Real Estate in Focus: Light Is There but the Tunnel Is Long

Key findings

- Global commercial-property returns and transaction volumes appear to have turned a corner in recent quarters though they remain in negative territory.

- Recent easing in policy rates across several markets offers asset owners and managers some hope for reduced financing costs, but rate cuts alone are unlikely to address all the sector’s challenges.

- Declines in commercial-real-estate values present risks for borrowers, especially those who financed at peak valuations, complicating loan-refinancing efforts.

Since late 2022, investors in commercial real estate globally have faced a challenging environment, with heightened inflation and sharply increased interest rates leading to a decline in transaction volumes and asset prices. Despite some optimism generated by central banks' rate easing in 2024, uncertainties and risks still cloud the outlook for the market's recovery.

Turning a corner

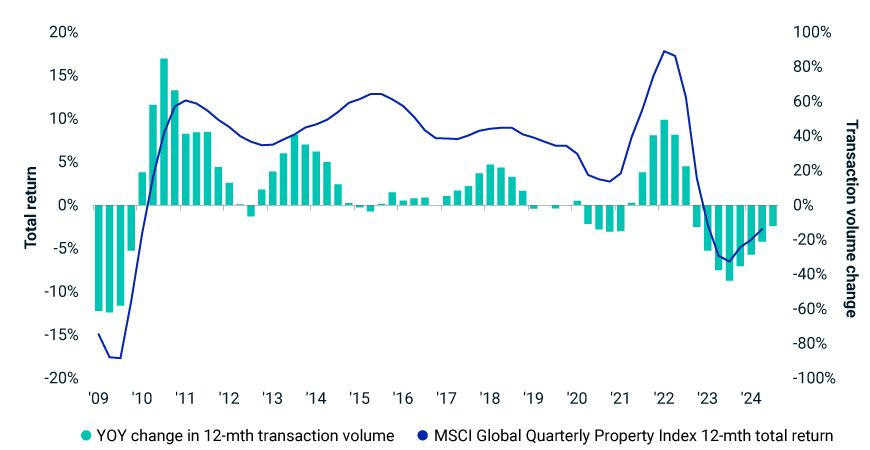

Following a period of declines in 2022 and 2023, returns and deal volume have started to stabilize, indicating that market conditions have begun to recover. The annual total return in the MSCI Global Quarterly Property Index bottomed out at -6.5% in Q3 2023, the same quarter in which year-on-year declines in annual volume reached a low of nearly 44%. The latest available figures remain in negative territory but show improved momentum, with the total return coming in at -2.7% in the second quarter and volume declining about 12% in the third quarter. This improvement suggests a potential easing of headwinds, as investor confidence slowly rebuilds.

Total returns and deal volume climb out of the trough

Rate cuts not a panacea

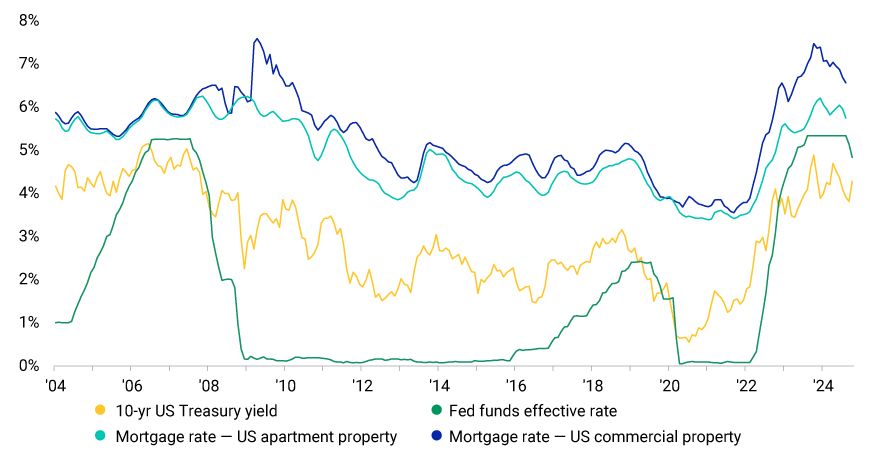

Some of the improvement in sentiment in the sector likely reflects recent rate cuts as central banks begin new easing cycles. For investors, the main challenge in the past two years has been capital-market-driven repricing pressures, so the start of a cycle of monetary easing is a welcome development that may lower financing costs. Investors should be cautious, however, as rate cuts alone are unlikely to resolve all challenges, and a return to the ultralow rates of 2020 seems highly unlikely in the near term. These cuts may take time to benefit borrowers directly, and policy rates are just one of several factors influencing overall borrowing costs.

Policy rates not the only driver of commercial-mortgage rates

Commercial property encompasses office, industrial and retail. Source: Federal Reserve Bank of St. Louis's FRED, MSCI

Moreover, while lower rates may alleviate capital-market pressures, they offer limited relief for parts of the market grappling with deeper structural issues, such as the shift toward remote work. For instance, rate cuts won't bring tenants back to a distressed office building.

Value declines still pose refinancing challenges

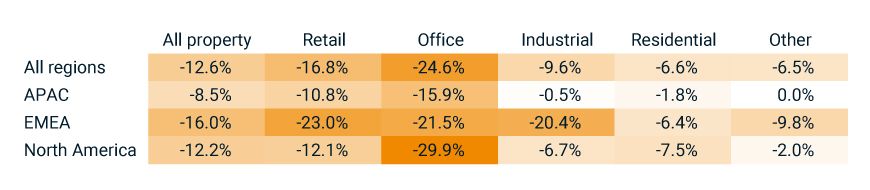

Refinancing remains a significant risk for investors, not only due to the possibility of negative equity — where the property's value falls below the outstanding loan balance — but also because declining values can hinder refinancing even when equity remains positive. As the table illustrates, commercial-real-estate values have registered notable declines across various regions and property types since their peak, particularly in office and retail markets. For borrowers who financed deals at the top of the market — when property values were highest and interest rates were at historic lows — this decline in value may complicate refinancing, even if borrowing costs fall.

Asset values globally still below recent peaks

Data as of June 2024. Figures relative to peak values of each corresponding property type/region. Source: MSCI Global Quarterly Property Index

Risks outside real estate

Investors are likely to be feeling more optimistic than they were at the start of 2024, but the market is not yet fully out of the woods. Commercial-real-estate investment faces a complex road ahead marked by the interplay of structural shifts and economic pressures, as well as an unsettled geopolitical picture and the risk of the reemergence of inflation. Investors can remain cautiously optimistic, though — while recognizing that sustained recovery will likely require time and adaptation to new market realities.

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.