How climate change may ‘flood’ global equities

Blog post

February 5, 2020

- We estimate that approximately 7% of global facilities operated by MSCI ACWI Index constituents are threatened by coastal flooding risk. Nearly 62% of index constituents had at least one facility in a flood-prone area.

- Regionally, Asia has the most coastal flooding exposure by far, with USD 2.25 trillion of revenue at risk between now and 2050.

- Without significant investment in coastal protection and adaptation, over half of covered global assets at risk could become untenable by midcentury.

Gauging the depth of the problem

MSCI ESG Research estimates that approximately 7% of all facilities owned by covered MSCI ACWI Index constituents are under threat from coastal flooding.3 Further, nearly 62% of all index constituents had at least one facility in a flood-prone area — underscoring the importance of accounting for these risks and integrating that information into investment decision-making. Rising sea levels would likely exacerbate these risks.

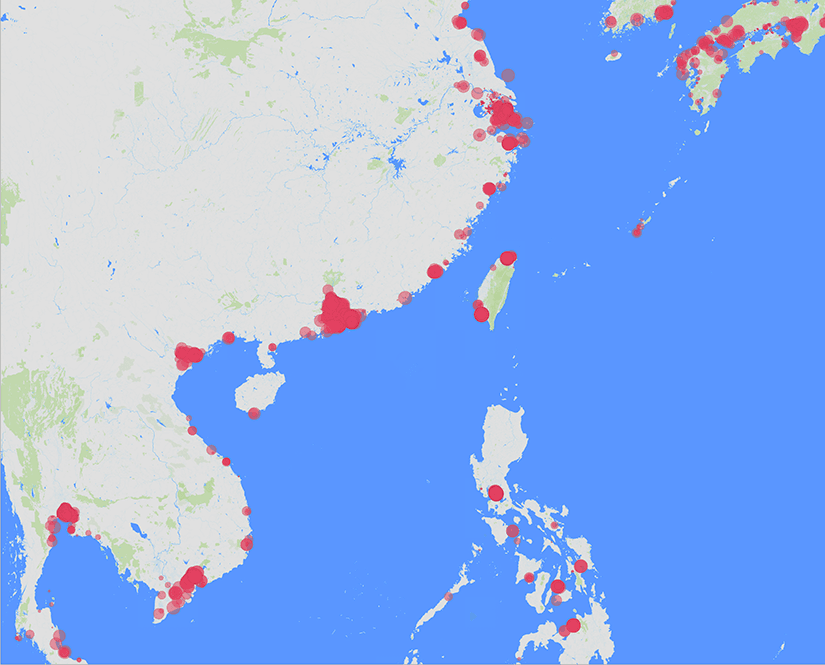

Relative asset-damage risk to Asian company facilities

Source: MSCI ESG Research, as of Jan. 20, 2020. Red dots indicate facilities of companies in the MSCI ACWI Index that would be affected by coastal flooding in 2050 under RCP 8.5. This pathway assumes global warming at an average of 8.5 watts per square meter, reaching a warming of 4.1 C by the end of the century, which is close to a business-as-usual scenario. Flood defenses are fixed at 2020 levels. The dot size indicates expected relative asset damage per year, using Cartography © OpenStreetMap data.

Asia had the highest exposure to coastal flooding risk by far, both in terms of the number of facilities and the level of potential damage at company sites. We identified 6,257 facilities at risk in Asia, with USD 2.25 trillion of revenue at risk4 between now and 2050. The EU had the second-highest number of facilities at risk from coastal flooding (2,270), while the U.S. had the second-highest amount of revenue at risk, at USD 541 billion. Without significant investment in coastal protection and adaptation, over half of the global assets at risk could become untenable by 2050, according to our model.5

No assurance of insurance

Should global action on climate change fail and extreme scenarios of sea-level rise occur as predicted by the IPCC, firms in the most exposed locations may experience more difficulty insuring assets, and without investment in flood protection measures, some companies could lose existing coverage.6 To identify the companies that are potentially more resilient to flood risk, investors may scrutinize which ones have more comprehensive insurance coverage as well as those that have put in place other risk-mitigation measures such as improved construction, upgraded floodwater drainage and retention capacity.

Institutional investors may want to review their options on how they work to protect their portfolios from physical-climate risks such as exposure to coastal flooding. For example, they may engage with companies on physical-climate risk, reduce their exposure within a sector and/or a portfolio or create climate-smart benchmarks. The one thing they cannot do about the potential risk is ignore it.

1 IPCC. "Special Report on the Ocean and Cryosphere in a Changing Climate." September 2019. This range refers to the projection of the global mean sea level under the RCP 2.6 scenario at the end to the century.

2 Jevrejeva, S. et al. 2018. "Flood damage costs under the sea level rise with warming of 1.5 degrees C and 2 degrees C." Environmental Research Letters.

3 The Climate VaR model covers 2,344 out of 2,955 MSCI ACWI Index constituents (as of Dec. 31, 2019). Of those companies covered by the model, 144,014 locations can be evaluated. Coastal flooding risk can be found at 10,242 of these locations, meaning that 7% of the company locations in the ACWI would be exposed to coastal flooding risk under the RCP 8.5 "business as usual" scenario, unless further action is taken.

4 We define revenue at risk as the share of current company revenue attributable to facilities affected by specific extreme weather events or gradual climate shifts. To allocate revenue, we use the global breakdown by country and map country revenue to asset locations.

5 Assets deemed untenable will experience on average more than 5% of asset damage per year.

6 Mollod, G. and Robson, W. 2019. "Climate risk in private real estate portfolios: What's the exposure?" MSCI Research Insight.

Further Reading

Climate Change Solutions

Is climate-change risk all about fossil fuels? Think again.

Corporate disclosure in a TCFD world

Underwater assets? Real estate exposure to flood risk

Climate risk in private real estate portfolios: What's the exposure?

The Paris Climate Deal: Implications for Companies

The MSCI Principles of Sustainable Investing

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.