Paris-Aligned Indexes to Manage the Future

- Futures linked to an index, such as the MSCI Climate Paris Aligned Indexes — as opposed to conventional market-cap futures — are one option for investors seeking to align exposures with net-zero strategies.

- Some investors have looked to futures to facilitate cash equitization as they work to transition to net-zero strategies in their portfolios.

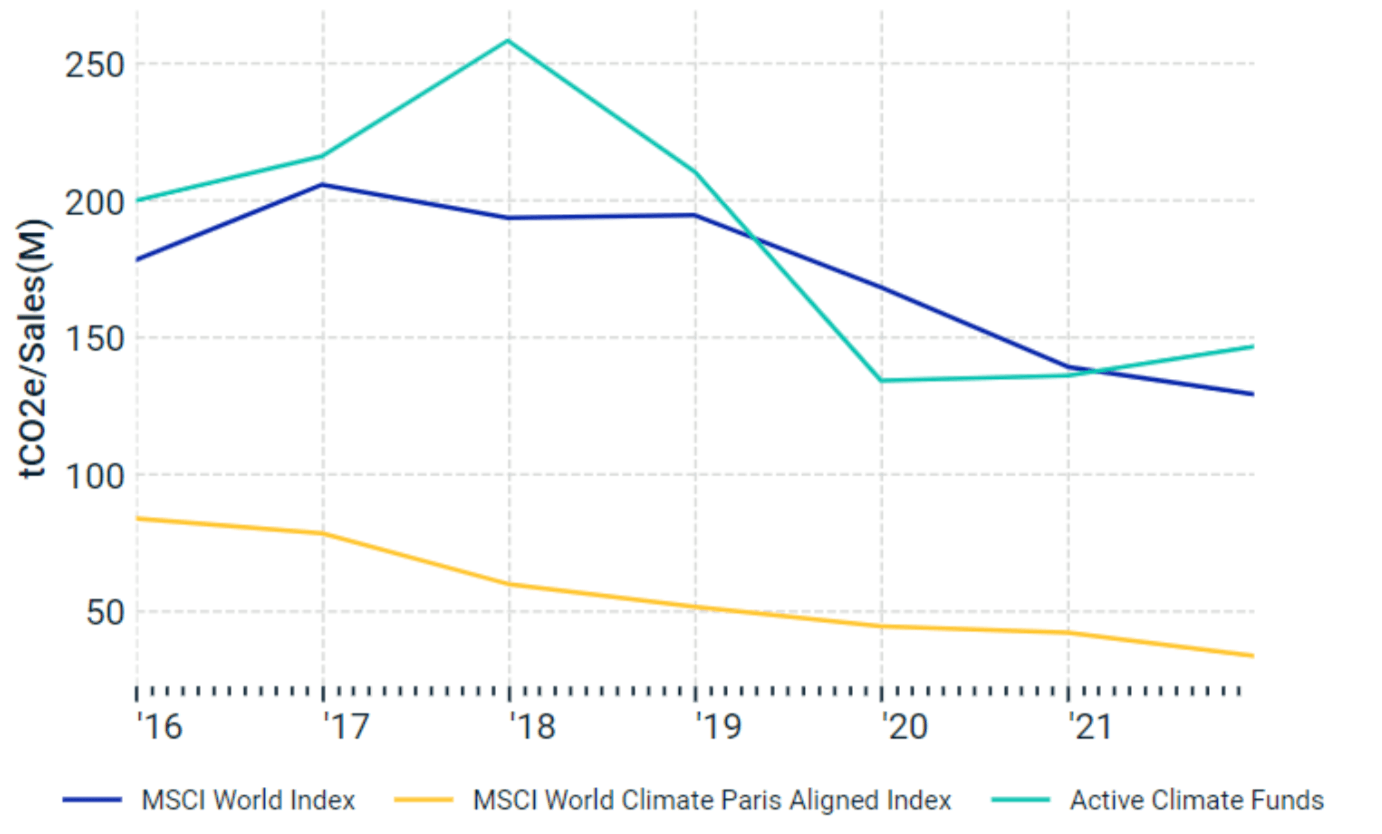

- The MSCI World Climate Paris Aligned Index outperformed a pool of actively managed climate funds and MSCI World Index, while showing a lower implied temperature rise and lower emissions intensity (as of December 2021).

- Transition management: The process by which assets or funds are moved from one portfolio strategy to another. A futures overlay creates a synthetic exposure to the target asset class and can be used to achieve an allocation shift immediately, eliminating the risk of holding cash.

- Derivative overlays: Asset managers often need to make adjustments in their holdings depending on asset-class performance and incoming/outgoing cash flows. In such cases, index futures may help in changing positions in a quick and cost-effective manner.

- Cash equitization: Maintaining adequate cash liquidity while achieving the desired equity exposure

None | MSCI World Index | MSCI World Climate Paris Aligned Index | MSCI Emerging Markets Index | MSCI EM Climate Paris Aligned Index | Weighted average climate Paris aligned benchmark | Active Climate Funds |

Emissions Intensity (Scope 1+2+3), tCO2e/Sales(M) | 752 | 391 | 1336 | 604 | 402 | 695 |

Emissions Intensity (Scope 1+2+3), tCO2e/EVIC(M) | 275 | 113 | 623 | 171 | 116 | 283 |

Emissions (Scope 1+2+3), Millions tCO2e | 40 | 18 | 50 | 15 | 18 | 18 |

Implied Temperature Rise (ºC) | 2.9 | 2.0 | 3.8 | 2.5 | 2.0 | 2.6 |

Average greenhouse-gas emissions intensity (tons of CO2 equivalent per USD 1 million in sales) across different portfolios, as of Dec. 31, 2021. Climate funds classified based on relevant keywords in their names. MSCI implied temperature rise estimates how companies and investment portfolios align with the international goals to limit global warming, incorporating future commitments. Weighted average Paris-aligned benchmark is calculated based on a weighted average of the MSCI World Climate Paris Aligned and MSCI EM Climate Paris Aligned Indexes with weights of 95% and 5%, respectively. This has been used given the average exposure of climate funds considered for the analysis. Climate metrics have been calculated based on the index constituents as of Dec. 31, 2021, and did not take into account the decarbonization trajectory within the index methodology.

- The MSCI World Climate Paris Aligned Index had lower emissions intensity than all the active funds.

- The MSCI World Climate Paris Aligned Index exhibited an implied temperature rise of almost 1 degree Celsius lower than its parent MSCI World Index, through decarbonization and fossil-fuel-based exclusions, as well as higher exposure to companies assessed to have a credible decarbonization pathway.

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.