Is There a Filings Factor?

Research Paper

August 6, 2021

Preview

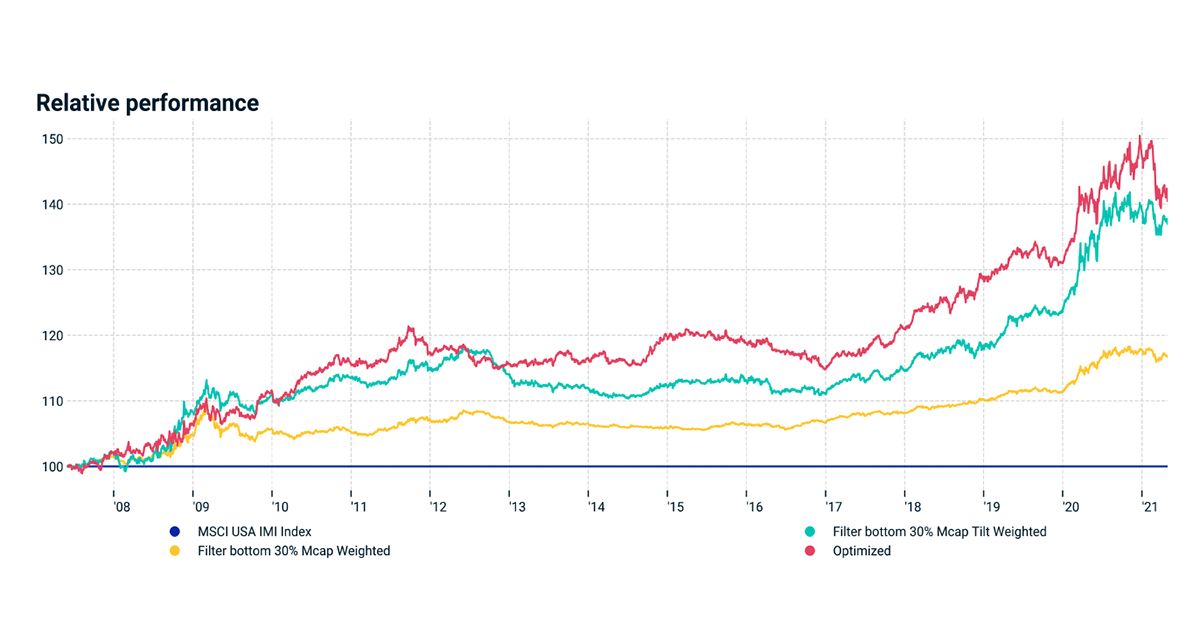

The language in regulatory filings typically changes little from one period to the next. However, when filings have big changes, it may indicate new material information that may have implications for future business outcomes. Using the quarterly (10-Q) and annual (10-K) filings by companies in the MSCI USA Investable Market Index universe, we found that changes in the structure and language of these filings had strong implications for a firm's future stock performance. Firms that had more changes in their regulatory filings underperformed the broader market over the next few months, while companies that made few changes outperformed.

Simulated Long-Only Reporting-Sentiment Portfolios' Performance Relative to the Benchmark

Data from May 31, 2007, to April 30, 2021

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

Finding the Sentiment Hidden in Regulatory Findings

Using natural language processing techniques, we constructed a sentiment factor that quantifies changes in the tone and content of company filings, and may be an indicator of future risks facing a company.

The Many Faces of Sentiment

In this paper, we extend our previous research on sentiment measures by introducing several more traditional and alternative datasets.

Did Pfizer Give the Value Factor a Much-Needed Shot in the Arm?

What can history and factor ETF flows tell us about our current conditions?

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.