What happens if Italy leaves the EU?

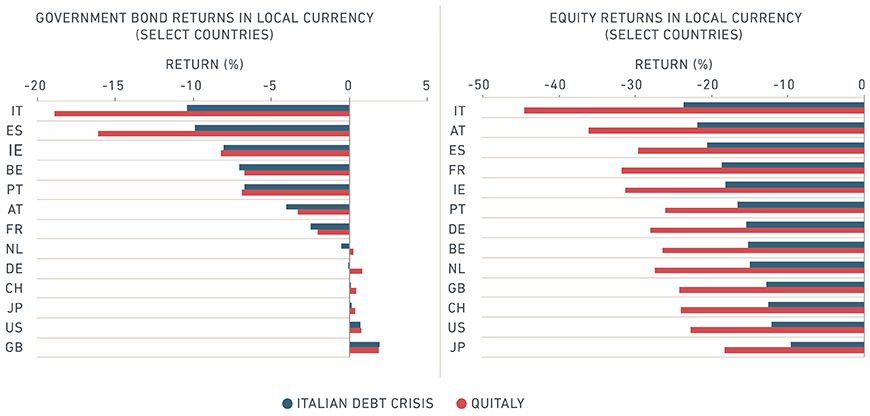

Could populist policies lead to long-term problems for Europe's third-largest economy? We examine two hypothetical scenarios: 1) an Italian debt crisis (mild scenario) and 2) Italy leaving the eurozone (severe scenario). While global markets in general could suffer under both scenarios, our stress test results suggest that an Italian departure from the eurozone, dubbed "Quitaly," could result in EU equities plunging as much as 30%. In Italy, we could see equities drop 50%, whereas Italian sovereign bond yields could rise as much as 480 basis points (bps).

Unnamed: 0 | Unnamed: 1 | Italian Debt Crisis | Quitaly |

|---|---|---|---|

Unnamed: 0 None | Unnamed: 1 Italian Sovereign Yield 5Y | Italian Debt Crisis +250 bps | Quitaly +480 bps |

Unnamed: 0 None | Unnamed: 1 MSCI Italy Index | Italian Debt Crisis -26% | Quitaly -50% |

Unnamed: 0 None | Unnamed: 1 VSTOXX | Italian Debt Crisis +110% | Quitaly +150% |

Unnamed: 0 None | Unnamed: 1 USD/EUR | Italian Debt Crisis +7% | Quitaly +10% |

Unnamed: 0 None | Unnamed: 1 EUR Financials BBB Yield 5Y | Italian Debt Crisis +100 bps | Quitaly +140 bps |

Contagion to the Periphery and A Flight-to-Quality

For equity markets, all countries could suffer. The magnitude of any potential losses would be partially driven by other countries' proximity to Italy, with peripheral countries likely to be the most negatively affected. However, the situation for equities is slightly different than for sovereign bonds, as country-specific sector allocations could skew the results. For example, the Austrian equity market could suffer more than some others because of its large exposure to the financial sector, which is impacted more severely under the stress test.4 In short, although the short-term political deadlock in Italy has been resolved, investors may be wary about the long-term outlook, amid concerns that populist policies could lead to troubles ahead for global equity and bond markets.

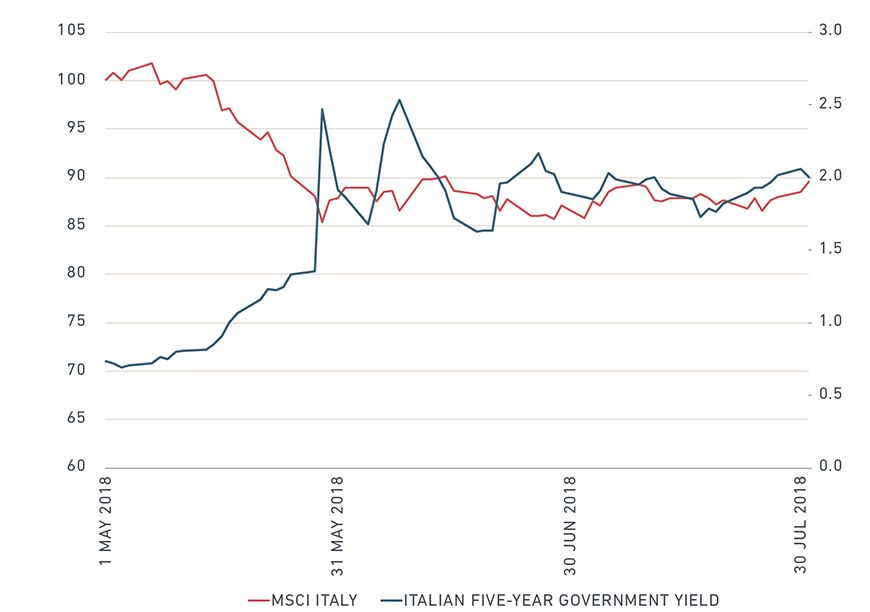

The author thanks Carlo Acerbi for his contribution to this post. 1 For a further discussion, see Suryanarayanan, R. et al. (2016) "Scenarios, Stress Tests and Strategies for Second Quarter 2016 – The Rise of Populism," MSCI Research." MSCI Research Insight. 2 The impact to the Italian markets is significant compared to the muted impact to U.K. stocks and bonds since the Brexit referendum was approved, as Italy is already under pressure even without such an exit. Furthermore, Quitaly would entail an exit from the monetary union, as opposed to the European Union. 3 These shocks are propagated to a portfolio using a predictive stress test in RiskManager based on 2011-2012 correlations. Under the Quitaly scenario, MSCI EU and the five-year Spanish government yield are used as additional core factors in the predictive stress test. Import files are available for BarraOne. A RiskManager implementation files will be available shortly. 4 Note that the market correction in May seemed to have priced in the stress test partially, with Italian equities and government bond yields being at new equilibrium levels as shown in the first exhibit.

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.