Investing for the Long Run: ESG and Performance Drivers

Blog post

September 4, 2017

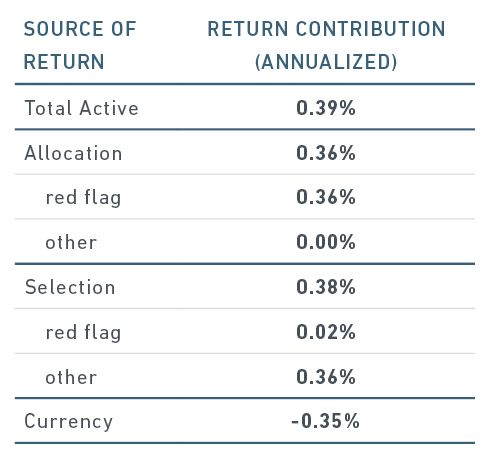

We see a growing number of institutional investors seeking to avoid financial risks associated with environmental, social and governance (ESG) factors, or even to enhance returns by investing in companies that have strong ESG track records. As we wrote in an earlier blog post, these investors are typically looking to limit the number of companies excluded from their portfolios, both to avoid sacrificing diversification and to be active owners able to engage with corporate management. The challenge raises several questions. How can a rules-based index represent the performance of a strategy with these goals? And how does construction of such an index affect its performance? Which is more important in driving performance — excluding companies with low ESG scores or picking those with strong ESG characteristics? Using the MSCI ACWI ESG Universal Index as an illustration, we find that it was possible to strike a balance between maintaining a large, diversified universe of companies with strong ESG characteristics while excluding only those companies that allegedly are the worst corporate wrongdoers. Index construction. The MSCI ACWI ESG Universal Index aims to tilt toward stocks with strong ESG characteristics, including those that have shown improvement in their MSCI ESG Ratings over the most recent 12 months. This index is also designed to exclude only a small group of highly objectionable stocks (mainly stocks that were flagged as "red" due to the worst types of alleged wrongdoing – typically massive scandals or incidents representing gross violations of global norms such as human rights or environmental protection). This construction is designed to maintain diversification within the index while enabling institutional investors to engage with poor ESG performers. Performance attribution. The MSCI ACWI ESG Universal Index outperformed its parent index (MSCI ACWI Index) by 39 basis points (bps) annually over the five years ended June 2017 (see exhibit below). The performance can be broken into two parts:

- Allocation effect: Measures the contribution at the group level from a) excluding highly objectionable ("red-flag") stocks and b) increasing the weights of remaining stocks during index rebalancings.

- Selection effect: Measures the effect of overweighting stocks with strong ESG scores or underweighting stocks with weak ESG scores.

Allocation and selection effects both added value

Annualized data from July 2012 - June 2017

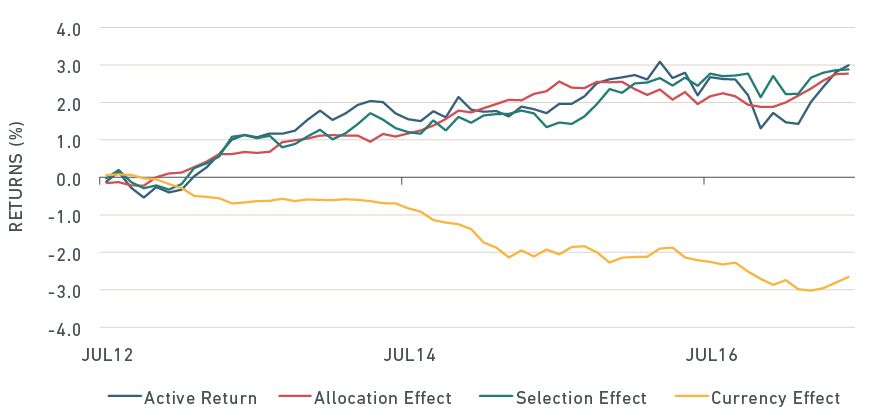

The second exhibit shows that both effects persistently contributed to outperformance over the entire five-year period, with no particular period dominating.

Performance was persistent over time

ACWI ESG Universal vs ACWI

Data from July 2012 - June 2017

The index also was overweighted in Japan, eurozone and U.K. stocks, and underweighted in U.S. equities. The underperformance of the pound, yen and euro relative to the U.S. dollar over the past five years thus hampered overall performance. Unlike the allocation and selection effects, which contributed to positive performance over the whole period, the negative currency contributions were concentrated in a few shorter episodes, such as the Brexit vote in June 2016. All told, the MSCI ACWI ESG Universal Index struck a balance between maintaining a large diversified portfolio overweighting better or improving ESG characteristics, and excluding only a small group of companies that allegedly are the worst corporate wrongdoers. During the five-year study period the index outperformed the parent index, driven by its construction methodology.1

Further reading:

Subscribe todayto have insights delivered to your inbox.

1 Past performance is not indicative of future results, which may differ materially.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.