Comparing Apples to Apples in Bond-Fund Liquidity

- The Securities and Exchange Commission's proposed liquidity rule would standardize liquidity classification to promote comparability across open-end funds.

- Funds' liquidity profiles would be publicly shared, under the proposal, allowing investors to better assess the liquidity of funds across different markets.

- The proposal is a reasonable middle ground to compare absolute liquidity of funds across asset classes, but may offer less differentiation within the same sector.

What changes?

Under the current rules, fund managers are required to determine a "reasonably anticipated trade size" — that is, what percentage of their holdings they expect they would need to sell under a large-redemption scenario. Managers also need to specify what they consider a significant change in market value resulting from the sale of the asset, which may be interpreted as the transaction cost for the trade.

Holdings are then classified into one of four liquidity buckets (ranging from "highly liquid" to "illiquid"), based on the number of days it would take to sell the assumed trade size under the specified transaction-cost limit. One drawback of this approach is that different funds may classify the same holding differently based on their modeling assumptions.

The new proposal would reduce model risk, by prescribing that the assumed size of the stressed trade should be 10% and the significant market-value impact is 1% for all fixed-income investments. Positions are classified into one of three (rather than four) liquidity buckets.2 Under both the current and proposed rules, illiquid assets cannot account for more than 15% of fund holdings.

How large is 1%?

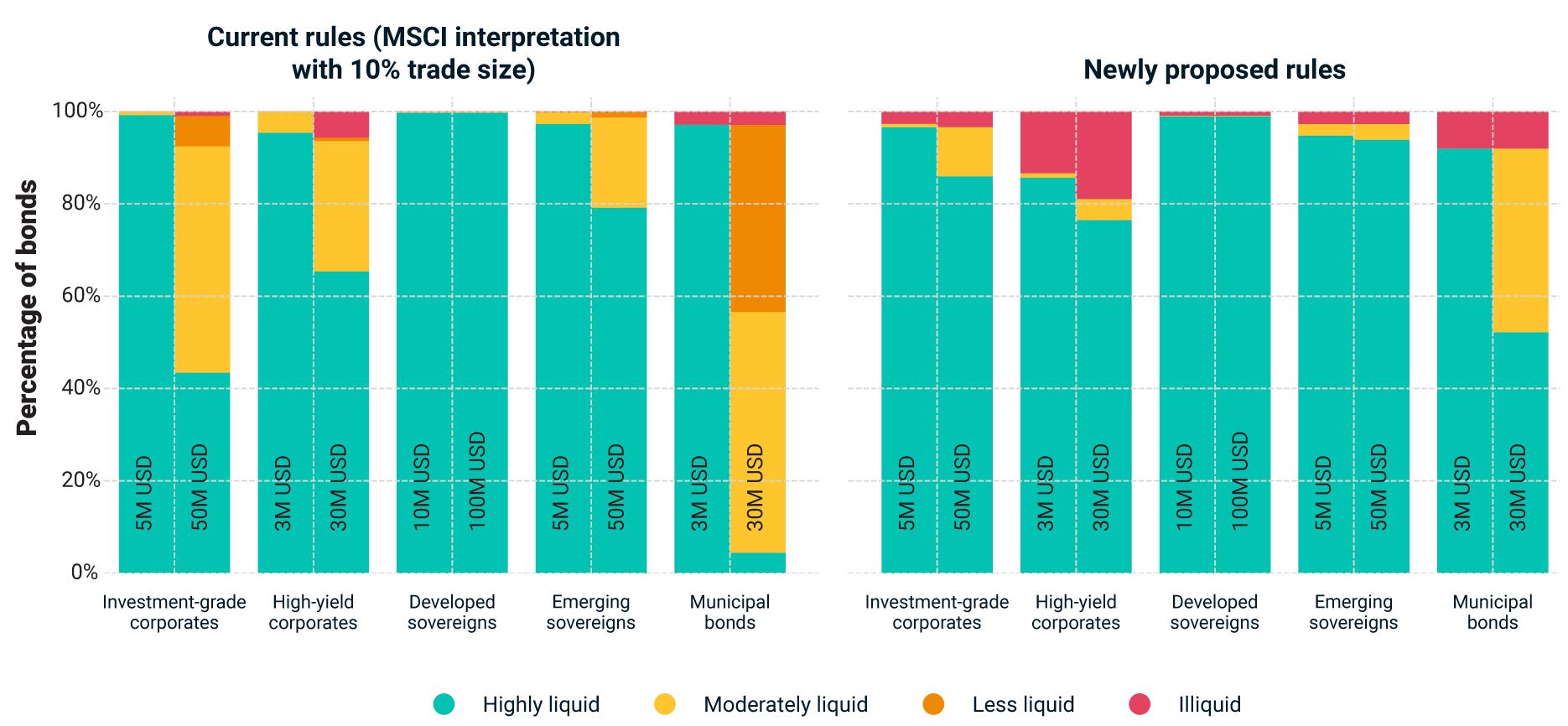

In the exhibit below, we compared the MSCI interpretation of the current rules to the proposed standardized approach for two different position sizes: The first is for a "typical" position size, and the second is for a large position.3

How the current and proposed rules differ

The figure is based on all bonds within coverage in MSCI's RiskMetrics® LiquidityMetrics®, equally weighted. The numbers in the columns represent position sizes. We classify positions assuming that 10% of this size is traded.

Using MSCI's RiskMetrics® LiquidityMetrics® to compute the liquidation horizons, we found that even very large positions of investment-grade (IG) corporate bonds would be mostly classified as highly liquid under the new approach. Transaction costs remained below 1%, even after accounting for excess market-impact costs due to executing large trades well above the typical trade size.

On the other hand, a significant portion of high-yield and municipal bonds (munis) would be classified as illiquid, even for bonds held in small positions.

What consequences to expect?

The proposed rule would standardize the assumptions for liquidity classifications and require public disclosure of funds' liquidity profiles, which may allow investors to better assess funds' liquidity. The proposed approach may lead to significantly different classifications for some sectors from those based on the current rule (e.g., for high-yield and municipal bonds) and may also result in less liquidity differentiation within certain bond-market segments (such as munis or IG corporate bonds).

A positive feature of the current rules is they allow fund managers to use security-specific price-impact definitions to better understand changes in relative liquidity. Even if the proposed rules are adopted by the SEC, fund managers may want to continue monitoring other measures of fund liquidity.

Further Reading

Subscribe todayto have insights delivered to your inbox.

1“Open-End Fund Liquidity Risk Management Programs and Swing Pricing; Form N-PORT.” Securities and Exchange Commission, Nov. 2, 2022.2If conversion to cash takes place within three business days, the asset is classified as “highly liquid,” under the current rule. If conversion to cash takes more than three business days but less than seven calendar days, the position is “moderately liquid.” If the position can be sold within seven calendar days, but the trade does not settle within the seven days, then the position is “less liquid.” If the position cannot be sold within seven days, then the position is classified as “illiquid.” Under the newly proposed rules, the “less liquid” bucket is removed and its contents are classified as “illiquid.”3We have classified each instrument in MSCI’s RiskMetrics® LiquidityMetrics® coverage into liquidity buckets based on both the newly proposed rules and the MSCI interpretation of the current rules. In both classifications, we used 10% liquidation. We ran the classifications for a typical investment size and a large investment size, specific to each market. We then aggregated the asset-level results using equal weighting.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.