "top-down" implementation, which is a more holistic approach that applies views across all policy, systematic indexed and active mandates. And, we unite several tools — the ESG characteristics of mutual funds, a risk model that incorporates an ESG factor and ESG indexes — to highlight how indexed and active management can be complementary.

We use a "bottom-up" implementation, a gradual, mandate-by-mandate approach that leaves the policy benchmark unchanged, and a "top-down" implementation, which is a more holistic approach that applies views across all policy, systematic indexed and active mandates. And, we unite several tools — the ESG characteristics of mutual funds, a risk model that incorporates an ESG factor and ESG indexes — to highlight how indexed and active management can be complementary.

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

ESG Indexes

MSCI Inc. is the world's largest provider of Environmental, Social and Governance (ESG) Indexes1 with over 1,500 equity and fixed income ESG Indexes.

ESG Foundations

Many studies have focused on the relationship between companies with strong ESG characteristics and corporate financial performance. However, these have often struggled to show that positive correlations — when produced — can in fact explain the behavior.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.