What’s the downside in real estate?

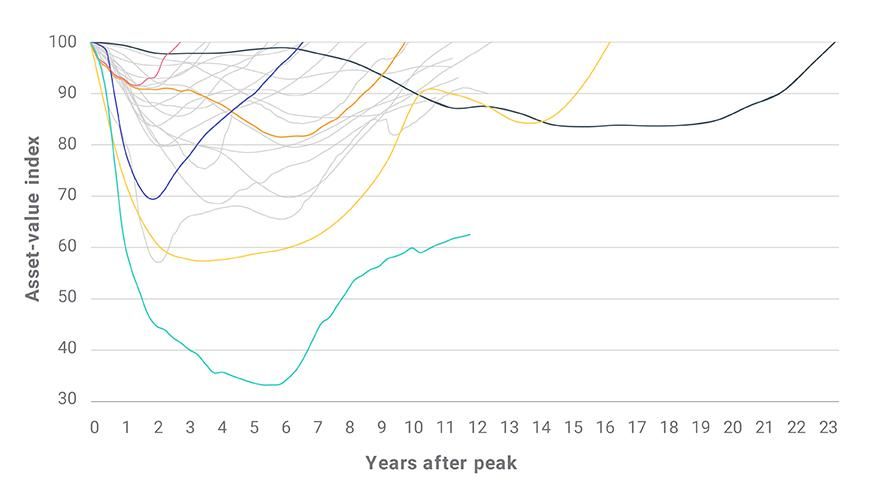

- Real estate is a cyclical asset class, and investors are exposed to potentially dramatic falls in asset values. But every cycle is different, and turning points have historically been hard to predict.

- MSCI data shows that falls in asset values have been relatively infrequent, but have also varied considerably in their magnitude and duration.

- While falling asset values are a risk to investor portfolios, diversification and income returns have in the past provided investors with some protection.

Country | Peak | Trough | Recovery | Max asset-value fall |

|---|---|---|---|---|

Country Ireland | Peak Dec 1984 | Trough Dec 1986 | Recovery Dec 1988 | Max asset-value fall -7% |

Country U.K. | Peak Nov 1989 | Trough May 1993 | Recovery Jul 1999 | Max asset-value fall -25% |

Country Australia | Peak Dec 1989 | Trough Sep 1993 | Recovery Mar 2002 | Max asset-value fall -32% |

Country Sweden | Peak Dec 1990 | Trough Dec 1994 | Recovery Dec 2006 | Max asset-value fall -43% |

Country Ireland | Peak Dec 1990 | Trough Dec 1993 | Recovery Jun 1996 | Max asset-value fall -14% |

Country Germany | Peak Dec 1995 | Trough Dec 2010 | Recovery Dec 2018 | Max asset-value fall -17% |

Country U.K. | Peak Jun 2007 | Trough Jul 2009 | Recovery Ongoing | Max asset-value fall -43% |

Country Ireland | Peak Dec 2007 | Trough Mar 2013 | Recovery Ongoing | Max asset-value fall -67% |

Country Spain | Peak Dec 2007 | Trough Dec 2013 | Recovery Dec 2018 | Max asset-value fall -30% |

Country Portugal | Peak Dec 2007 | Trough Dec 2013 | Recovery Ongoing | Max asset-value fall -21% |

Country Global Index | Peak Dec 2007 | Trough Dec 2009 | Recovery Dec 2015 | Max asset-value fall -20% |

Country France | Peak Dec 2007 | Trough Dec 2009 | Recovery Jun 2016 | Max asset-value fall -16% |

Country Sweden | Peak Dec 2007 | Trough Dec 2009 | Recovery Dec 2011 | Max asset-value fall -9% |

Country Norway | Peak Dec 2007 | Trough Dec 2009 | Recovery Dec 2014 | Max asset-value fall -8% |

Country Belgium | Peak Dec 2007 | Trough Dec 2013 | Recovery Ongoing | Max asset-value fall -7% |

Country Japan | Peak Feb 2008 | Trough Nov 2012 | Recovery Ongoing | Max asset-value fall -22% |

Country U.S. | Peak Mar 2008 | Trough Mar 2010 | Recovery Dec 2014 | Max asset-value fall -31% |

Country New Zealand | Peak Mar 2008 | Trough Jun 2011 | Recovery Dec 2014 | Max asset-value fall -13% |

Country Australia | Peak Mar 2008 | Trough Dec 2009 | Recovery Dec 2013 | Max asset-value fall -13% |

Country Italy | Peak Jun 2008 | Trough Dec 2015 | Recovery Ongoing | Max asset-value fall -15% |

Country Netherlands | Peak Sep 2008 | Trough Jun 2014 | Recovery Jun 2018 | Max asset-value fall -19% |

Country Canada | Peak Sep 2008 | Trough Mar 2010 | Recovery Jun 2011 | Max asset-value fall -8% |

Subscribe todayto have insights delivered to your inbox.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.