Householding: One Client, Many Accounts

Research Paper

December 7, 2023

Preview

Householding is the practice of applying a single target asset allocation across all family assets and managing those assets to produce the highest practicable after-tax return. Wealth managers of high-net-worth clients, particularly married U.S. taxpayers who file jointly, can offset the realized capital gains of one spouse with the realized capital losses of the other spouse. The option often substantially reduces the couple's total tax liability.

The holistic approach does present some operational challenges. The manager must continually monitor tax-lot information for multiple taxable and tax-deferred accounts and ensure the accounts are periodically rebalanced to the target allocation in the most-tax-efficient way possible, considering the assets' locations.

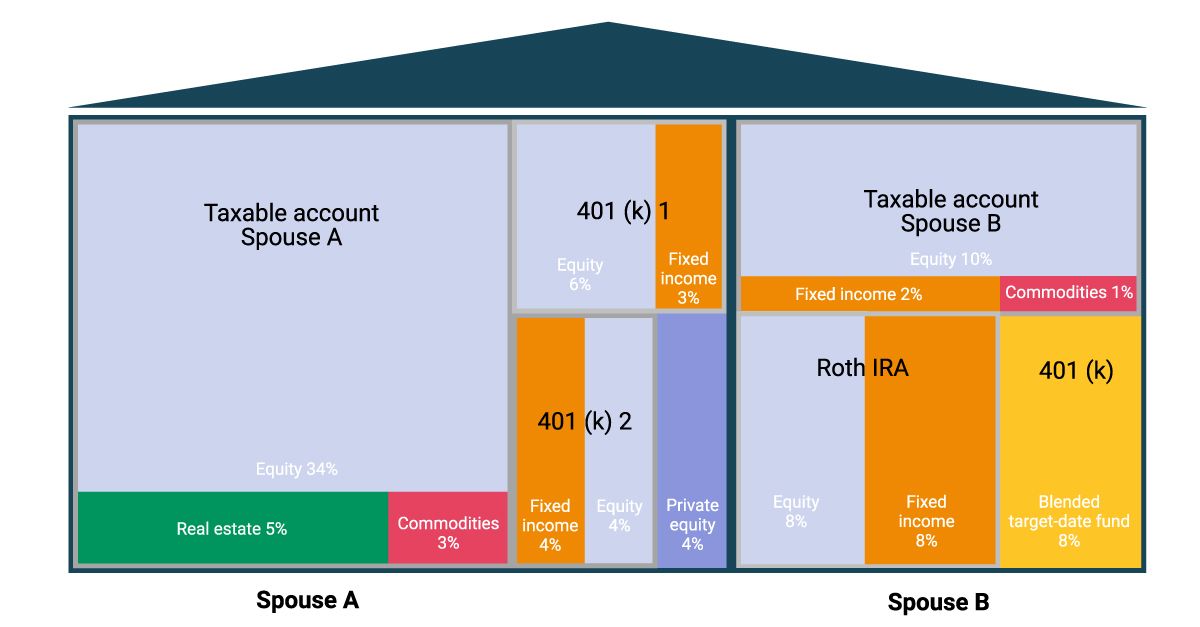

Percentages indicate share of household assets, excluding the family home. Spouse A has a taxable account invested in equity (34%), real estate (5%) and commodities (3%); a 401(k) invested in equity (6%) and fixed income (3%); a second 401(k) invested in equity 4% and fixed income (4%) and a taxable investment in private equity. Spouse B has a taxable account invested in equity (10%), fixed income (2%) and commodities (1%); a 401(k) invested in a target-date fund that holds equity and fixed income, and a Roth IRA invested in equity (8%) and fixed income (8%). Real estate is a real estate investment trust (REIT).

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

A Roadmap to Personalizing Model Portfolios: Scaling with Purpose

High-net-worth investors are seeking portfolios tailored to their financial goals, personal values and tax situation. Wealth managers need scalable solutions. We explore using factor, thematic and sustainable investing to customize portfolios.

Measuring Tax Alpha

The concept of tax alpha can help a wealth manager explain a client's after-tax performance. We propose two frameworks to provide transparency around the after-tax attribution calculation used to measure tax alpha.

Breaking Down the Direct Indexing Investment Process

Direct indexing has prompted wealth managers to evaluate their implementation choices for individual clients. Our research focuses on aspects of the wealth manager's implementation of direct indexing as well as tax optimization.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.